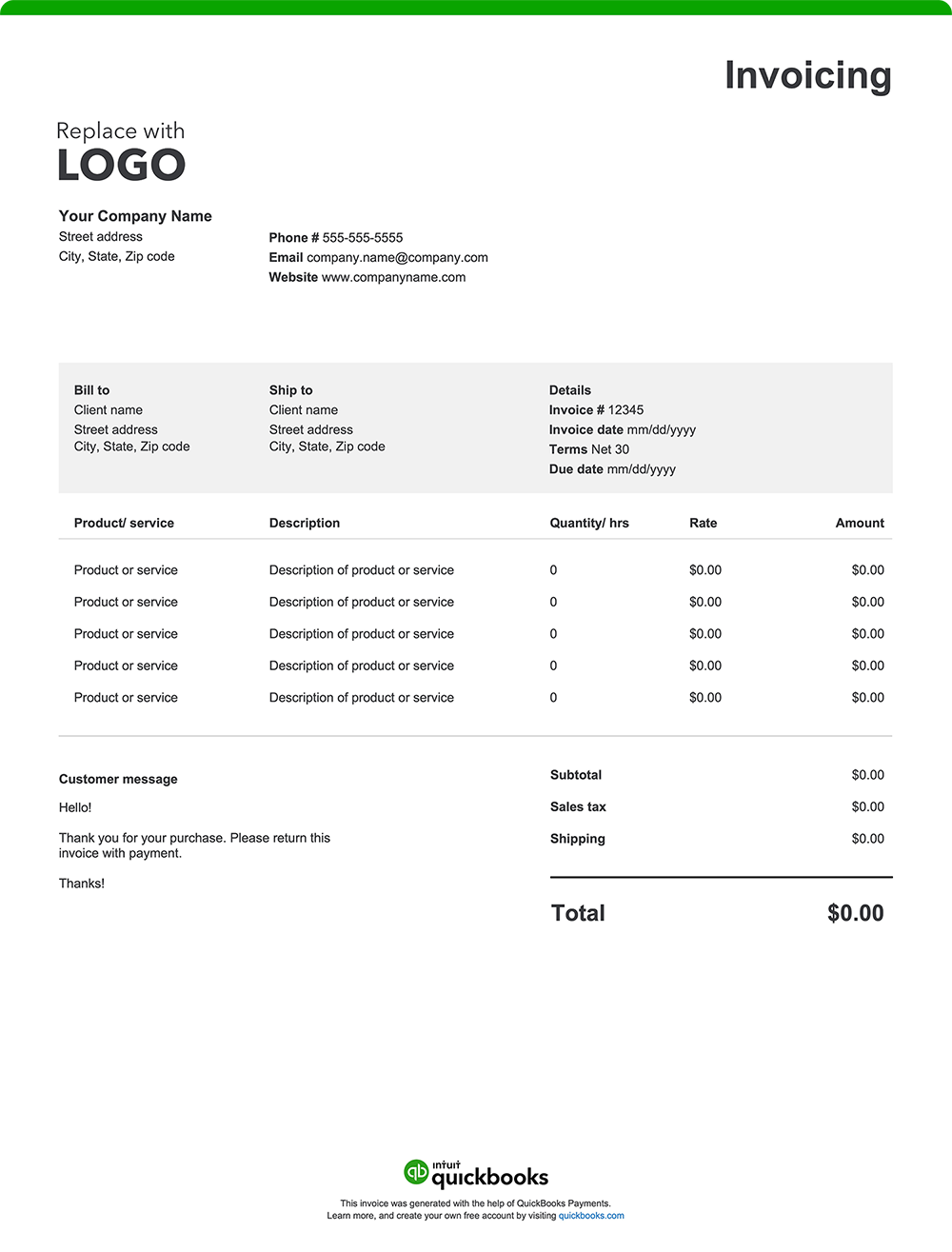

Legal invoice template vs QuickBooks

As in any professional field, law firms rely on efficient invoicing to support a steady cash flow and promote timely payments. While basic Excel, Word, and PDF invoice templates can be a starting point for invoice creation, they may fall short when it comes to handling the precise hourly billing and expense tracking that legal practices require. A better option? QuickBooks invoicing and legal accounting software.

Less manual entry means fewer errors

Legal billing can be highly detailed, especially when tracking billable hours, client communications, and reimbursable expenses. Traditional invoice templates often require manual input of time entries, case descriptions, and client details, leaving more room for error.

QuickBooks simplifies this process by automatically populating recurring details, minimizing mistakes, and saving valuable administrative time.

Automate invoicing for legal services

Law firms managing multiple cases and clients benefit from automation features that streamline invoicing tasks. With QuickBooks, you can:

- Create recurring invoices: Ideal for ongoing retainers or long-term engagements.

- Batch invoices. Create multiple invoices using standardized fee structures and customer-specific terms from a single-entry input. With batch invoicing, you can generate invoices 37% faster.¹

- Schedule invoices. Schedule invoices to be created and emailed on specific dates.

- Set-and-forget it. Set hourly billing rates for each service, or custom rates for partners, associates, paralegals, and assistants. Add billable hours to invoices and the accounting software will do the calculations.

- Integrates with time tracking. You can convert billable hours into invoices with QuickBooks Time.

This level of automation offered by QuickBooks reduces administrative work and eliminates delays, so you can prioritize your practice, instead of time-consuming payment paperwork.

Invoice from anywhere

Whether you're in the office, at court, or working remotely, QuickBooks allows you to send and manage invoices directly from your smartphone, tablet, or desktop. You can also attach engagement letters, receipts, or supporting documentation.

Manage cash flow across clients and cases

Legal practices often juggle various billing arrangements—hourly, flat-fee, or contingency. QuickBooks integrates invoicing with bookkeeping, so you can track unpaid invoices, forecast income, and manage your firm’s cash flow with more precision.

Offer flexible payment options

Give your clients the convenience of paying with credit cards, debit cards, ACH transfers, and even popular platforms like Apple Pay, PayPal, and Venmo. This flexibility can help you get paid faster and improve your cash flow.

Send invoices through email or SMS

QuickBooks allows attorneys and other legal professionals to send digital invoices directly via email or SMS—making it easy for clients to access and respond quickly.

How do I accept payments in QuickBooks?

QuickBooks makes payment collection simple and secure. You can accept payments online with a “Pay Now” button directly on your invoice or use in-person options like mobile card swipes. Payments are automatically matched to the right client and case, reducing the need for manual tracking.

What is recurring invoicing for law firms?

Recurring invoicing is ideal for lawyers who offer retainer services or ongoing legal support. QuickBooks lets you schedule invoices at regular intervals (monthly, quarterly, etc.) and will automatically send them to clients. You’ll stay on schedule without needing to start each billing cycle from scratch.