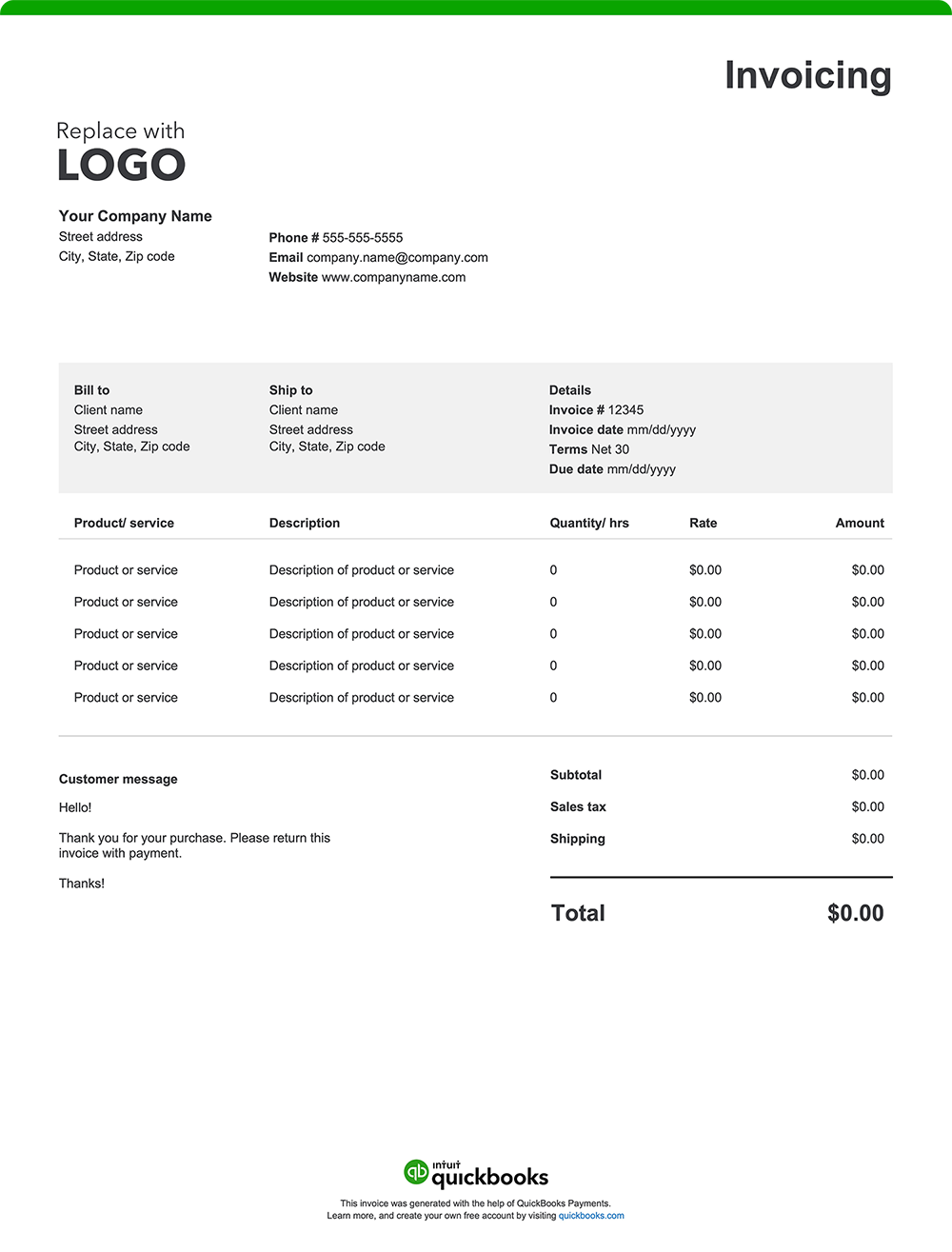

Photography invoice template vs QuickBooks

Like any professional service, photography requires efficient invoicing to maintain steady cash flow and support timely payments. While basic Excel, Word, and PDF invoice templates can be a starting point for invoice creation, they often lack the functionality and automation that photographers need to manage their complex billing processes. A better option? QuickBooks invoicing and photography accounting software.

Less manual entry means fewer errors

Photographers often work on a variety of projects, all requiring detailed invoicing. Traditional invoice templates usually involve manual data entry for client details, shoot descriptions, and editing charges. This method can be time-consuming and prone to errors, especially for photographers balancing multiple jobs.

QuickBooks streamlines invoicing by automating much of this manual work. It automatically populates client details, service descriptions, and pricing information, saving you valuable time and reducing the risk of costly errors.

Automate invoicing

As a photographer, juggling numerous clients with different billing schedules can be a challenge. QuickBooks offers automation features that can simplify your invoicing and help you stay organized.

Automated workflows

Set up customized workflows to automate tasks such as sending invoice reminders or approving invoices.

Real-time tracking

QuickBooks lets you see when clients view or pay invoices, making it easy to follow up on overdue payments and facilitate collections.

Invoice from anywhere

Whether you're in your studio, on location at a client’s office, or capturing an event on-site, QuickBooks allows you to create and send invoices directly from your mobile device or tablet.

Manage cash flow from booking to delivery

Photography projects often involve variable payment schedules—upfront deposits, milestone payments, and final balances on image delivery. QuickBooks integrates invoicing with bookkeeping, so you can monitor payment timelines and forecast income. This helps you plan your budget, even when payments come in stages.

Offer flexible payment options

Make it easy for clients to settle their bills by offering them more ways to pay. QuickBooks enables you to accept various payment methods, including credit cards, debit cards, ACH transfers, and popular platforms like Apple Pay, PayPal, and Venmo.

Send invoices through email or SMS

QuickBooks allows you to send invoices directly via email or SMS, catering to client preferences and ensuring prompt delivery. For recurring services, automated invoices can save time and ensure consistent billing.

How do I accept payments in QuickBooks?

You are in control of how you get paid. Accept payment options such as credit cards, bank transfers, checks, or even cash. Create invoices with a "Pay Now" button for instant online payments, or you can swipe cards on the spot with our mobile card reader. Payments will be tracked to the correct job, and funds will be deposited directly into your bank account.