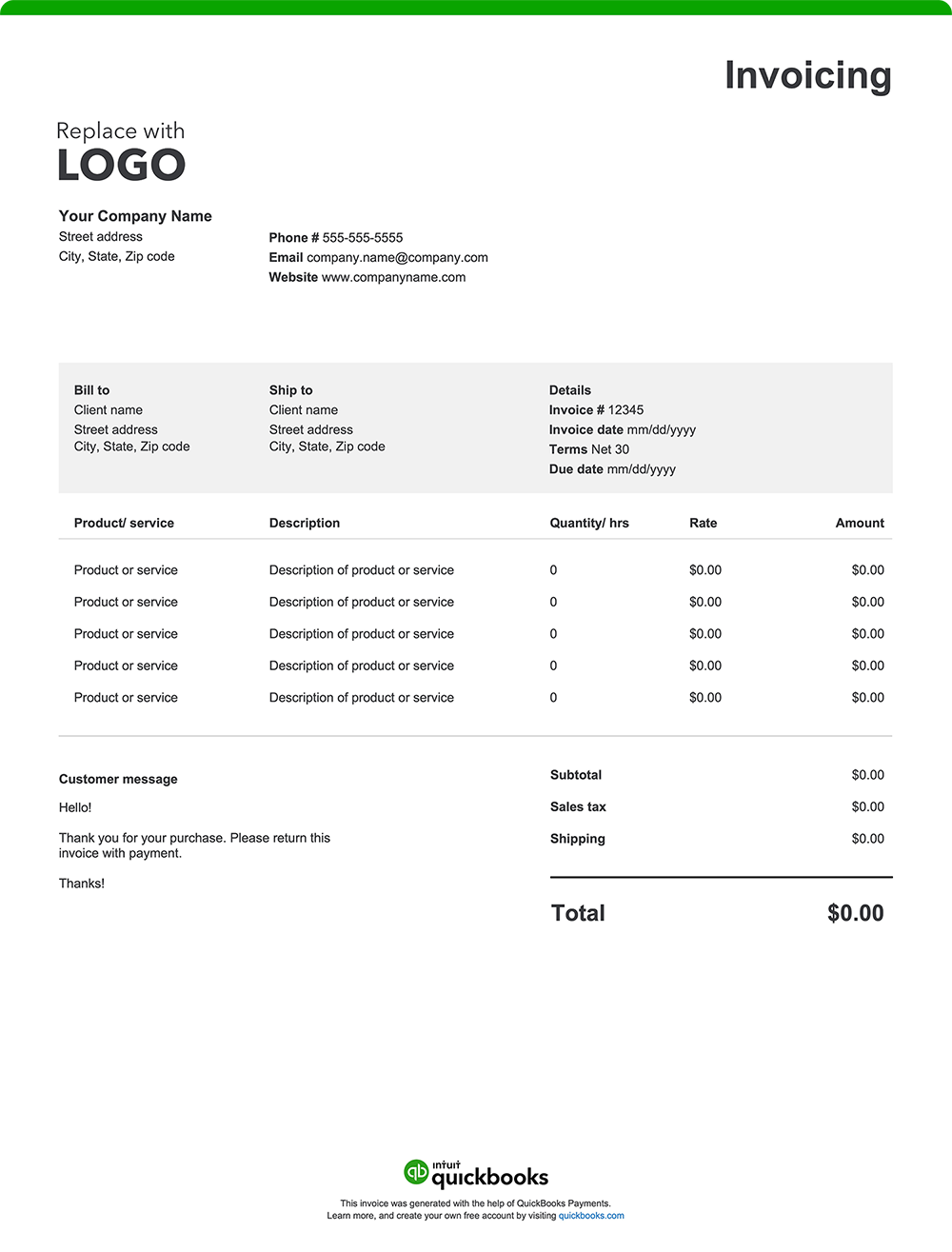

If you run a restaurant or food service business, having a customizable invoice template is essential for billing clients beyond the point of sale. Whether you're providing catering, managing large events, or offering meal prep subscriptions, professional invoicing helps clarify terms, support timely payments, and keep your cash flow steady. Provide transparency and help ensure accountability by creating an invoice using a free invoice template. Download a free, customizable, and printable restaurant invoice template from QuickBooks.

*See invoice template | Generate free invoice*

Jump to:

- Downloadable invoice templates for restaurants

- 7 elements every restaurant invoice should include

- What is a restaurant invoice?

- Common restaurant and food service businesses that use invoicing

- Restaurant billing overview

- Restaurant invoice template best practices

- When to use a restaurant invoice template

- Key considerations for a restaurant invoice template

- Is a restaurant invoice the same as a receipt?

- Restaurant invoice templates vs. QuickBooks

- Try our free restaurant invoice generator