No matter how much your employees love their jobs, they probably won’t work for free.

The process of adding up hours worked and calculating employee pay is commonly referred to as running payroll. Running payroll is essential to any business, whether large or small, and it's crucial to getting your employees paid correctly.

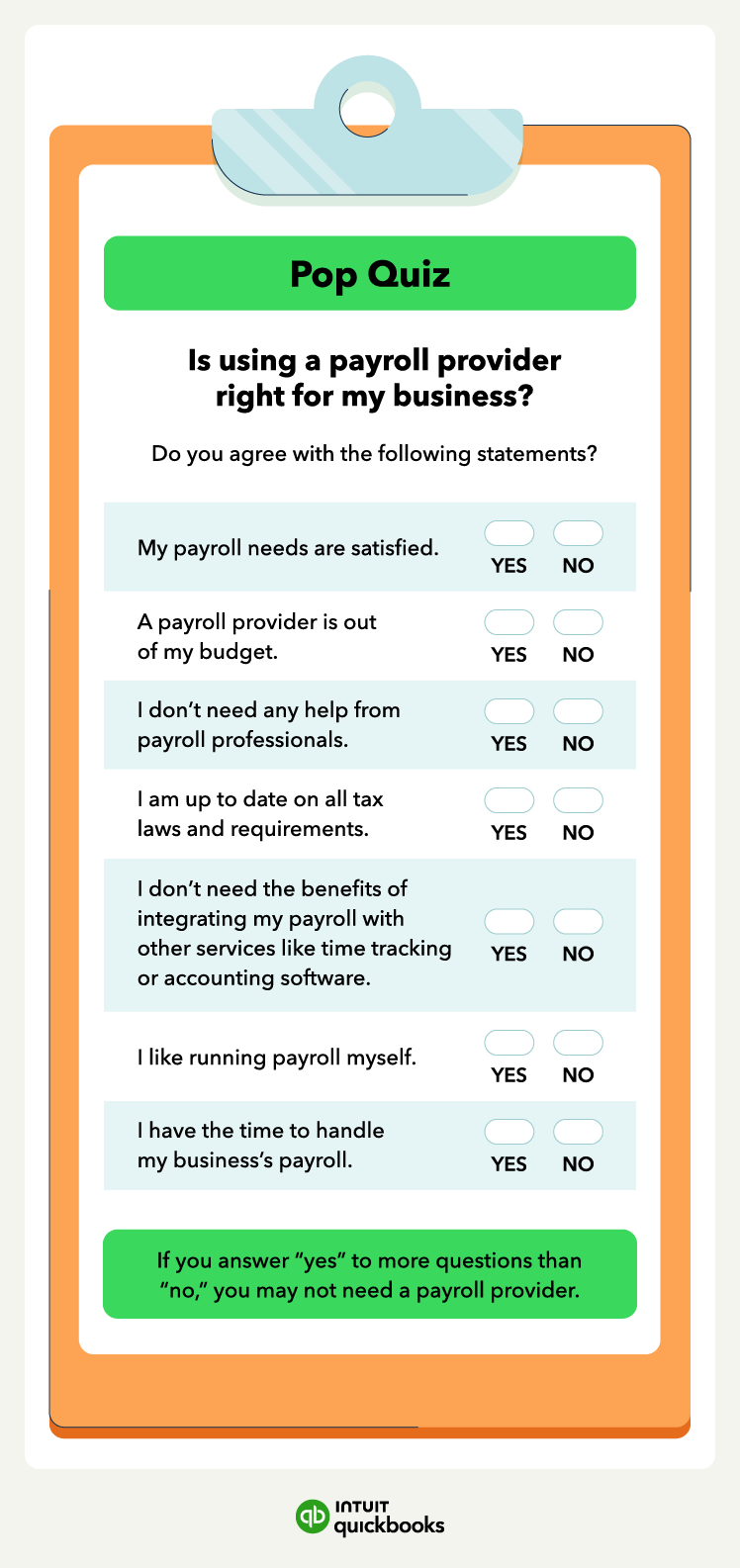

While some business owners may handle payroll in-house, many choose to outsource payroll using a payroll provider. Before deciding whether or not working with a payroll provider is the right decision for your business, read through this guide, including the following considerations you should keep in mind when choosing a provider:

- Your business needs

- Service integration

- Payroll software pricing

- Customer support options

- Reputation

- Tax compliance updates

In addition, we’ll further break down how to choose a payroll provider, the services they offer, as well as their pros and cons.

Let’s get started!

But first, just what is a payroll provider?

A payroll provider is a company that handles all sorts of payroll services for different businesses. Payroll companies are typically responsible for processing payroll, which involves the various steps to compensating an employee for their work. Thus, payroll providers are tasked with calculating employees’ gross pay, making any necessary payroll withholdings or garnishments, disbursing payments, and creating the payroll records.

What services do online payroll providers offer?

Online payroll providers offer a wide array of different services. While some providers simply process payroll, others come with several advanced features that can serve as useful assets to a company. Let’s start with some of the services that payroll providers may offer:

- Payroll automation: With payroll automation, you can set up your payroll to run automatically, helping free up your busy schedule.

- Tax compliance: By utilizing an online payroll provider, you maintain compliance with all current tax laws and regulations.

- Time tracking: With integrated time tracking features, you can easily view, manage, and approve your employee’s timesheets on the go.

- Payroll reporting: Online payroll providers often offer customizable payroll reports you can use to overview important payroll data, from payroll deductions to wage summaries.

- Tax filing: Some online payroll providers also offer tax assistance, including calculating, filing, and paying your payroll taxes on your behalf.

- New-hire reporting: Whenever you hire a new employee, you have to report it to your state agencies. Some online payroll providers can help take this task off your plate and do the necessary reporting for you.

- PTO and sick leave management: An online payroll provider can provide easy-to-access data that can help you monitor your employee’s use of paid time off and sick leave.

- Software integrations: With the ability to integrate your payroll with other software, such as accounting software, you can manage your payroll and small business accounting in one easy-to-use place.

- Management of employee benefits and retirement plans: Certain online payroll providers offer additional services like health benefits and 401(k) plans, providing exciting perks you can offer your employees.

- Direct deposit: A late paycheck can have a devastating effect on your employees. Choosing an online payroll provider with direct deposit can help you pay employees on time, the same day you run payroll.

With an understanding of what a payroll service provider can offer, you can better decide which provider will be best for you and your payroll needs.

How much are payroll services?

The cost of online payroll providers can vary, with some costing as little as $37.50 a month for the first three months. While the cost of payroll service providers can vary based on your provider and the services you need, many charge on a monthly or per-pay-period basis.

Additionally, online payroll providers may offer tiered pricing plans that increase in price based on the additional services offered. For example, a basic payroll management service plan may only include full-service payroll, whereas a more expensive plan may offer additional time tracking services and 24/7 support.