Disclaimers:

*Limited availability. Features may be more broadly available soon.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

Savings vary monthly based on actual processing volume and transaction type. Results may vary and are not indicative or a guarantee of future performance. Terms and conditions apply.

**Product Information

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Not available in US territories or outside the US

QuickBooks Card Reader: Data access subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance. Separate card reader purchase, product registration and QuickBooks Payments account required. Terms, conditions, and features subject to change.

Apple Pay: Apple Pay is a registered trademark of Apple Inc.

Google Pay: Google Pay is a trademark of Google LLC.

Venmo is available only in the US.

**Features

Automatic Matching: QuickBooks [Online/Money] will only match bank deposits with transactions processed through QuickBooks Payments. Not all transactions are eligible.

Tap to Pay on iPhone: Tap to Pay on iPhone requires a supported payment app and the latest version of iOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install. Some contactless cards may not be accepted by your payment app. Transaction limits may apply. The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC. Tap to Pay on iPhone is not available in all markets. For Tap to Pay on iPhone countries and regions, see https://developer.apple.com/tap-to-pay/regions/.

1’Four times faster’ is an average, based on time to receive payment from the date invoice was sent, for U.S. customers using QuickBooks Online invoice tracking and payment features, compared to customers not using these features, from Aug 2023 to Jul 2024.

2Calculation based on a comparison of monthly QuickBooks Payments transactions with those that were automatically categorized from January 2024 through March 2024.

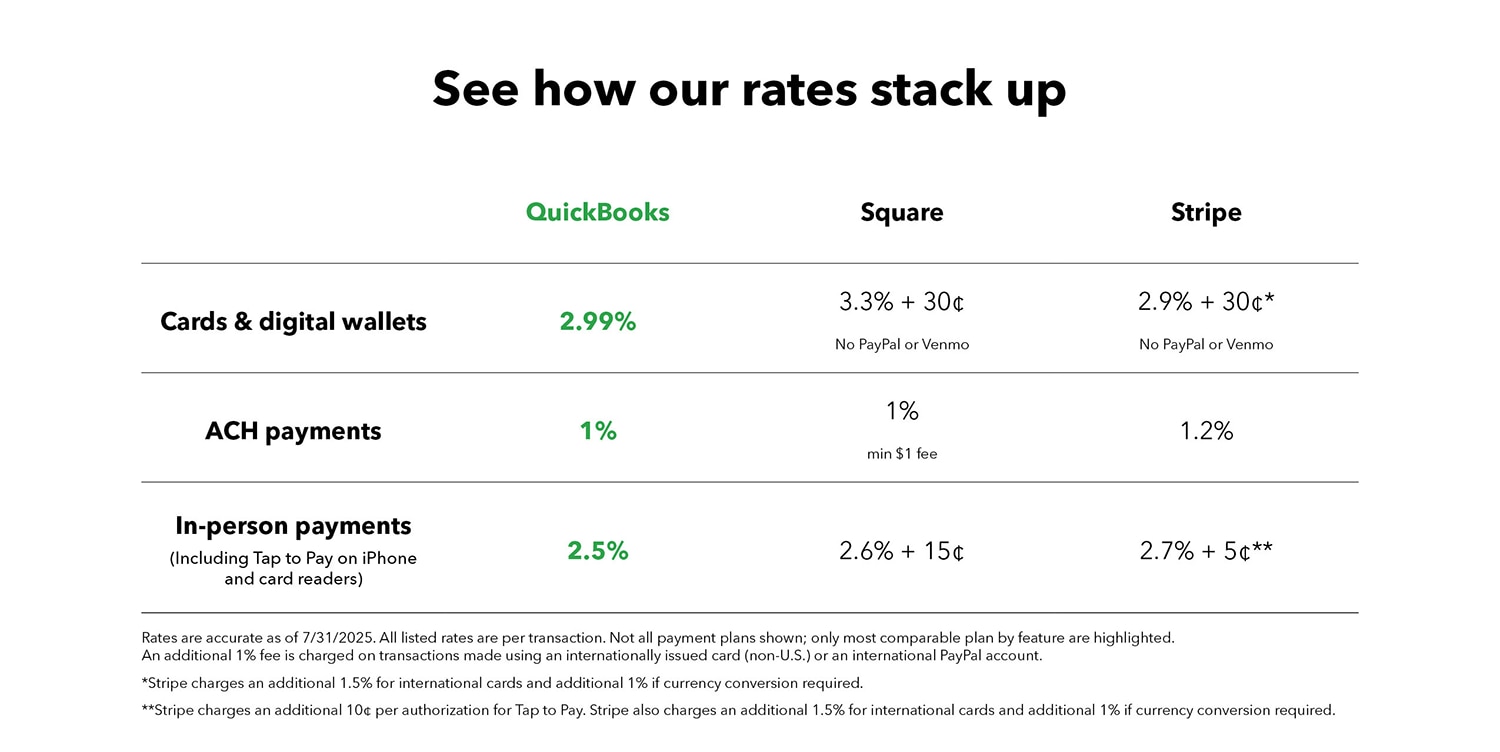

3Rates are accurate as of 7/31/2025. All listed rates are per transaction. Not all payment plans shown; only most comparable plan by feature are highlighted. An additional 1% fee is charged on transactions made using an internationally issued credit card (non-US) or an international PayPal account.