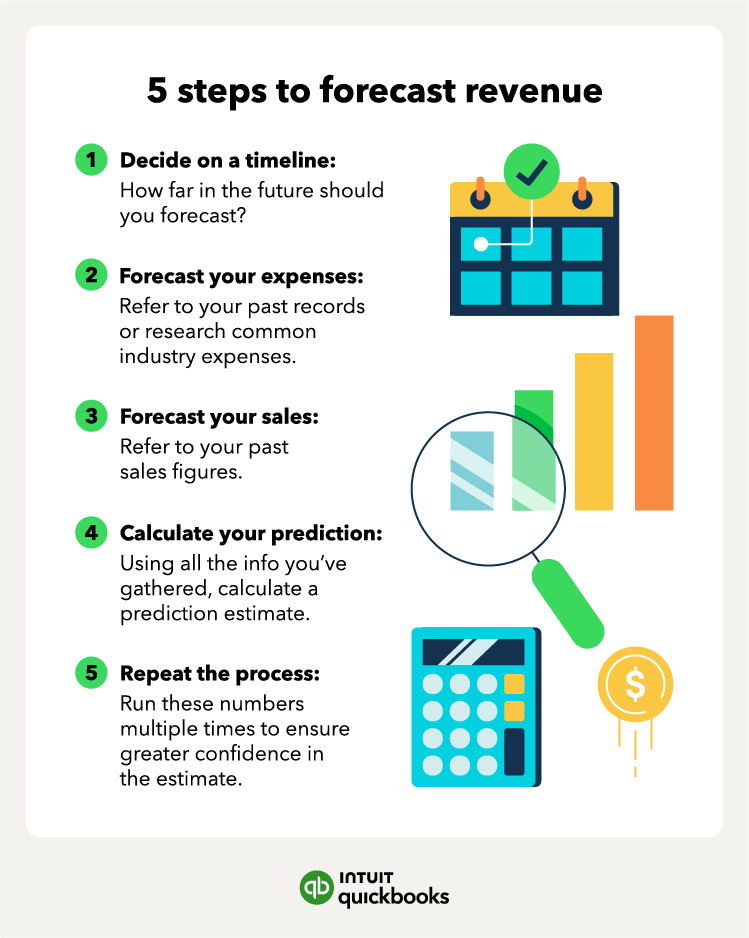

Revenue forecasting should be performed as a step-by-step process. Below, we’ve included a system that will help you achieve the most accurate revenue forecast for your business. The steps include:

- Deciding on a timeline

- Forecasting your expenses

- Forecasting your sales

- Calculating your prediction

- Repeating the process

1. Decide on a timeline

Before forecasting your revenue, you’ll need to decide how far into the future you want to look. This will be determined by your specific goals. For instance, if you want to determine whether you can add a second location in two years, then you’ll calculate a two-year forecast.

However, keep in mind that the further into the future you plan, the more you should expect a degree of error. This is a result of unseen internal and external forces that may arise.

2. Forecast your expenses

To forecast your expenses, refer to your past expense records or research expenses for your industry if you’re a startup. You’ll need to calculate two types of expenses:

- Fixed costs: These are expenses that remain the same every month. They include rent, fixed salaries, utilities, insurance, phone, internet, technology, postage, advertising, marketing, legal, accounting, and bookkeeping expenses.

- Variable costs: These are expenses that can change every month, but taking an average will give you a baseline to run with. They include the cost of goods sold (including materials and supplies), packaging costs, sales, cost of labor, marketing, and customer service costs as they directly relate to the sale of your product.

3. Forecast your sales

If you own an existing business, look at your past sales figures and then consider the following factors to make an educated guess about future sales on a month-by-month basis:

- Your customers: Identify your customer base and determine which customers you’ll include in the forecast. Remember, common wisdom says that you’ll get 80% of your business from 20% of your customers.

- Your service area: Do you have plans for expansion? If so, include your current geographical area as well as the area you plan to include in the future.

- Market conditions: What is the state of the market? Will it remain steady or increase?

- Business position: Consider the position of your business within your industry and factor in your growth expectations.

- Seasonal adjustments: Many businesses have increased or decreased sales in a seasonal cycle. If your business falls into that pattern, take this into consideration.

If you own a startup and don’t have historical records to work from, forecasting your revenue may take some extra work. It will take meticulous research on your part, and the outcome should be based on this research rather than guesswork. Here are some good sources of information:

4. Calculate your prediction

Next, you’ll take all of your research and mold it into a prediction for your future sales. If you offer more than one product or service, you should do this for each of those areas and then combine them for a total figure. Here’s how to arrive at that figure:

- Determine how sales are calculated for your industry: For example, if you own a service-based business, sales are typically calculated by billable hours. Retail forecasts, on the other hand, are typically based on sales per square foot.

- Create a profile of your ideal customer: For regional businesses, use the data from the Census Bureau to determine how many of your ideal customers live within a reasonable radius of your business.

- Estimate your market share: Do this by determining the total number of available customers and then predicting how many of them will buy from you. Remember, your customer base will increase over time, and that should be reflected in your numbers.

- Determine how often your customers will buy from you: This will vary by industry. For example, beauty salons can count on customers booking a service every four to six weeks. On the other hand, a tree-trimming service might estimate once a year.Predict the average dollar amount of each purchase for each of your product or service categories.

To arrive at your projected sales volume, take all the figures you have and input them into this formula:

Number of customers x average sales price x number of yearly purchases = Yearly projected sales

Next, deduct your total projected expenses from step two and you’ll have your revenue forecast.

Yearly projected sales – total projected expenses = Revenue forecast

5. Repeat the process

It’s easy to be overconfident or too conservative in your projections. That’s why it’s a good idea to run these numbers three times. Run an optimistic projection, a pessimistic one, and a middle-of-the-road one. You can adjust your projections monthly as you see how real-world sales compare to your predictions.

- Optimistic projection: Use data in a best-case scenario with all external and internal factors working in your favor.

- Middle-of-the-road projection: Use data averages and stay slightly more conservative with your predictions.

- Pessimistic: Use extremely conservative data to create your projection, assuming external and internal factors do not work in your favor.