If you’re in business, you know there are dozens of accounting formulas and terms that relate to the financial health of your small business. At first, it can be a bit overwhelming. Fortunately, you don’t have to be a CPA to get a handle on the basics, but getting to know some key terms is extremely helpful—and there’s a lot you can do on your own with accounting software.

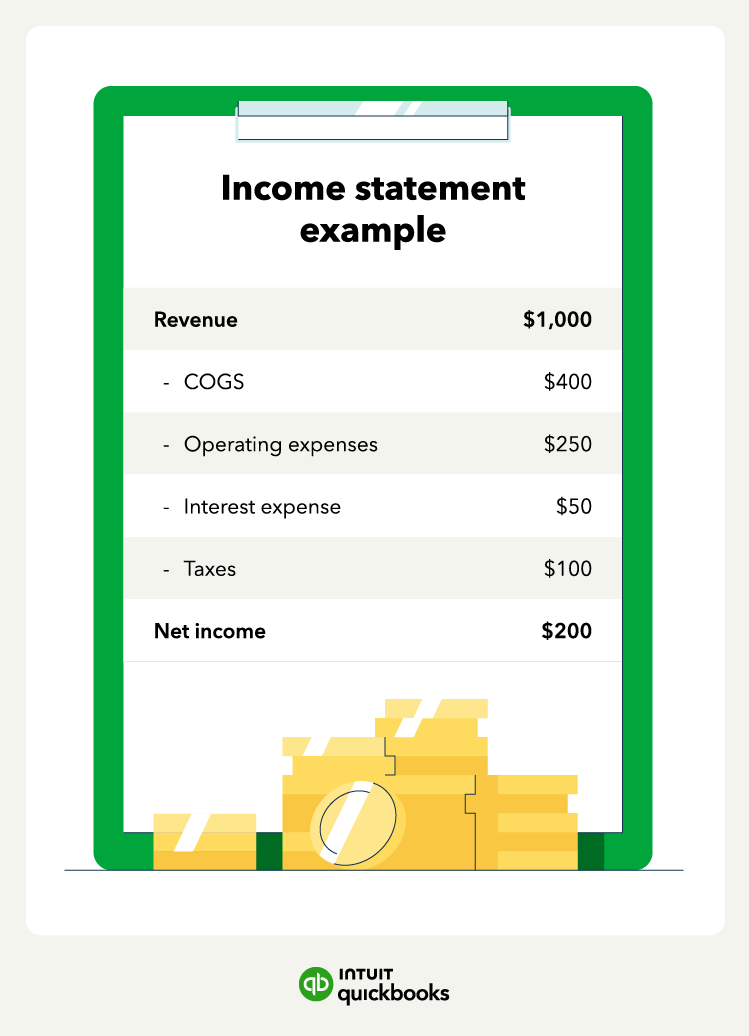

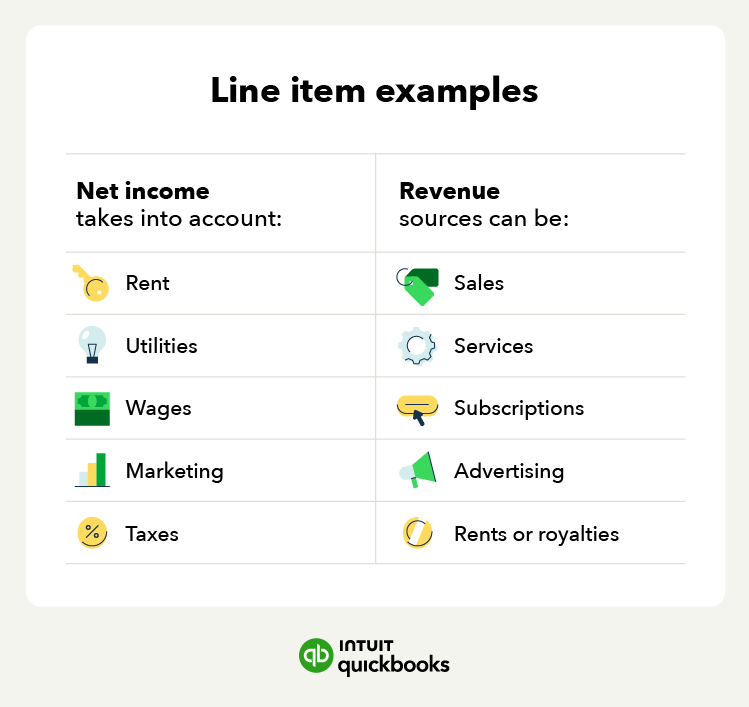

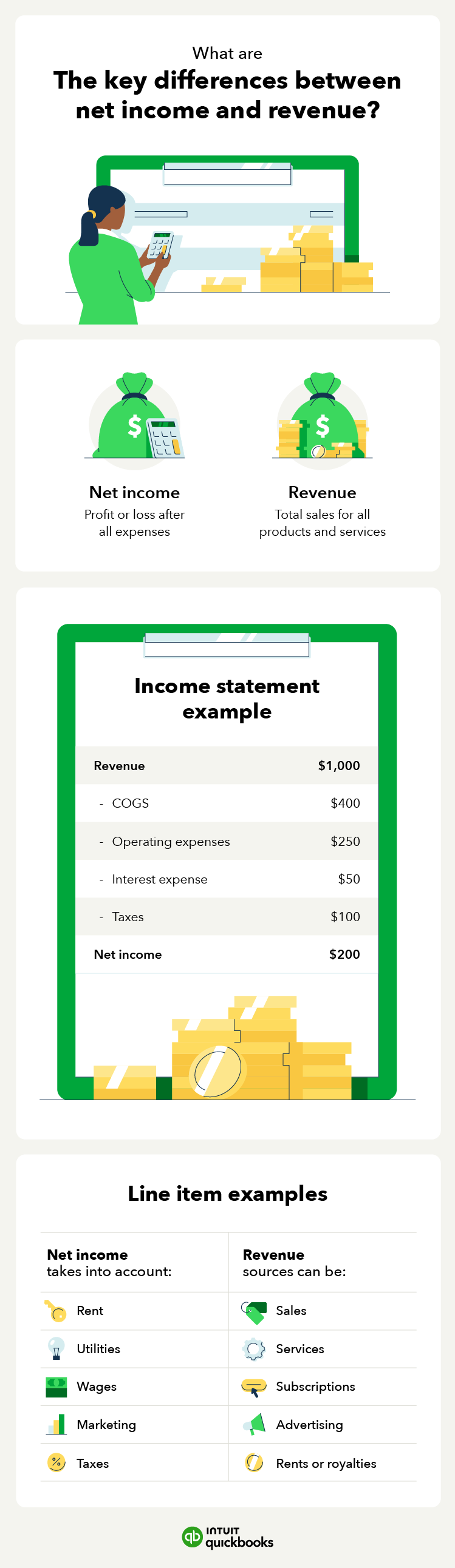

Two of the most common and valuable terms you’ll come across in managing your day-to-day business finances are revenue and net income. Both figures appear on the profit and loss (P&L) statement, but net income accounts for company expenses, while revenue does not.

Understanding the difference between net income and revenue is crucial for business owners and investors, as they:

- Help business owners make decisions about investments

- Identify areas for optimization

- Allow investors and creditors to assess the company’s profitability

For example, if a company's revenue is increasing, but its net income is decreasing, this could be a sign that the company is spending too much money on expenses. This information helps you make decisions about how to cut costs and improve the company's profitability. Let’s explore other key differences, how to calculate each, and when to use them.