You have a business idea, the drive, and the passion, and now you’re ready to make it official. Taking your hustle to the next step means figuring out how to register a business—and whether you need to at all. Starting a business is exciting but can also be an overwhelming process. However, you can register your business in as few as six steps.

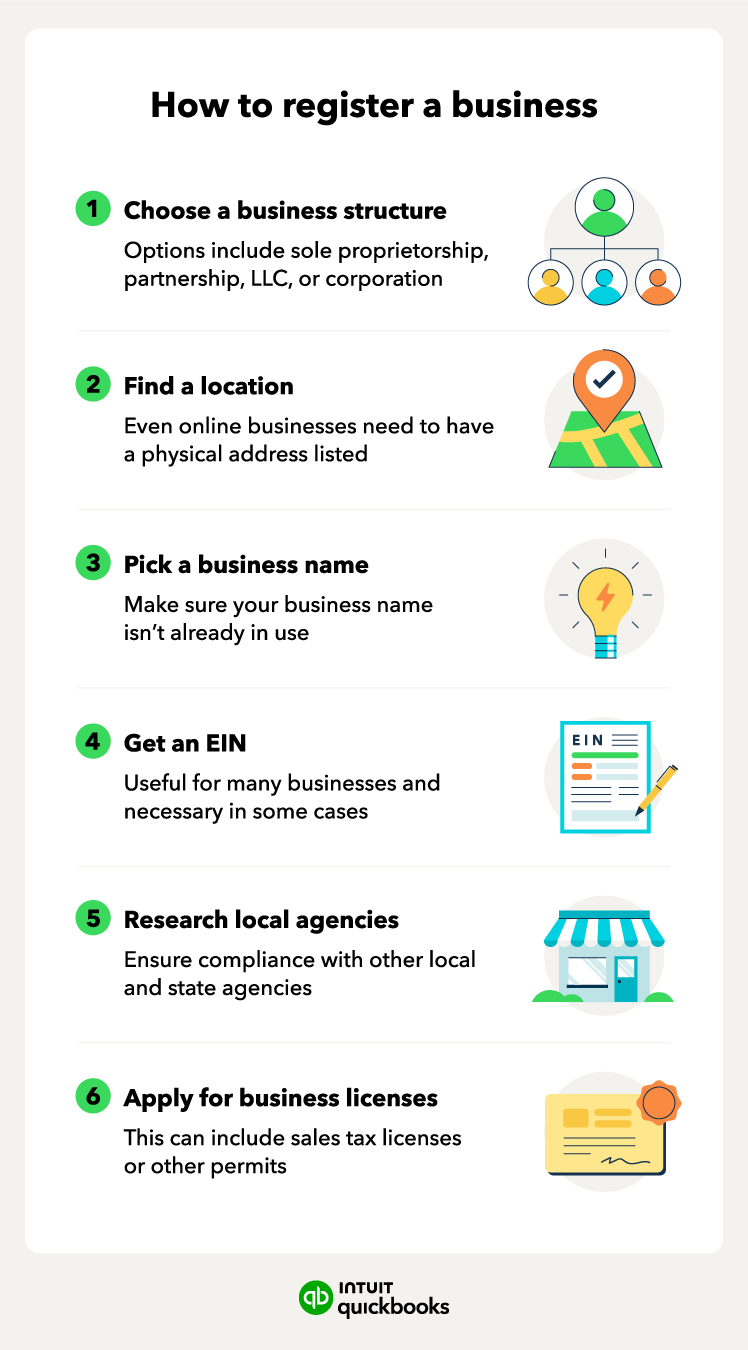

How to register your business in 6 easy steps

Let’s look at how to register a business, the reasons, the benefits, and the steps you need to take:

1. Choose a business structure

Your business structure is the foundation of your business, including how you file your taxes. It also impacts business registration, such as how and whom you register with. There are various business structures, so it’s important to choose the one that best suits your organization's needs. The most common business structures include:

Sole proprietorship

This is the most common type of business. It doesn’t require formal registration, but you may still need to obtain the necessary licenses and permits, which can vary by industry and state. If you don't pick one of the other options, this is what your business structure will be considered by default.

As a sole proprietor, you use your own name to conduct business and use your Social Security number as your tax ID number.

Partnership

A partnership is a business with two or more owners. The most basic type of partnership is a general partnership, in which owners divide all profits and liabilities equally. In addition to a general partnership, there are limited partnerships and limited liability partnerships (LLPs).

Limited liability company (LLC)

A limited liability company (LLC) combines the simplistic tax laws of a partnership with the limited liability protection of a corporation. An LLC can have one or more owners, or “members.”

As a member of an LLC, you file taxes as if you were a sole proprietor or partner. All of your business income and deductions pass through to your personal tax return. However, the LLC provides personal liability protections.

C corporation

C-corps have more requirements and have different tax advantages than other types of business structures. A C-corp files a separate tax return from its owners.

Corporations require formal company proceedings, such as electing a board of directors and assigning board duties. C-corps work well for companies looking to raise outside capital or have many shareholders but tend to be more complicated to run.

S corporation

Like C-corps, S-corps offer limited liability protections, but an S-corp is taxed more like a partnership or sole proprietorship. In other words, income passes through to the shareholders’ personal tax returns. S-corps are corporations that file an election with the IRS to be taxed as S-corps.

2. Find a location

After choosing the structure, it’s time to settle on a location for your business. Even if your company operates mostly online, you still need to register a location for operations like receiving government documents, filing taxes, and more.

You can use a PO box to communicate with customers and suppliers, but some government agencies require a street address to do business. Many lenders and suppliers also prefer to work with businesses that have a street address.

When researching potential locations, keep in mind the costs and taxes you’ll have to pay for filing at that address.

3. Pick a business name

Next, you’ll want to register your business name to prevent other businesses from using it now or in the future. Registering your business name is part of the registration process if you go with a separate entity, like an LLC or corporation.

Also, you can operate under a name other than your legal name—you’ll need to file a doing business as (DBA). In some states, business owners have to file DBA registrations with the state agency in charge of business filings—usually the Secretary of State’s office.

4. Get an EIN

Registering your business with the Internal Revenue Service gets you an employer identification number (EIN). This is essentially a Social Security number for businesses, also known as a federal tax ID.

EINs are necessary for things like filing taxes, opening business bank accounts, and hiring employees. With IRS registration, you can report income tax, sales tax, franchise tax, and other business taxes.

Remember that if you file your business as a sole proprietorship, you’ll use your own Social Security number.

5. Research local and state agencies

You’ll need to register separately with some of your local and state agencies, such as the:

- Department of Revenue

- Secretary of State

- Better Business Bureau

Each entity has its own requirements that you must follow, so it’s worth working with an attorney to get things done correctly and promptly.

6. Apply for business license and permits

You’ll need specific licenses to run different businesses, and they vary by industry and state. To avoid future problems, it’s a good idea to have any necessary permits or licenses before you start your business.

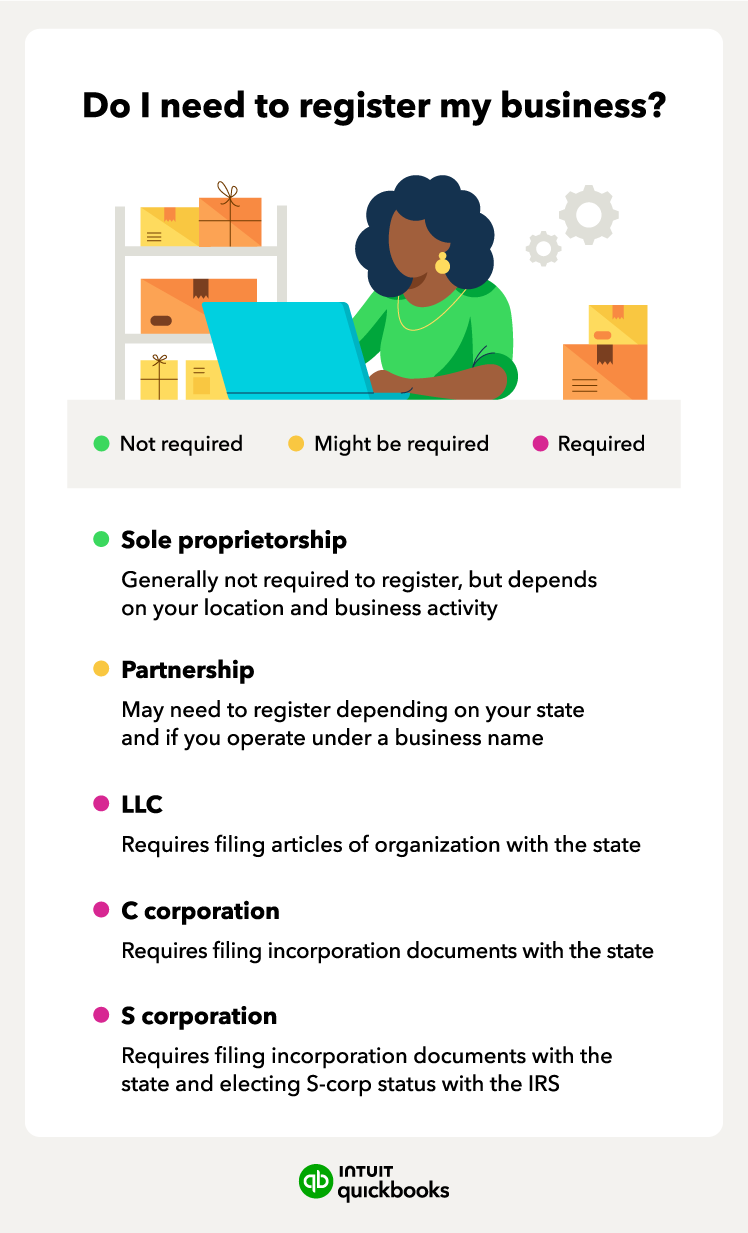

Do you need to register your business?

Whether you need to register your business depends on the type of business structure you choose. Existing businesses that are perhaps expanding should be aware of the registration requirements, and new businesses should consider the following:

- Sole proprietorships: You generally do not have to register as a self-employed business owner or sole proprietor, though registering can be beneficial to you and your business.

- Partnership: You may need to register depending on your state and whether you operate under a business name.

- LLC: You’ll need to register with the state by filing articles of organization with your Secretary of State or similar agency.

- C-corp: You’ll need to file articles of incorporation documents with your Secretary of State.

- S-corp: You’ll need to file articles of incorporation documents with your state and elect S-corp status with the IRS.

While registration isn't necessary for sole proprietorships or certain partnerships, doing so can provide liability protection and other benefits.

Why should you register your business?

Registering a business isn’t difficult, and the benefits tend to outweigh the time and effort it may take to do so. Registering your business separates your personal assets from your business assets.

A registered business can protect you from personal liability, which means you won’t risk losing your personal assets if something goes wrong with your company.

There are plenty of legal reasons to register your business, but there are also other benefits:

- Build your brand: Registering helps you build your brand’s reputation because potential customers will see you as a legitimate organization.

- Hire employees: You can hire employees and pay them per your state’s laws. When you register your business with the state, you’ll receive a state EIN that allows you to collect state taxes for your employees.

- Financial benefits: Registering comes with its share of financial benefits, including tax benefits and the ability to apply for loans and other funding officially.

Also, if you intend to open a business bank account, you’ll need to provide proof that your business is properly registered with the state.

Start your business with confidence

After figuring out how to register a business, it’s time to create your business plan and get your operations off the ground. Registering your business, if you need to, is an important step, but so is having your finances in order. Accounting software built for self-employed individuals like QuickBooks Solopreneur helps you track your income and expenses and file taxes with ease.