Schedule C

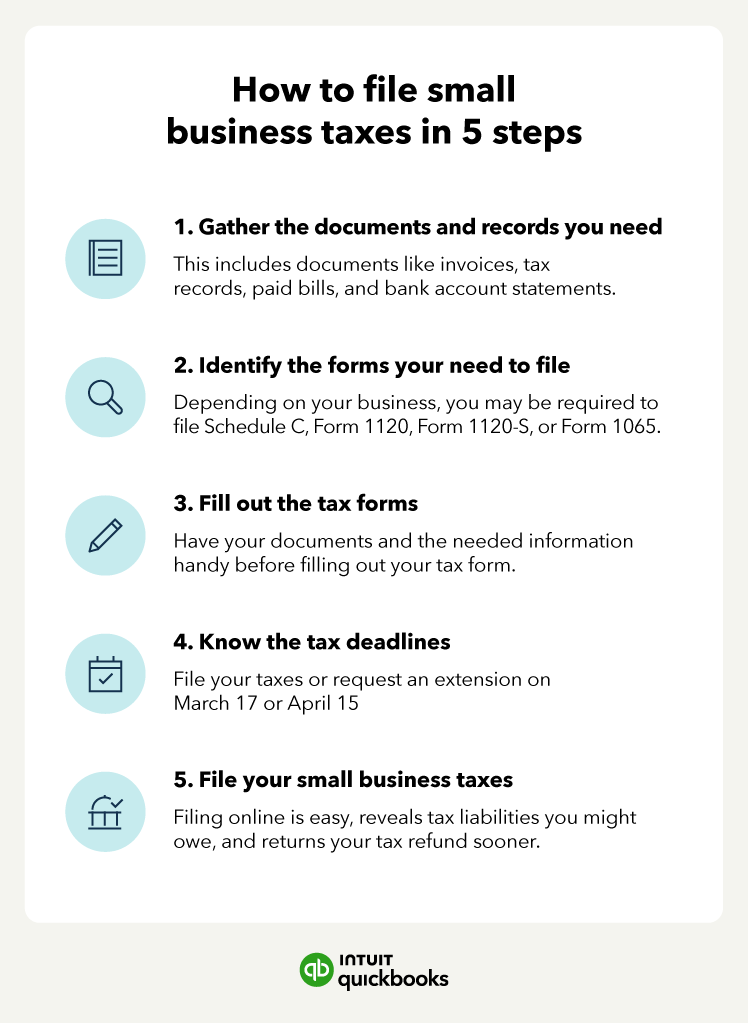

If you’re filing using Schedule C, the form is a bit less complex, as it is only two pages. Start by entering your basic business information, like your business name, address, and EIN (if you have one). Then, you'll move on to reporting your income and expenses.

- Income: Report all the money your business earned during the year. Be sure to include all sources of income, such as sales and services.

- Expenses: Deduct your business expenses, like advertising costs, office supplies, and travel expenses. Remember to have your records handy to back up these deductions.

Once you've entered all your income and expenses, you'll calculate your net profit or loss. This is the amount you'll report on your personal income tax return (Form 1040).

Form 1065

Form 1065 is a bit more complex than Schedule C. You'll need to provide information about your partnership or LLC, including the names and addresses of all partners or members. You'll also need to report the partnership's income and expenses.

Once you've completed Form 1065, you'll need to prepare Schedule K-1 for each partner or member. This form shows their share of the partnership's income or loss.

Form 1120 and Form 1120S

Form 1120 and Form 1120S are more extensive and might require a bit more time to fill out. Be prepared with all of the required information, and have your supporting documents handy before filling out your form.

Accurately filing your tax forms is crucial to avoid penalties and ensure you're paying the correct amount of taxes. Take your time, be organized, and don't hesitate to seek help if you need it.

Accurately filing your tax forms is crucial to avoid penalties and ensure you're paying the correct amount of taxes. Take your time, be organized, and don't hesitate to seek help if you need it.