In case you haven’t noticed, Intuit® has been ramping up the features in QuickBooks Online® over the past year. I wanted to share some of them with you, and tell you which are my favorites and why.

Before we start, I want to mention one of my favorite features: Price Rules. This was added in 2017, so I won’t list it this article, but you can read about it here; I also have some tips for using it to create discounts here.

Here are some of the more recent QuickBooks Online Greatest Hits. My personal favorites are marked with an asterisk (*).

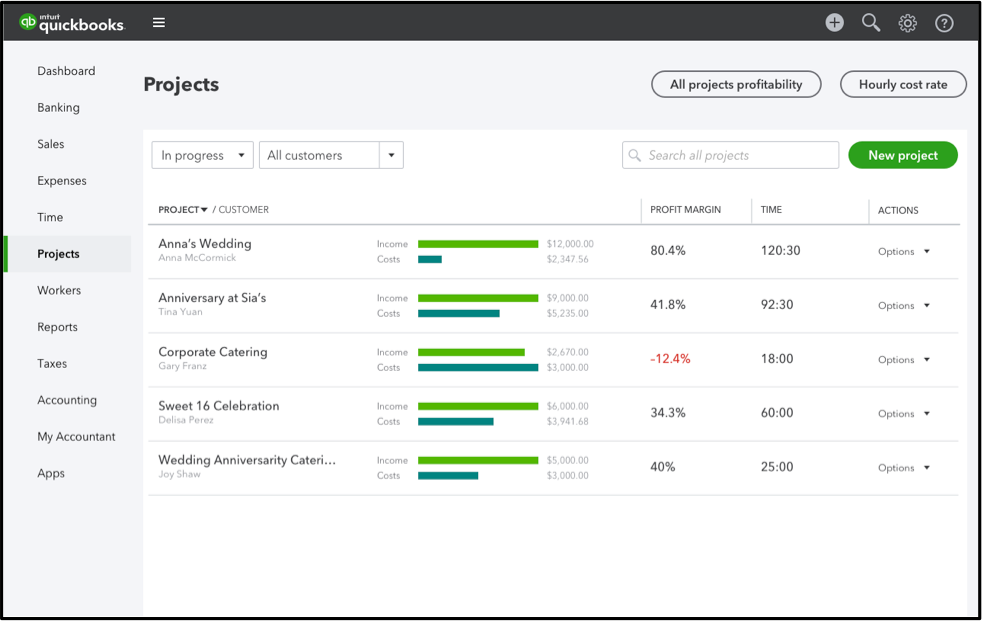

*Track project profitability: Bottom line here is that we now have labor costing in Projects. This is a big, huge deal. (And, yes, I realize those words mean the same thing.)

With QuickBooks Online Plus or Advanced, you can use Projects to track each job’s expenses, income and labor costs, all in one place.

To access Project Profitability, select Projects from the left navigation. If you don’t see that option, you’ll need to turn on Projects. I thought the best way to explain this was to link to a video that Woody Adams created.

You’ll see a consolidated list of your projects, as well as their profit margin.