Inventory analysis is the process of examining inventory to determine the optimum amount a business should carry. By obtaining a clear picture of the inventory that keeps your company profitable, you can keep up with customer demand while increasing sales and controlling costs.

How you can use inventory analysis to optimize your operations

You don’t need a complex data infrastructure or an ERP to reap the benefits of inventory analysis. It simply requires understanding inventory analysis formulas and a grasp of inventory analysis principles. We’ll cover both of those later on, but first, let’s take a step back and better define this concept.

What is inventory analysis?

Inventory analysis refers to any calculation that helps a business better understand their inventory levels, ultimately improving cash flow, reducing stockouts, and operating efficiently.

Inventory analysis empowers you to work on your business instead of being stuck inside it so you can be proactive with your most valuable assets. For example, a contractor can use inventory analysis to see if their business has adequate materials to take on a new project. It also helps identify trends and acquire the right mix of products based on customer demand.

What are the benefits of inventory analysis?

Conducting regular inventory analyses helps to keep your inventory management on track and increases efficiencies over time. Here are the biggest benefits of using inventory analyses in your business workflows.

1. Reduce stockouts and project delays

Some companies take on projects that require hundreds, sometimes thousands, of items. Stockouts can mean project delays, which upsets the client and cuts into profits. For retail companies, stockouts mean lost sales and unhappy customers who will go to a competitor to get a similar product.

2. Improve cash flow

A study by U.S. Bank found 82% of business failures are due to cash flow issues. For manufacturing and retail businesses, the vast majority of their cash is represented by their inventory every month. Without effective inventory analysis methods, operating a business can feel like riding a roller coaster that is about to run off the rails.

Low on cash and run out of an in-demand SKU? Finding short-term financing can be difficult and cuts into your margins. Capital all tied up in inventory that is sitting rotting in storage? It’s incredibly painful to write it off as a loss. Inventory analysis can show you when your business’s lean times are and when the rush is, so you can prepare with safety stock or stop buying inventory you’re not selling.

3. Delight customers

In his 1997 annual letter to Amazon shareholders, Jeff Bezos wrote that his goal was to make Amazon the earth’s most customer-centric company. Well, their inventory analysis (rivaled only by Walmart) allows Amazon to offer Prime members free two-day shipping on millions of products. Inventory analysis enables faster response times and efficiently filled orders, giving you the ability to earn loyal customers.

4. Reduce inventory waste

Writing off inventory as a loss is akin to lighting cash on fire. A proper analysis can dramatically improve inventory control, so you never again have to see those boxes that have been sitting in the back of your warehouse for the past year. The same applies to lost inventory, theft, and leakage, which reduces costs and enables you to introduce cost controls.

5. Better pricing from suppliers and vendors

When you know what items produce the most profit for your company, you’ll be more likely to confidently negotiate better terms with suppliers, improving your bottom line. Operating a business can drag you in a million directions, often pulling you away from the actions that make money. By analyzing the inventory that keeps your company profitable, you can prioritize it, making the supply chain for that inventory as efficiently as possible.

How do you analyze inventory?

Depending on the business you run and the types of inventory you carry, you can use several inventory analysis methods. Here are a few examples:

ABC analysis

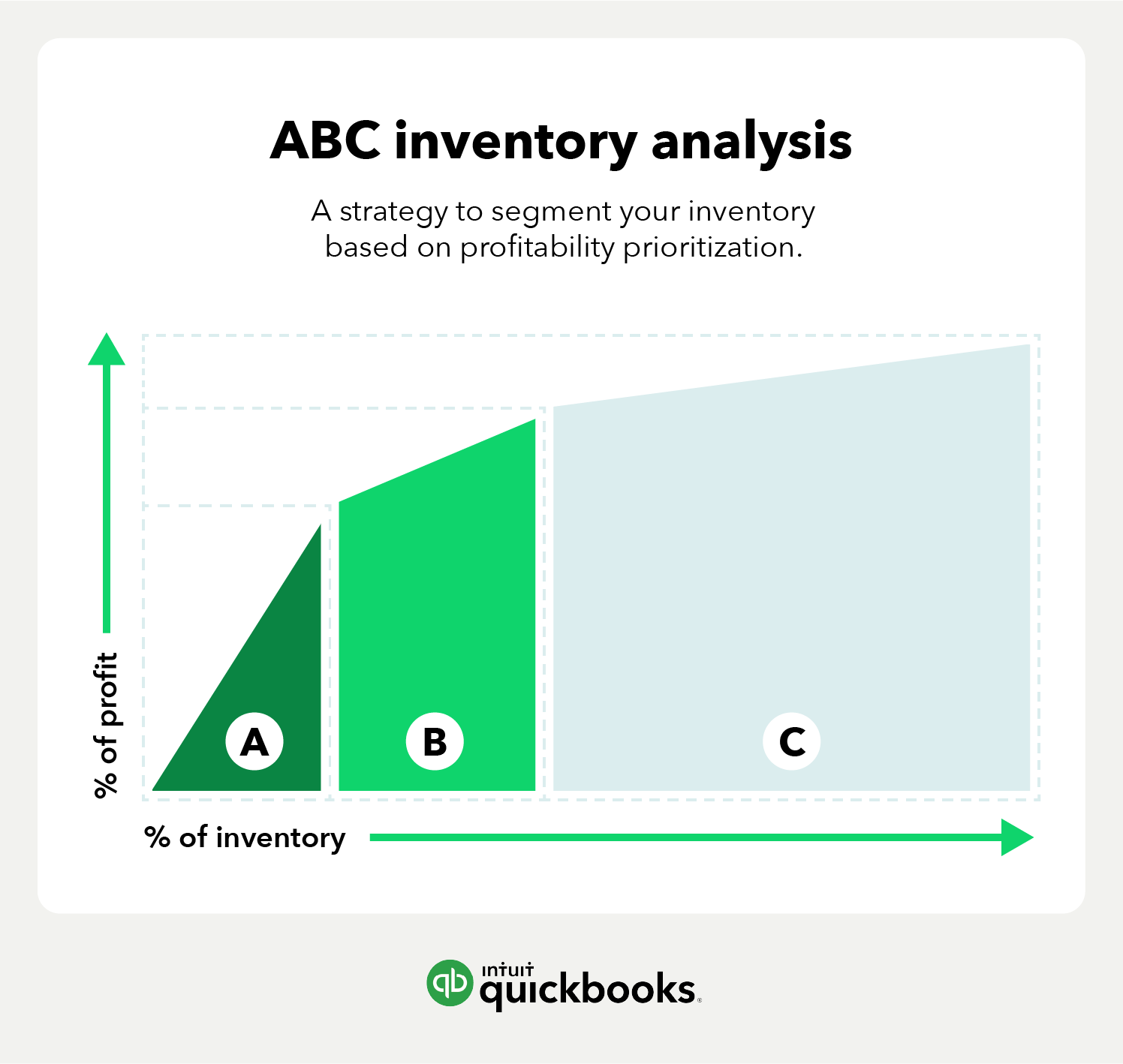

ABC analysis is one of the most popular inventory analysis methods. It is based on the Pareto Principle, which states that, for many events, roughly 80% of the effects come from 20% of the causes. ABC stands for “Always Better Control.”

ABC analysis brings simplicity to inventory analysis by putting all of your inventory into three buckets, enabling you to make more strategic decisions. The buckets are:

- A-Inventory: This inventory has the highest value, most often the highest profit margins or sales revenue. It should be your highest priority and rarely, if ever, stockout.

- B-Inventory: Inventory that sells regularly but doesn’t have as much value as A inventory. Often inventory that costs more to hold than A inventory.

- C-Inventory: This is the rest of your inventory that doesn’t sell much and generates the least revenue, and makes up the bulk of your inventory cost.

ABC Analysis allows you to separate your most important inventory from the rest so you can give it more time and focus, boost your profits, and control your costs. This enables you to reduce obsolete inventory, optimize inventory turnover rate, increase prices, and forecast demand.

VED Analysis

VED Analysis is based on inventory value and how critical it is for an item to be in stock. This method is useful for manufacturing companies that stock many components and parts. It’s different from ABC analysis in that it only takes into account how necessary an item is to the continuing operation of the business.

- Vital: Inventory that must be in stock

- Essential: A minimum amount of these items is enough

- Desirable: These are optional items

HML Analysis

HML analysis is measured according to an item’s unit price. It’s different from ABC analysis because it only considers cost and doesn’t include the sales value of items. HML analysis is useful for controlling costs and staying on budget.

- High Cost: High unit value item

- Medium Cost: Medium unit value item

- Low Cost: Low unit value item

SDE Analysis

This inventory analysis method is based on the scarcity of items in the market or how soon you can acquire them. It’s usually used in businesses that deal with raw materials or items with long lead times to acquire.

- Scarce: Scarce or imported items that have long lead times

- Difficult: Inventory that has lead times anywhere from weeks to 6 months lead time

- Easily available: Items that are easily acquired

Safety stock analysis

Safety stock is inventory that a business holds to mitigate the risk of shortages or stockouts. Think of it as a type of insurance for when demand spikes or there’s a material shortage. Businesses can use a safety stock formula to make data-driven decisions about managing inventory levels to maximize profits.

The formula for safety stock is the difference between your maximum daily usage and lead time and your average daily usage and lead time:

(Maximum Daily Usage x Maximum Lead Time) – (Average Daily Usage x Average Lead Time)

As you can tell, there are different ways to analyze your inventory depending on the type of business you’re running, but the underlying principle remains the same. By simplifying your inventory analysis method, you can easily prioritize where to place your time and focus, increasing your operations’ efficiency.

Next, let’s look at some key metrics you can use to drill down and see how healthy your business is.

What are key metrics you can use to measure inventory efficiency?

Inventory analysis doesn’t just end with the Pareto Principle. You can use key inventory metrics to measure different segments of your business, which uncover ways to optimize your operations and increase profits.

The following inventory formulas can all be used to find ways to increase your bottom line:

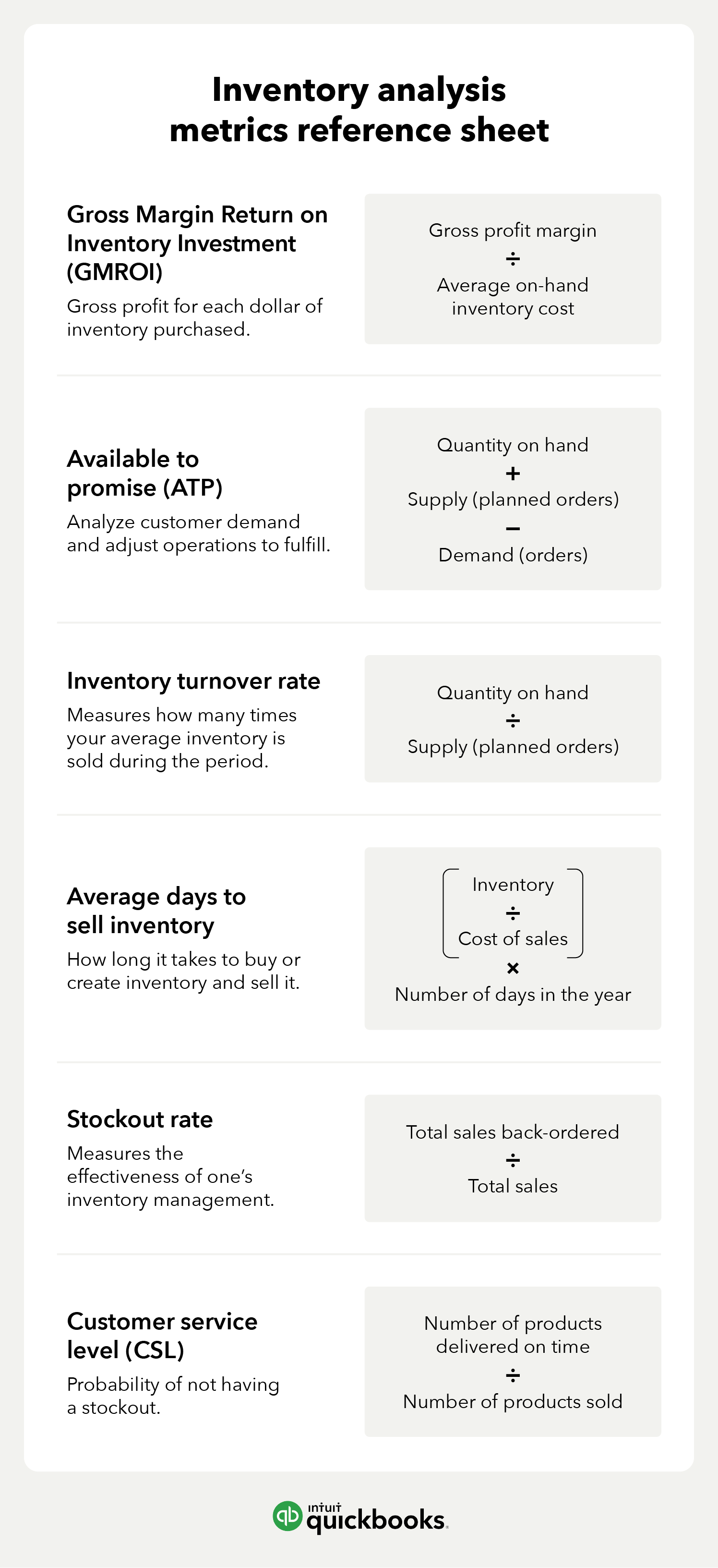

Gross margin return on invested inventory (GMROI)

GMROI is an inventory formula used by retail businesses to measure a certain element of their profitability. It measures the gross profit that a retailer makes every year for each dollar of inventory they purchased. The formula is:

Gross profit margin ÷ average on-hand inventory cost

After doing this calculation, the number should at least be higher than one. If it’s below one, it means you are losing money on your inventory and aren’t a profitable business. A GMROI of 1.50 means you are making a profit on your inventory at 150% of your cost.

There’s no specific benchmark for GMROI. It depends on your industry. Industry-specific retail associations are good resources for benchmarks like this, as is the Retail Owners Institute.

Available to promise

Available to promise (ATP) is an inventory formula used for analyzing order fulfillment. It helps analyze customer demand and adjust operations to meet it. For example, every time you order takeout from a food delivery app, the app goes through the available to promise formula to calculate how long it will take for your food to arrive.

Here’s the formula:

ATP = Quantity On Hand + Supply (Planned Orders) – Demand (Sales Orders)

The ideal promise time depends on customer expectations and varies by industry.

Inventory turnover rate

Your inventory turnover rate shows you how effectively you’re managing inventory. It measures how many times your average inventory is sold during a certain period.

This inventory formula is calculated by dividing the cost of goods sold by the average inventory for a certain period. So if your average inventory the past year was $1,000 and your cost of goods sold was $10,000, your inventory turnover rate would be 10, meaning you sold your inventory ten times over. Ideally, you want this rate as high as possible because it shows how quickly you can sell your products and proves you’re not overbuying inventory and wasting capital.

Carrying costs

Carrying costs (also called holding costs) are costs incurred in storing and maintaining inventory. This may include insurances, warehouse space, equipment, security, and labor costs.

An example of a holding cost could be a forklift truck required to move stock in the warehouse. Holding costs are represented by the cumulative dollar value of these various costs. They can be accounted for separately or grouped together.

Average days to sell inventory

This metric indicates how long it takes a company to buy or create inventory and sell it. Average days to sell inventory is calculated as follows:

(Inventory cost of sales) x number of days in the year

The average days to sell inventory ratio alerts the business owner how long, on average, it takes to sell each item of inventory.

Stockout rate

The stockout rate is the ratio of a company’s total stockout losses to total orders, expressed as a percentage. This metric measures how effective a business is at managing inventory.

Let’s say you are a clothing retailer and want to figure out your stockout rate. One way to calculate your rate would be to divide your total sales back-ordered by your total sales.

So if you did $100,000 in sales, but $10,000 of those sales were for items that were on backorder, your stockout rate would be 10%, which is high. You’d want to look at why and make sure you had enough inventory on hand the next quarter to reduce that rate.

For your most in-demand and profitable inventory, you want your stockout rate to be as close to zero as possible. A high stockout rate can also hurt customer satisfaction, which we’ll talk about next.

Customer service level (CSL)

CSL is the expected probability of not having a stockout for a given period or the probability of not losing sales. Ideally, your CSL should be as close to 100% as possible, especially if it’s A-inventory based on ABC analysis. There are few ways to calculate customer service level, but an easy inventory calculation is to divide the number of products delivered on time divided by the number of products sold.

How to start using inventory analysis in your business

If you’re new to inventory analysis, here are some best practices to keep in mind.

1. Audit your stock levels

Before conducting an inventory analysis, you should first determine the amount of inventory you have on hand to make sure it aligns with what you think you have. You can audit stock efficiently with a barcoding system.

2. Align your inventory analysis with your strategy and business goals

There is no one-size-fits-all approach to analyzing inventory. You can mix and match any of the above methods, but the most important thing is aligning with your team on your inventory management strategy and business goals to use your resources effectively.

3. Use inventory management software

When time is at a premium, automation is key when it comes to analyzing inventory. With QuickBooks Desktop Enterprise, you can track inventory in real-time, generate real-time reports, designate reorder points, and ensure the right inventory is in the right place at the right time.

Final thoughts

In today’s on-demand world, customers expect their orders delivered quickly and correctly. Effective inventory analysis allows you to keep up with them and do it without getting overwhelmed. This means better cash flow, greater profits, and fewer sleepless nights.

With QuickBooks Desktop Enterprise, you’ll have everything you need to efficiently manage your inventory, with automatic data tracking and customized reports. With fewer inventory fires to put out, you’ll be able to work on the reason you started your business in the first place — doing what you love.