How to find and calculate fixed costs

You can use your income statement to find and calculate the total fixed expenses your business incurs:

Locate the expense section

Begin by opening your income statement (also known as a profit and loss statement) for a specific period, such as a month, quarter, or year. Scroll down to the "Expenses" section.

This section details all the costs incurred by your business during that period. It includes costs like interest, utilities, rent, wages, costs of goods sold (COGS), and more.

Identify fixed expense line items

Within the expense section, look for line items that represent costs that remain consistent regardless of your sales or production volume, like rent or insurance.

You may want to note these expenses on the side for reference later.

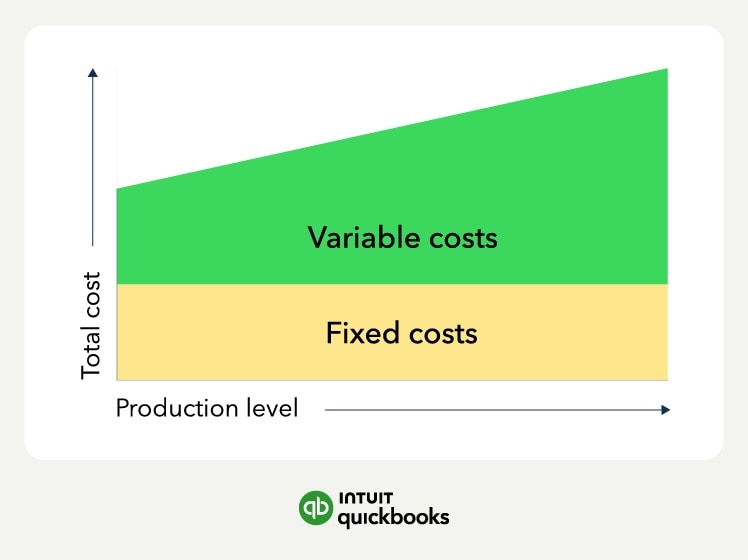

Distinguish from variable expenses

Differentiate fixed expenses from variable expenses like raw materials, sales commissions, and hourly wages. These are all costs that change depending on your production and sales.

Note these expenses on the side for later use, such as calculating total costs.

Find the variable cost per unit

Divide the total variable costs incurred by the number of units produced during that period. For example, this could mean dividing the cost of materials by the units your company produced with those materials.

Variable cost per unit formula

Variable cost per unit = total variable cost / total units produced

Calculate total fixed costs

Once you've identified all the fixed expense line items, add them together to calculate your total fixed costs for the period. This total represents the baseline expenses your business must cover, regardless of its level of activity.

Calculate total costs

Total costs are the sum of all fixed and variable costs incurred. Your income statement may calculate this for you, so be sure to read it carefully.

Total cost formula

Total cost = fixed cost + variable costs

Regularly review your fixed costs. While they don't change with sales volume, you might find opportunities to renegotiate contracts or switch providers for better rates.

Regularly review your fixed costs. While they don't change with sales volume, you might find opportunities to renegotiate contracts or switch providers for better rates.