There are many aspects of being a business owner that drive success.

Sales, production, and employee retention are all extremely important. And while it may not be the most glamorous topic, bookkeeping also plays a part.

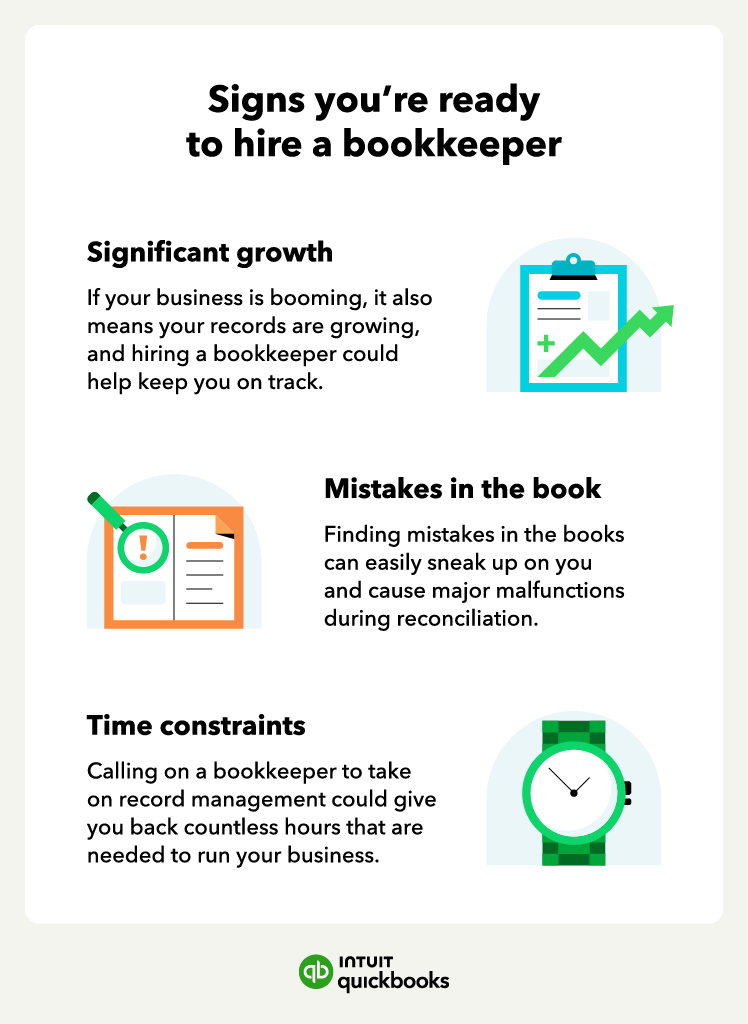

But who wants the task of sifting through receipts and organizing statements when there’s a whole slew of business operations to attend to? It may be time for you to make the executive decision of hiring a bookkeeper to take the reins.

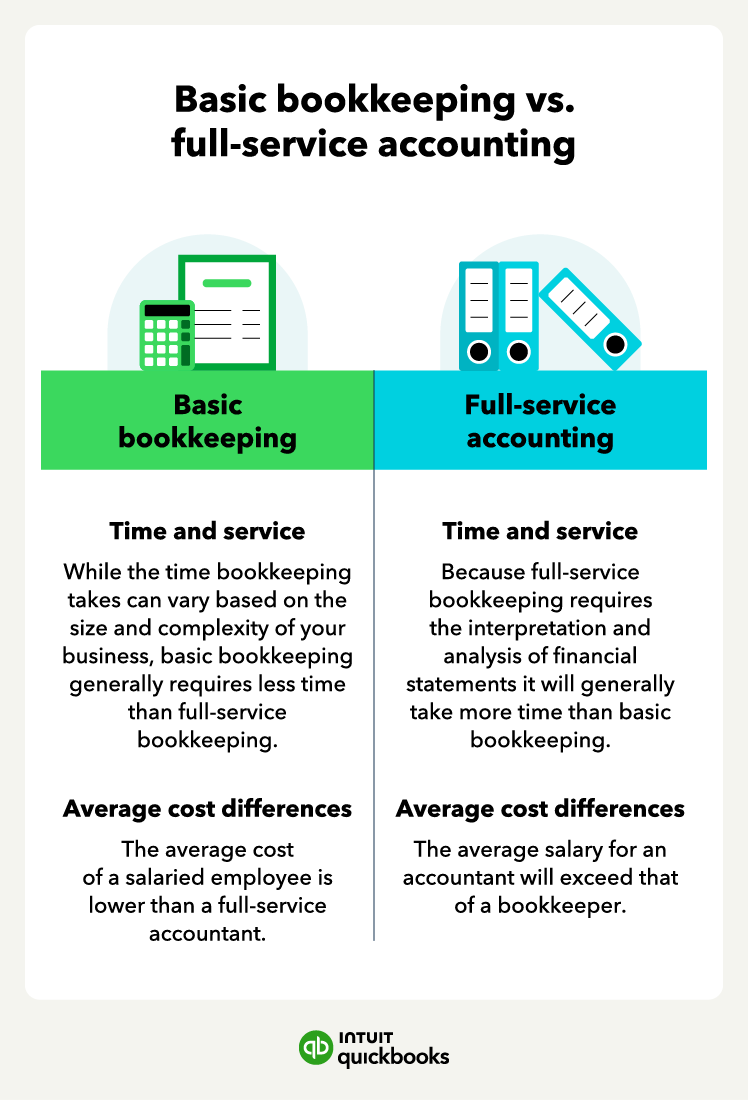

And now that you know the answer to the question “How much does a bookkeeper cost?” you may wonder what exactly a bookkeeper does and the different types of bookkeeping services you can pay for.

To learn more about the cost of bookkeeping, follow this small business guide.

What does a bookkeeper do?

A bookkeeper is responsible for recording transactions and keeping track of a business’s finances. Some common responsibilities of a bookkeeper include:

- Posting journal entries

- Assisting with payroll

- Reconciling bank accounts

- Reviewing the general ledger

- Paying client’s bills

On top of this, it is also a bookkeeper’s job to keep everything organized. That way, when it is time to file your small business taxes, you can easily access all the data you need.

Additionally, a bookkeeper may work with an accountant, who is responsible for more advanced tasks such as assessing the health of a business or generating financial statements.