For most small businesses, the holiday season can bring an extra dose of excitement ... and maybe some anxiety. From staffing to holiday marketing strategies, it’s about maximizing resources and minimizing manual effort. So we’re here to help—lending an extra hand with automation and upgrades that speed up your workflow, so you can focus on growing your business.

Now available: Commerce accounting in QuickBooks® Online

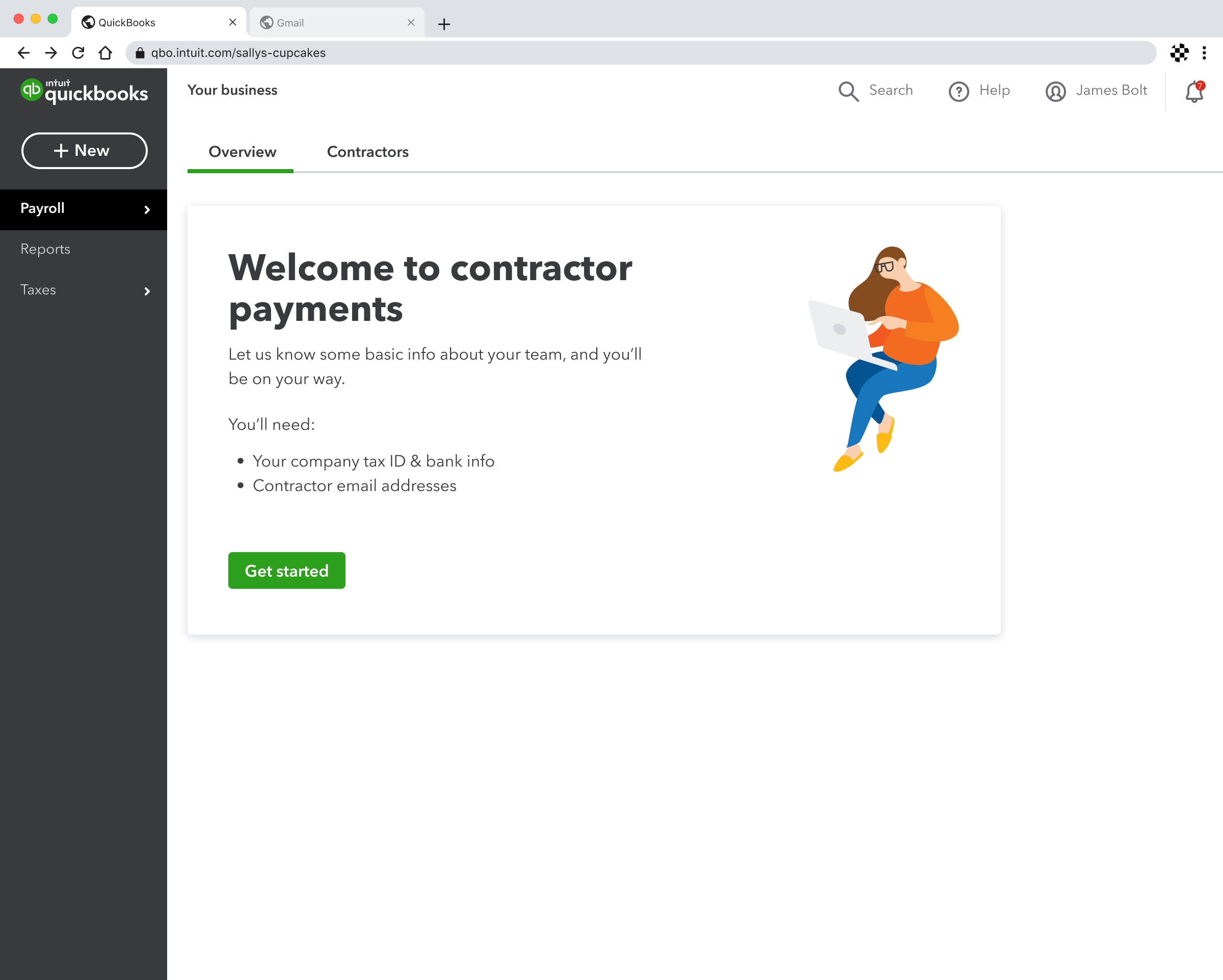

In a nutshell: QuickBooks Online now seamlessly integrates with your online sales channels, including Amazon, Shopify, and eBay.

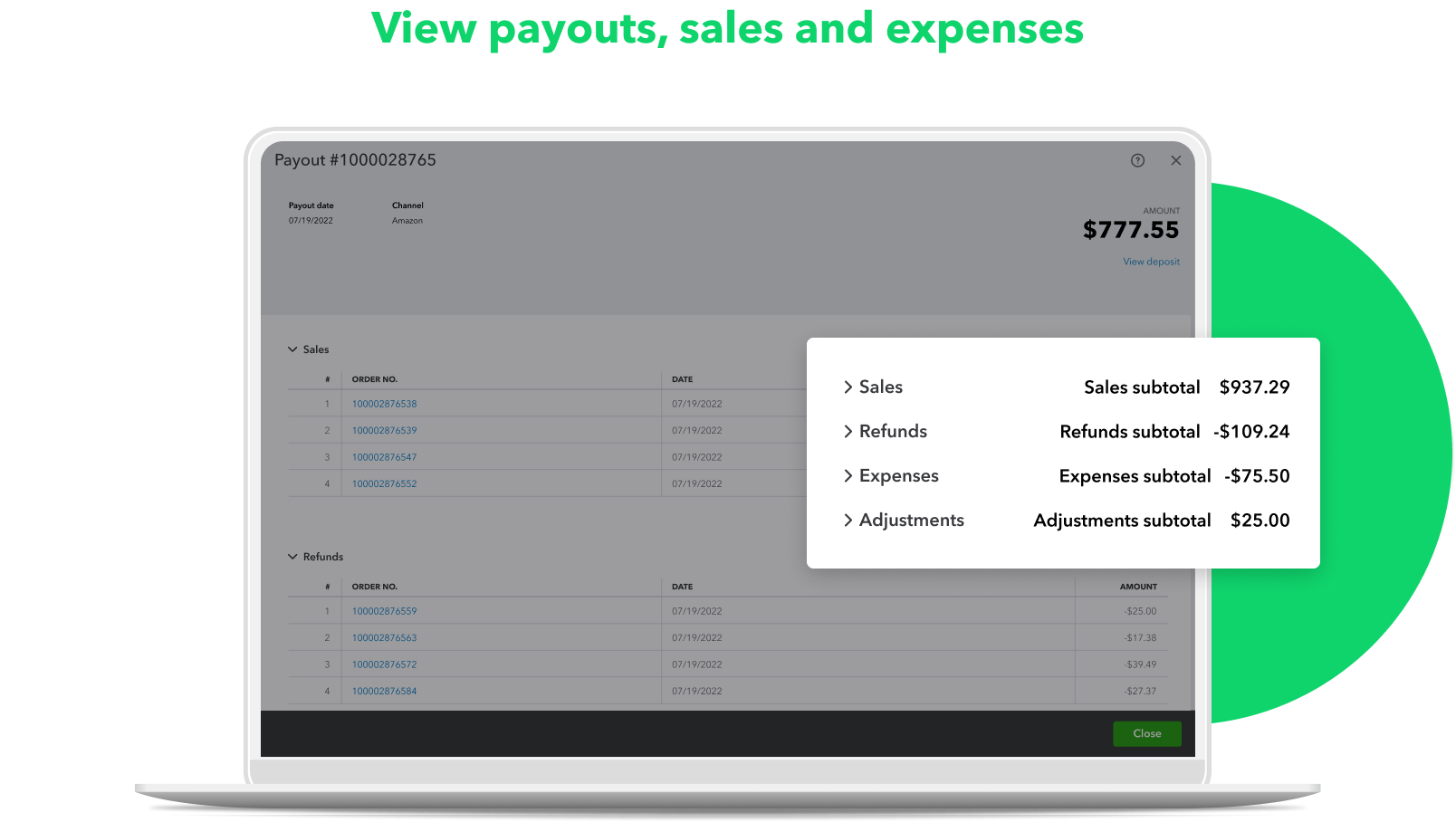

Rolling out in time for the holiday season, this new integration will help sync sales, refunds, and fees, as well as match transactions as they automatically appear in the books for you to review and approve. With QuickBooks Online commerce accounting capabilities, you can:

- Send e-commerce data to QuickBooks: Connect your e-commerce platforms and marketplaces with a fast and easy setup.

- Do less manual work: QuickBooks automatically separates your revenue from taxes and fees across your sales channels and seamlessly maps it to the right accounts.

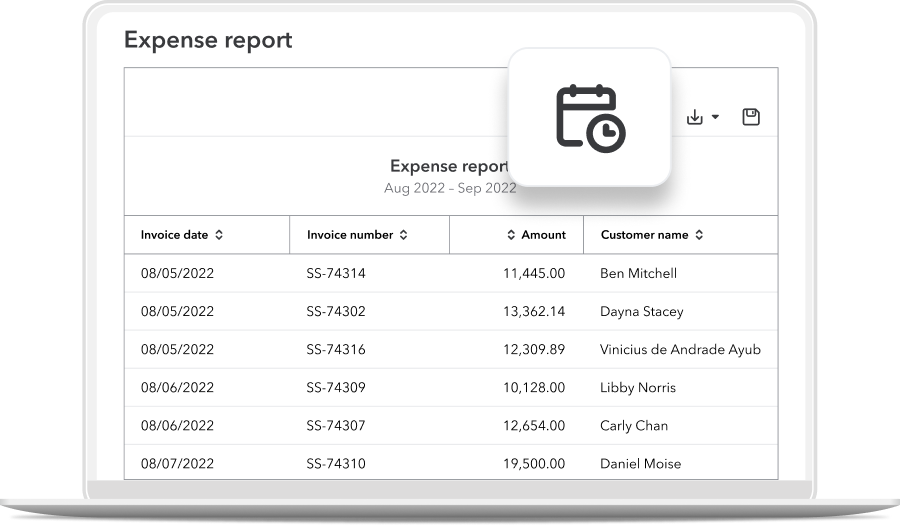

- See trends at a glance: Stay on top of cash flow, run accurate reports, and get insights into your revenue, expenses, and profitability.

- Make tax time easier: Maximize your deductions and minimize the stress of doing taxes.

This upgrade is now included in new QuickBooks Online subscriptions and will be available to existing customers over the next several weeks. Learn more