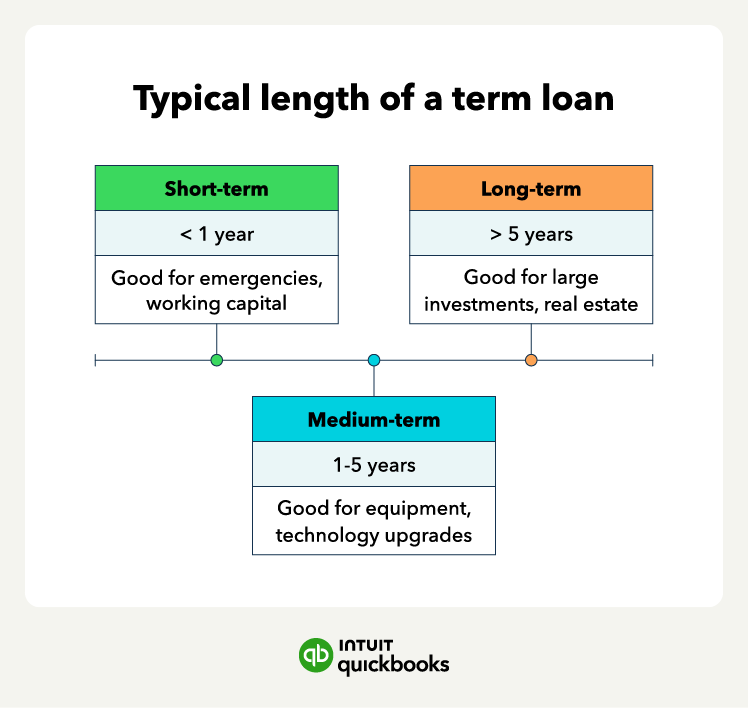

Short-term

Short-term loans typically have a repayment period of less than one year and are usually for immediate cash flow needs, inventory purchases, or small projects. These loans have more flexible qualifications and faster funding processes than other types of term loans but may come with higher fees.

Medium-term

Medium-term loans, on the other hand, have a repayment period ranging from one to five years. These loans are commonly for equipment purchases, expansion plans, or larger projects. They often have higher loan amounts than shorter-term loans, giving businesses a reasonable repayment period and manageable monthly payments.

Long-term

Long-term loans have longer repayment periods. Repayment periods for these loans are usually more than five years. They are for major investment projects, property acquisitions, or business acquisitions.

Long-term loans generally have lower interest rates versus short- and medium-term loans but may have stricter qualifications. Additionally, the funding process can be slower versus shorter-term loans. Note that longer-term loans may have a higher interest rate given the potential higher risk profile.

Ultimately, the choice between short-, medium-, or long-term loans depends on your business’s needs.

Term loan example

You can get a term loan for various purposes. Here are some real-life examples of what small businesses often use term loans for:

- Expansion and renovation: A local restaurant wants to expand its seating area and renovate the interior—they take out a term loan to cover the costs of construction, furnishings, and equipment.

- Inventory purchase: A clothing store wants to stock up on inventory and hire for the holiday season—they take out a term loan to purchase a large amount of merchandise.

- Equipment purchase: A small manufacturing company needs to upgrade its machinery to increase production—they use a term loan to buy new equipment.

- Working capital: A seasonal business, like a landscaping company, experiences cash flow dips during the offseason—they get a term loan to cover operating expenses and payroll until business picks up again.

- Debt consolidation: A small business has multiple high-interest loans and credit card debts—they use a term loan to consolidate these debts into one with a lower interest rate.

- Technology upgrades: A retail store wants to implement a modern point-of-sale system and upgrade its e-commerce platform—they secure a term loan to cover the costs of software and implementation.

- Franchise purchase: An entrepreneur wants to buy into a popular franchise and open a new location—they secure a term loan to cover the initial franchise fee, equipment, and startup costs.

Pros and cons of term loans

Term loans are a valuable financing option for businesses seeking set loan terms. Along those lines, they offer several advantages for businesses over other financing options, for example:

- Allows businesses to borrow large amounts of money, making them suitable for funding major investments or expansion projects.

- Long repayment terms may be available, which can help businesses manage their cash flow by spreading out the payments over an extended period.

- Can contribute to building a business's credit history, where regular and timely payments can lead to a good business credit score.

- Typically has a fixed interest rate, allowing businesses to plan their budget more effectively.

However, there are also drawbacks to term loans, including:

- May require collateral, such as business assets to secure the loan.

- May be more difficult to qualify, especially for businesses with a lower credit score or being in business for a short period of time. Stricter qualification requirements are often imposed on long-term loans.

It’s important to consider the collateral requirements, potential challenges in qualifying, and the approval and funding time frame when deciding on your term loan.