Past due invoice email templates: copy and paste

If you’re not automating reminders, starting with a payment reminder template can help you write a professional and friendly past due invoice letter.

Customize these templates to your specific business and match the tone of your customer relationship to them. Below are guides to help you start.

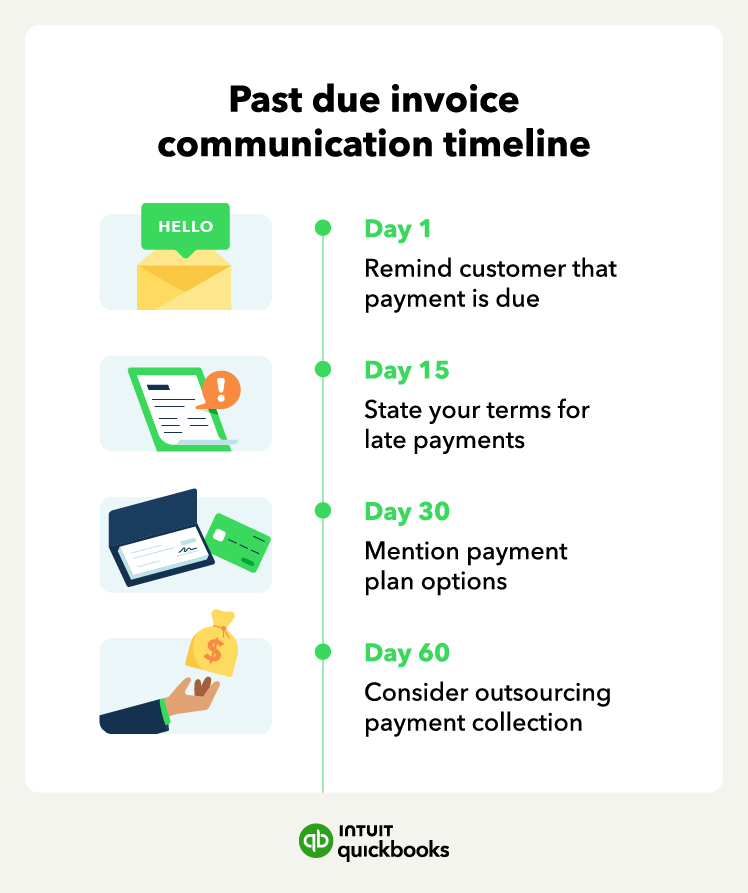

Day 1: The payment due date

If you haven’t received the payment by the due date, check to see if your customer even received the bill. If you use invoicing software like QuickBooks, you can see whether a customer has viewed their invoice, which can tip you off that they might have overlooked the email.

Either way, send a polite email reminder mentioning that the invoice may have gotten lost in the shuffle. That might be enough to spur them into action.

Invoice due email template:

Hi [Customer’s Name],

I hope this email finds you well.

This email is to notify you that payment on invoice #XXXXX for the amount of [invoice amount], which was sent on [sent date], is due today.

We have not yet received payment on this invoice and ask that you kindly confirm an ETA for the payment. If payment is not received by [late fee penalty date], a late fee will be charged.

We hope to avoid a late fee penalty, so if you have any questions about this invoice, please let us know; we will be happy to clarify.

Thank you,

[Your Name]

[Your Company Name]

Day 15: Two weeks late

If you haven’t received payment after your first reminder, it's a good time to reach out with a polite phone call. Reconfirm that your customer has the invoice, and see if they have any questions.

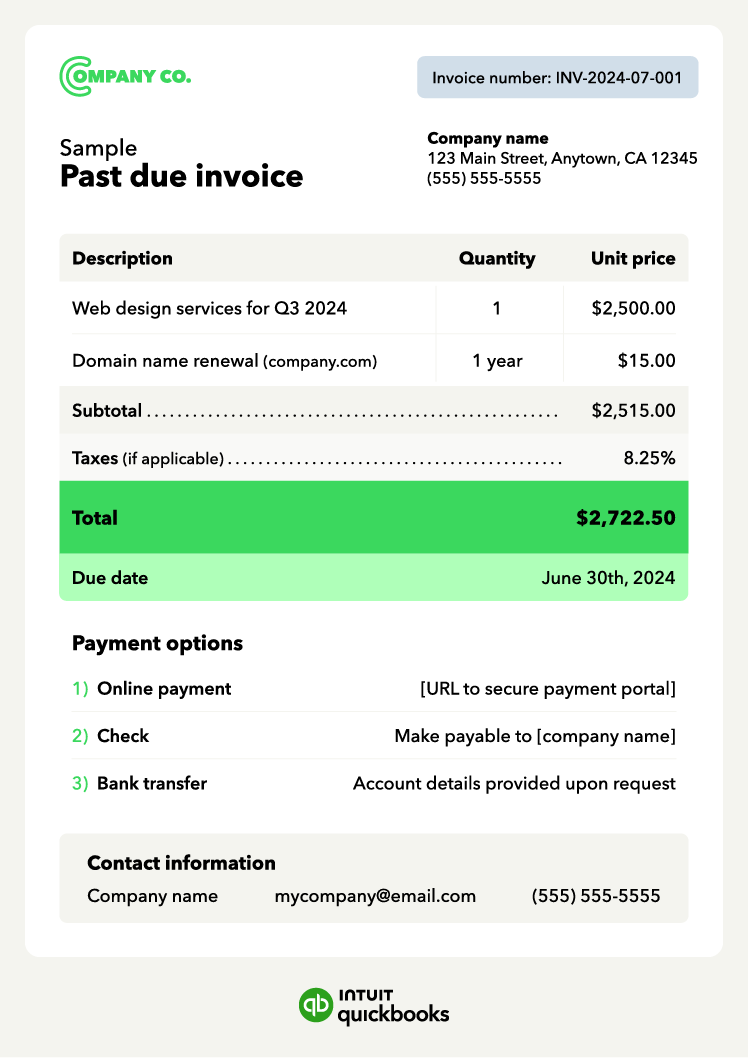

You might also begin assessing late payment fees, but—this is important—only if you've already made the terms clear in your contract or onboarding process. Hitting a customer with an unexpected late fee could cause more animosity than it’s worth. However, it’s perfectly fine to state your terms for late payments upfront and then itemize them on the invoice.

15-day past due invoice email template:

Hi [Customer’s Name],

I hope this email finds you well.

This email is to notify you that payment on invoice #XXXXX for the amount of [invoice amount] was due 15 days ago, on [due date].

We have not yet received payment on this invoice. [Optional, if applicable] As your invoice is now past its due date and grace period, a late fee of [amount] has been assessed.

The outstanding invoice amount is [invoice amount plus late fees, if applicable]. Attached is a copy of the invoice. You may make a payment here: [link to online payment or other payment methods].

Please update me with the status of your payment. Don't hesitate to reach out if you have any questions.

Thank you,

[Your Name]

[Your Company Name]

Make it easy to pay: Always include clear details like the invoice number, the amount due, and a direct link to your online payment portal or a list of available payment methods (mail-in checks,

Make it easy to pay: Always include clear details like the invoice number, the amount due, and a direct link to your online payment portal or a list of available payment methods (mail-in checks,