Types of business taxes in Texas

As an employer in Texas, you may be responsible for reporting and paying other business taxes in addition to withholding payroll taxes from your employees' paychecks. From federal to state and local levels, understanding the different tax programs and their impact on your business’s finances is important.

Federal taxes

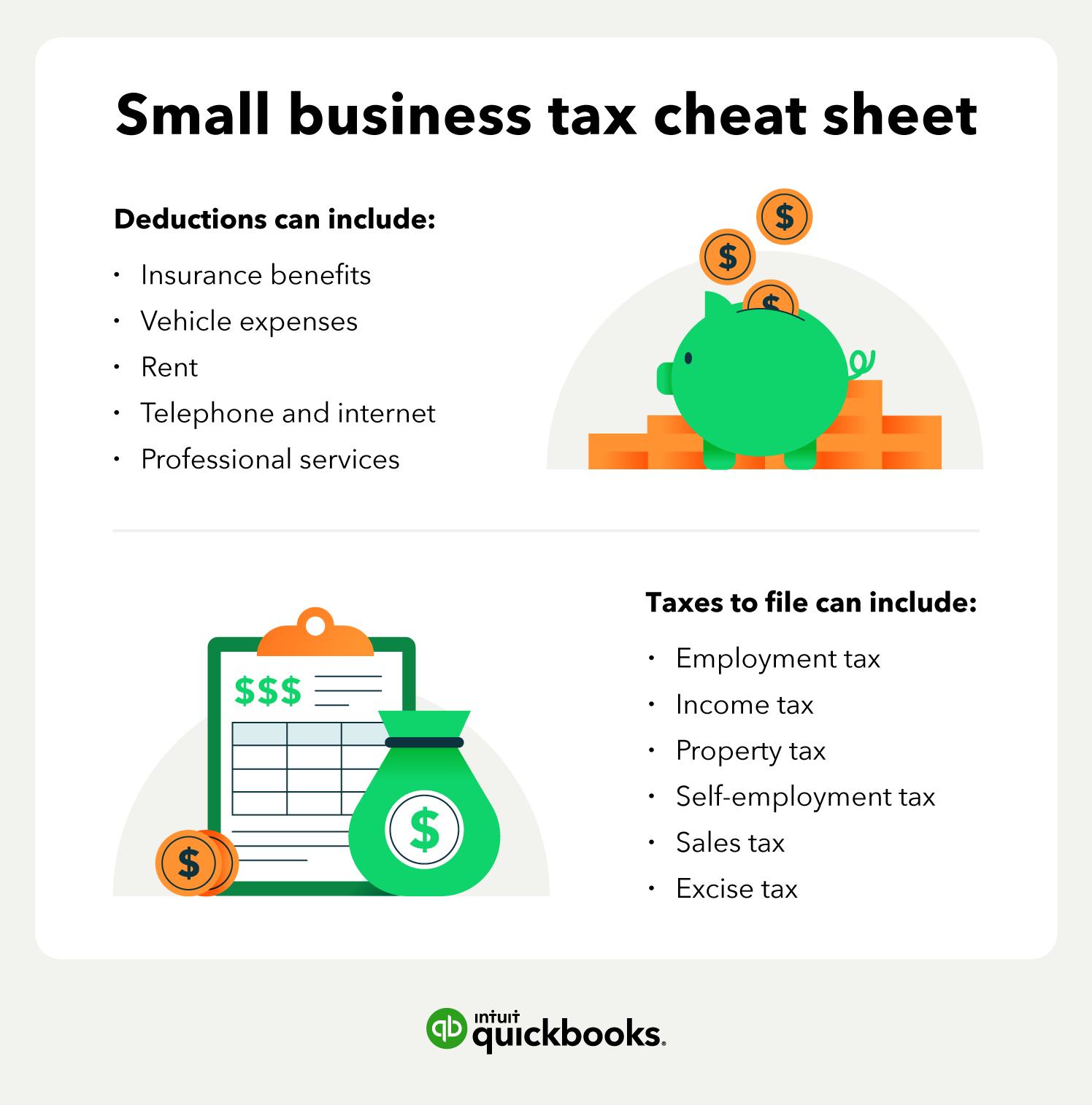

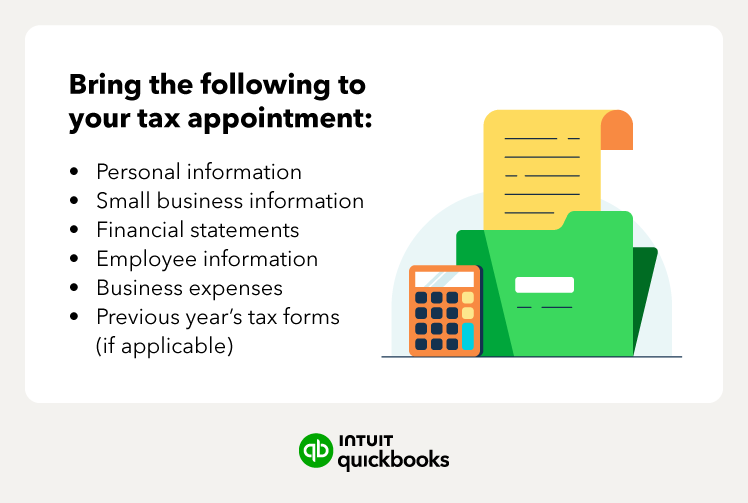

You'll be responsible for federal taxes in whatever state you open a business in. There are dozens of federal tax forms with unique due dates and requirements, so using an accountant or small business accounting software can help you avoid mistakes that could lead to overpayment or penalties.

As a business owner, you have both personal and business tax filing obligations. Here’s what you need to know:

Personal tax filing

Federal income tax returns:

Every individual is required to file and pay federal personal income tax. This forms the foundation of your overall tax responsibility.

Business tax filing

Business owners have additional filing requirements, depending on the business structure:

- Sole proprietorship: Income and expenses are reported on your personal tax return using Schedule C (Form 1040).

- Partnership: A partnership must file an information return (Form 1065) to report income, deductions, and other relevant details, while each partner reports their share of income on their personal return.

- Corporation: A corporation files a corporate tax return (Form 1120), paying taxes on its profits.

- S Corporation: An S corporation files an informational return (Form 1120S). Its income, losses, and deductions pass through to shareholders, who report them on their personal returns.

- Limited Liability Companies (LLCs): LLCs are not classified separately for federal tax purposes and are taxed based on their ownership structure. Single-member LLCs default to sole proprietorship taxation or may elect corporate taxation, while multi-member LLCs default to partnership taxation or may elect corporate taxation.

Self-employment tax

If you work for yourself and earn more than $400 a year, you pay toward Social Security and Medicare programs through a self-employment tax. The Social Security system provides retirement benefits, disability benefits, survivor benefits, and hospital insurance (Medicare) benefits.

Employment taxes

As an employer, you are responsible for withholding and depositing federal income tax and the employee contribution to Social Security and Medicare taxes. You must also pay the employer portion of Medicare and Social Security and pay federal unemployment tax (FUTA).

State taxes

There is no state income tax, but it does collect several types of taxes to fund its government, such as excise taxes, franchise taxes, property taxes, and others.

Texas franchise tax

Texas’ franchise tax is the state’s alternative to a corporate income tax. The franchise tax is considered a “privilege tax,” or a tax companies pay for the privilege of doing business in Texas. One difference between corporate income taxes and Texas’ franchise tax is that the former is based on a business’ profits while the franchise tax is based on gross receipts (total revenue).

What is the franchise tax rate?

The franchise tax rate in Texas depends on the type of business and its revenue. Here’s the breakdown for 2024:

- No-tax-due threshold: Businesses with total revenue under $2.47 million owe no franchise tax.

- EZ Computation Method: Businesses with total revenue between $2.47 million and $20 million can use the EZ Computation method, which applies a tax rate of 0.331% to taxable revenue.

- Standard Franchise Tax Rates:

- 0.375% for retail or wholesale businesses.

- 0.75% for all other businesses.

For more information and updates, visit the Texas Comptroller's website.

How is the franchise tax calculated?

The tax is applied to what Texas calls a company’s “taxable margin.” Margin can be calculated in several ways, including:

- 70% of total revenue

- 100% of revenue minus cost of goods sold

- 100% of revenue minus total compensation

- Total revenue minus $1 million

Who may be liable for a franchise tax?

Your franchise tax obligation depends on establishing "nexus," which is a connection or link between your business and the state. A company establishes nexus in Texas if it has:

- A physical presence in the state, such as an office, store, or warehouse.

- Over $500,000 in gross receipts from business activities conducted in Texas.

If your business meets either of these criteria, it likely has nexus in Texas and may be required to pay the franchise tax if its revenue is above the no-tax-due threshold.

Most taxable types of businesses are liable for the franchise tax, except for individual proprietors and certain general partnerships.

No-tax-due threshold

As of January 1, 2024, the threshold for being exempt from paying franchise tax (known as the no-tax-due threshold) has increased to $2.47 million. This means:

- If your business's total revenue is $2.47 million or less, you will not owe any franchise tax and will not need to file a traditional no-tax-due report.

- However, even if you fall below this threshold, you still need to file either a Public Information Report (Form 05-102) or an Ownership Information Report (Form 05-167). Visit the Texas Comptroller website for more information and forms.

Excise taxes

Excise taxes are special taxes imposed on specific goods or services. In Texas, these taxes apply to a wide range of products and activities, including:

- Alcoholic beverages: Liquor, beer, malt liquor, wine, and mixed beverages are taxed at varying rates. For example, distilled spirits have an excise tax rate of $2.40 per gallon.

- Tobacco: Cigarettes, cigars, and other tobacco products are subject to excise taxes, often based on quantity or weight, making these items more expensive for consumers. Currently, in Texas, the tax rate for a 20 pack of cigarettes is $1.41.

- Motor fuel: Texas levies a flat 20 cent per gallon tax on gasoline and diesel fuels. This helps fund transportation projects and public education.

It’s important to review which special taxes or fees may apply to your Texas business.

Unemployment tax

As in all states, employers must pay federal unemployment insurance (UI) taxes. In Texas, employers also fully fund state unemployment insurance. State UI tax is paid on each employee's wages up to a maximum annual amount. That amount is known as the "taxable wage base" or "taxable wage limit."

For 2025, the taxable wage limit for Texas UI tax is $9,000. Rates range from .25% to 6.25%, depending on the business’ experience rating.

Local taxes

There are no local personal income taxes in Texas. However, many cities, counties, and other jurisdictions in Texas levy other kinds of local taxes to fund essential services and infrastructure such as schools, roads, police, and fire protection.

Sales and use taxes

The state imposes a sales tax rate of 6.25% on most taxable goods and services. In addition to this state rate, local taxing jurisdictions—including cities, counties, special purpose districts, and transit authorities—can levy an additional sales and use tax of up to 2%. This means that the total combined sales tax rate in some areas can reach as high as 8.25%. You can use the state’s Sales Tax Rate Locator to find local rates.

Remote seller tax considerations

Remote sellers are out-of-state sellers whose only activity in Texas is the remote solicitation of sales (through internet, mail, phone, etc). In 2018, states were given permission to collect tax from businesses that have an economic presence in the state, even when they don’t have a physical presence there. Remote sellers must report their sales and pay Texas sales and use taxes if their total annual revenue from Texas-based sales reaches or exceeds $500,000.

Property taxes

Texas has no state property tax, but local jurisdictions use property taxes to help pay for local services.

If your business owns property in Texas, you will receive a bill from the local jurisdiction based on the appraised property value and local tax rate. Tax rates vary by county from 0.64% to 2.48%.

Local jurisdictions can also tax personal property, which, in the case of a business, may include office furniture, machinery, or even inventory.