What you need to know before filing W-2 and 1099 together

Tax season can raise a lot of questions, especially if you’re managing both W-2 and 1099 income for the first time. Whether you’re a small business owner issuing forms or an individual earning mixed income, here’s what you should know before you file.

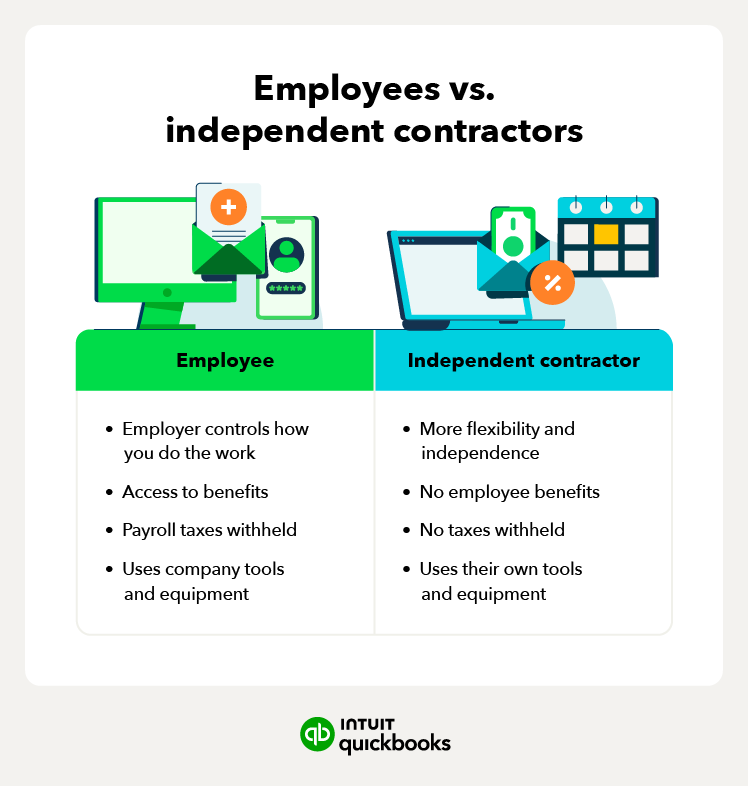

Choosing between 1099 and W-2 depends on your business needs

Small businesses must weigh flexibility against responsibility when deciding how to classify workers. W-2 employees require employers to manage payroll taxes, benefits, and insurance—but they often bring more stability and long-term control.

1099 contractors, on the other hand, give you flexibility for short-term or project-based work but require accurate 1099 filings and clear contracts to avoid misclassification penalties.

If you’re unsure which classification is right, review the IRS’s guidelines on worker classification or consult a payroll expert before hiring.

Self-employed workers can still receive W-2s

Even if you run your own business or freelance, you might still get a W-2 from a part-time or seasonal job. For example, a freelance designer could take a short-term in-house contract for a few months and receive a W-2 for that role.

When filing taxes, treat each income source separately: report the W-2 income under wages and the 1099 income on Schedule C. This helps you claim the correct deductions and keep business and personal finances separate.

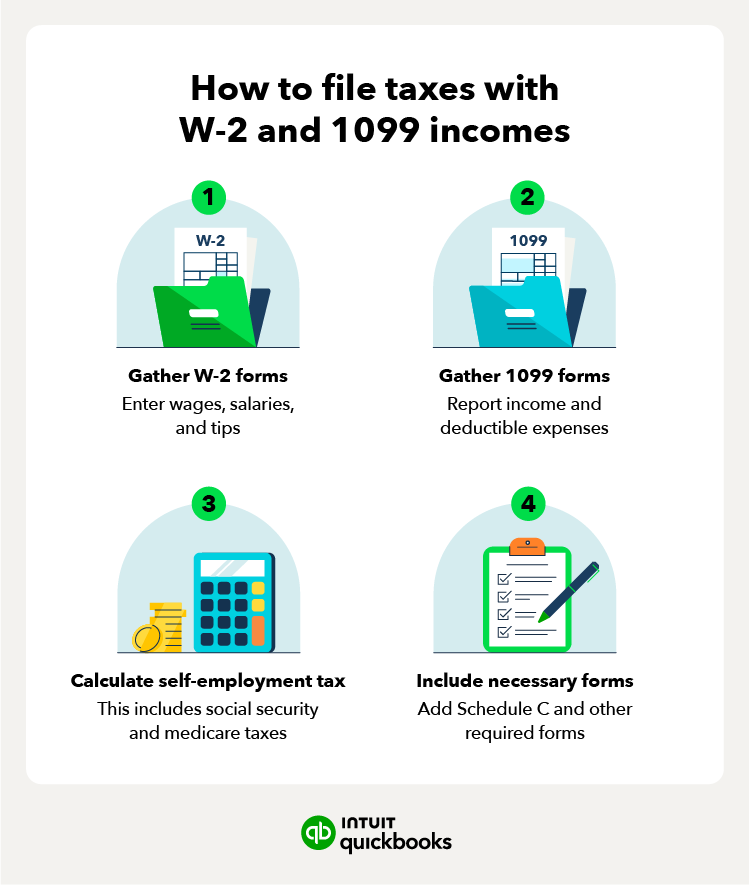

You can file both forms together without issue

It’s perfectly normal to have both W-2 and 1099 income. When filing, include both forms on your Form 1040. Report W-2 income as employee wages, and1099 income under self-employment income on Schedule C.

Tax software like QuickBooks or TurboTax can handle both forms in the same return, automatically calculating total taxable income and self-employment taxes.

Adjusting your withholdings can balance your tax bill

If you’re earning both types of income, taxes can get tricky. One smart option is to increase your withholdings from your W-2 job using Form W-4. This helps cover the taxes you’ll owe on 1099 income, which typically has no automatic tax withholding.

If you’re self-employed full time, make quarterly estimated tax payments to spread your tax burden and avoid a large bill—or penalties—at year's end.

Both income types must be reported together

No matter how many income streams you have, all earnings must be reported on the same return. Omitting even one 1099 form, even accidentally, can trigger an IRS notice.

Create a checklist of expected forms—W-2s from employers, 1099s from clients, and other income statements—to ensure nothing slips through the cracks. Keeping organized records throughout the year makes this process much easier.

You can receive both a W-2 and 1099 from the same company

It’s rare, but it happens. For instance, if a marketing agency employs you part-time (W-2) and also pays you separately for freelance design work (1099), you’ll receive both forms.

Just make sure each income type reflects the type of work performed. The W-2 should show your employee wages and benefits, while the 1099 should report freelance or project-based payments.

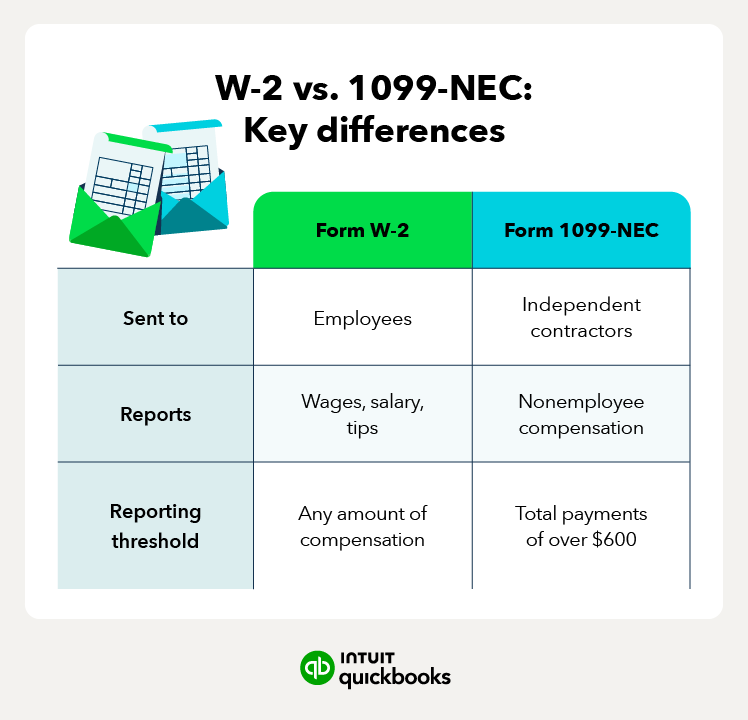

Taxes may be higher for 1099 income

1099 income typically results in higher taxes because you’re responsible for both the employer and employee portions of Social Security and Medicare—called self-employment tax.

However, 1099 contractors claim business deductions to offset those taxes. Track expenses like software, supplies, mileage, or your home office to lower taxable income.

Independent contractor deductions still apply if you earn both

If you earn both W-2 and 1099 income, you can still deduct eligible business expenses for your freelance or contractor work. The key is to keep your business and employment records separate.

For example, you can’t deduct travel or equipment costs from your W-2 job, but you can for your 1099 work. Good recordkeeping, such as saving digital receipts or using accounting software, makes filing smoother and helps support deductions if you’re ever audited.

Form 1040 is your main filing form

Report both W-2 and 1099 income on Form 1040, the standard individual tax return. Use Schedule C to report business income and expenses, and Schedule SE to calculate self-employment taxes.

Keep all supporting documents—1099-NEC, 1099-MISC, and W-2s, and receipts for deductible expenses. Staying organized through the year helps you save time and reduce errors at tax time.

When issuing both 1099 and W-2 forms to the same individual, consider using tax software to streamline the process and reduce errors.

When issuing both 1099 and W-2 forms to the same individual, consider using tax software to streamline the process and reduce errors.