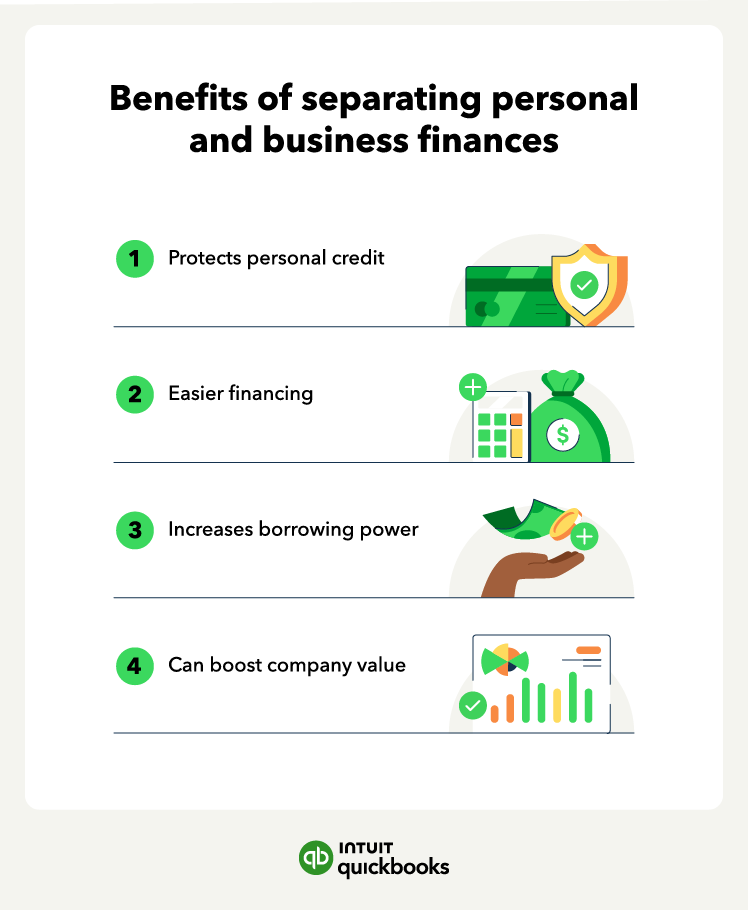

Like personal credit, building your business credit is important. Business credit tells a story about how trustworthy your business is to lenders and protects your personal assets. It can also help you establish and grow your business.

You should begin building your business credit rating as soon as your business is up and running. And if you’re already going, it’s never too late to start.

Knowing how to build business credit will make it easier to get small business loans and convince suppliers to extend credit. Let’s look at the ten essential steps to setting your company up for success when building business credit: