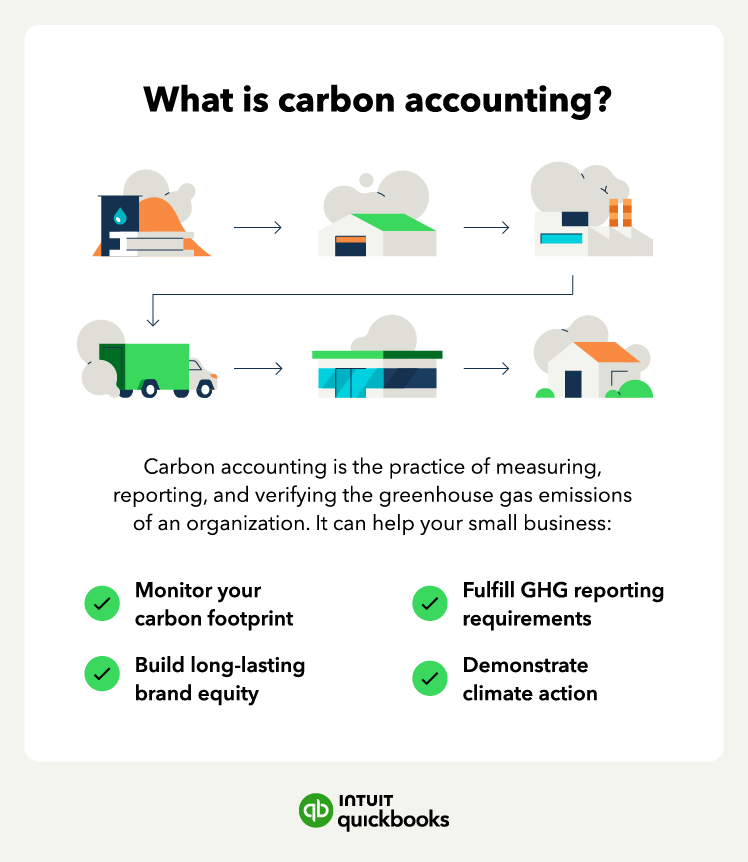

Carbon accounting helps small businesses track and reduce their carbon footprint by providing a clear picture of their environmental impact and identifying opportunities for improvement in how they can run their business more sustainably.

Help fulfill GHG reporting requirements

Carbon accounting helps fulfill GHG reporting requirements by providing a standardized and transparent way of quantifying and disclosing the environmental impact of different business activities. The following global climate action initiatives require the use of carbon accounting to lower emissions:

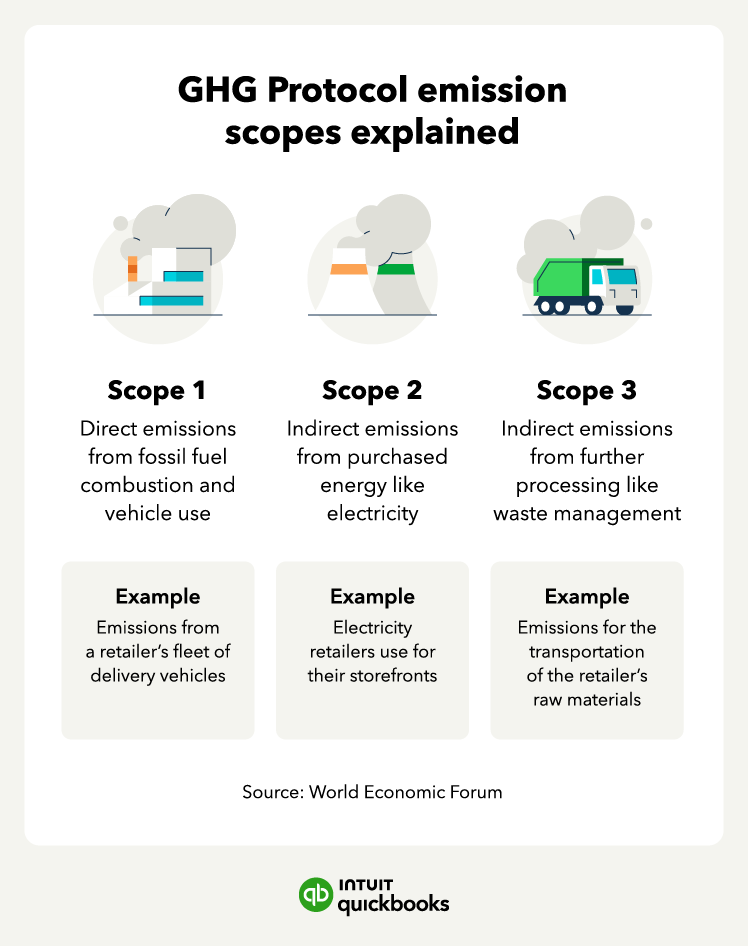

- Greenhouse Gas Protocol: The GHG protocol provides guidance on measuring, managing, and reducing GHG emissions across different scopes and sectors.

- ISO 14064: A protocol designed by the International Organization for Standardization international framework that standardizes the quantification and reporting of greenhouse gas emissions.

- Global Reporting Initiative: The GRI helps organizations develop carbon accounting best practices via online courses, certificate programs, and specialized training.

These carbon accounting standards represent the global effort to lower greenhouse gas emissions, including carbon. As climate action continues to grow in importance and urgency, GHG reporting may also become the new normal for small businesses across the globe.

Increase efficiency at your small business

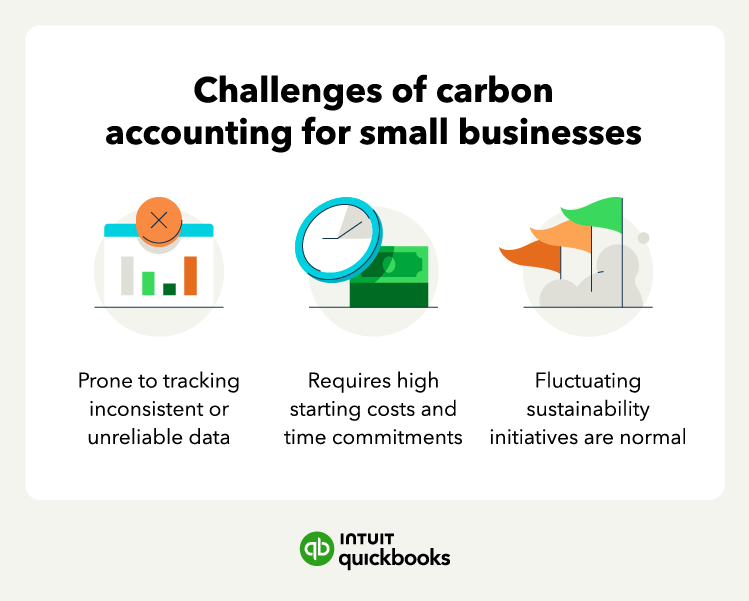

Understanding the emissions of your small business is the first step toward creating a more sustainable supply chain. Not only do carbon emissions take a toll on the environment, but they can also contribute to high energy costs.

Understanding which processes of your business contribute to the most GHG emissions could show you which areas could benefit from redevelopment. Perhaps this looks like redesigning how a good is processed or transported to consumers.

Demonstrate climate action to your customers

Show your customers, stakeholders, and supporters that you know the urgency of climate action and that your business is playing its part in creating a more sustainable future for the planet. Allow your actions to speak for themselves by investing in something tangible, like sustainable packaging materials.

Sharing these changes with your audience continues the conversation about climate action in your community, and it can establish your small business as being ahead of the sustainability curve.

Build long-lasting brand equity

Brand equity can influence customer loyalty, satisfaction, and willingness to pay. By adopting carbon accounting, small businesses can demonstrate their commitment to environmental and social responsibility, differentiate themselves from competitors, and attract and retain customers who value sustainable business practices

Carbon accounting can help businesses to comply with regulatory requirements regarding GHG emissions, avoid potential fines or penalties, and access incentives or subsidies for low-carbon activities. Investing in sustainability now is also a means of future-proofing your company’s Environmental, Social, and Governance (ESG) efforts.

How carbon accounting works (GHG protocols explained):