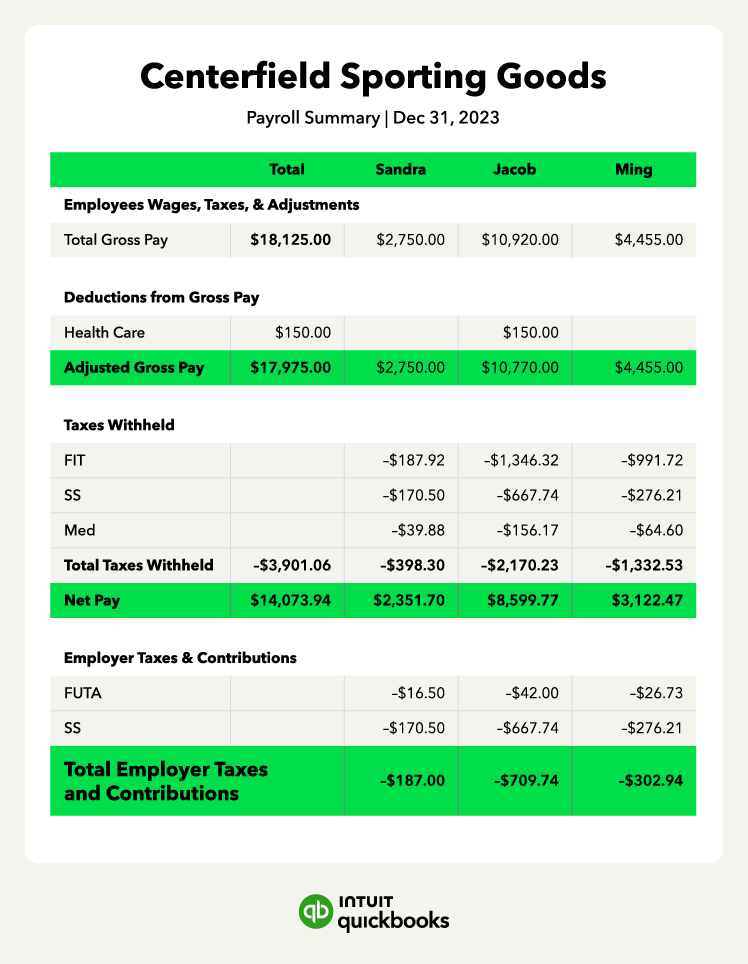

Medicare assesses a tax on every dollar of earnings. Social Security taxes, however, have a wage base limit. For tax year 2025, workers pay Social Security tax on the first $176,100 in earnings and an added 0.9% Medicare tax on wages above $200,000.

Form 940

Employers submit Form 940 to report the Federal Unemployment Tax Act (FUTA) tax annually. FUTA and the State Unemployment Tax Act (SUTA) provide temporary income for workers who lose employment, generally when the employee is not at fault.

The FUTA tax rate is 6% and applies to the first $7,000 paid to employees during the year. If you also pay SUTA tax, you may be eligible for a tax credit of up to 5.4%. Keep in mind that SUTA tax rates can vary from state to state.

Form 1096

Form 1096, Annual Summary and Transmittal of US Information Returns, reports the dollars paid using Form 1099 and the gross earnings paid. Businesses issue Form 1099-NEC (or simply Form 1099) to report non-employee compensation to freelancers and independent contractors.

Form 1099 doesn’t include withholdings for FICA tax or income taxes.

Companies have to send a Form 1099 to workers paid $600 or more during the year. Freelancers and independent contractors must pay income taxes and FICA taxes on all earnings, even if a 1099-NEC isn’t issued.

For government-funded projects, employers should also create and submit certified payroll reports to prove they're paying employees fairly.

Form 944

If your business liability for federal income taxes and FICA taxes is $1,000 or less in a particular year, you can file Form 944 and pay taxes annually.

Forms W-2 and W-3

Employees file Form W-2 annually with their personal tax return to report gross wages and federal tax withholdings.

Form W-3, Transmittal of Wage and Tax Statements, reports an employer's total wages and tax withholdings. When you submit Form W-3, include a copy of each W-2 you issued for the tax year.

State payroll reports

Companies must also withhold and submit state income taxes using state tax forms. The requirements depend on the state, and some states do not assess state income taxes.

Local payroll reports

Similar to state payroll reports, businesses may also be subject to income tax at the local level, whether at the city or state level. These reports may be due annually or quarterly, so check with your local authorities.