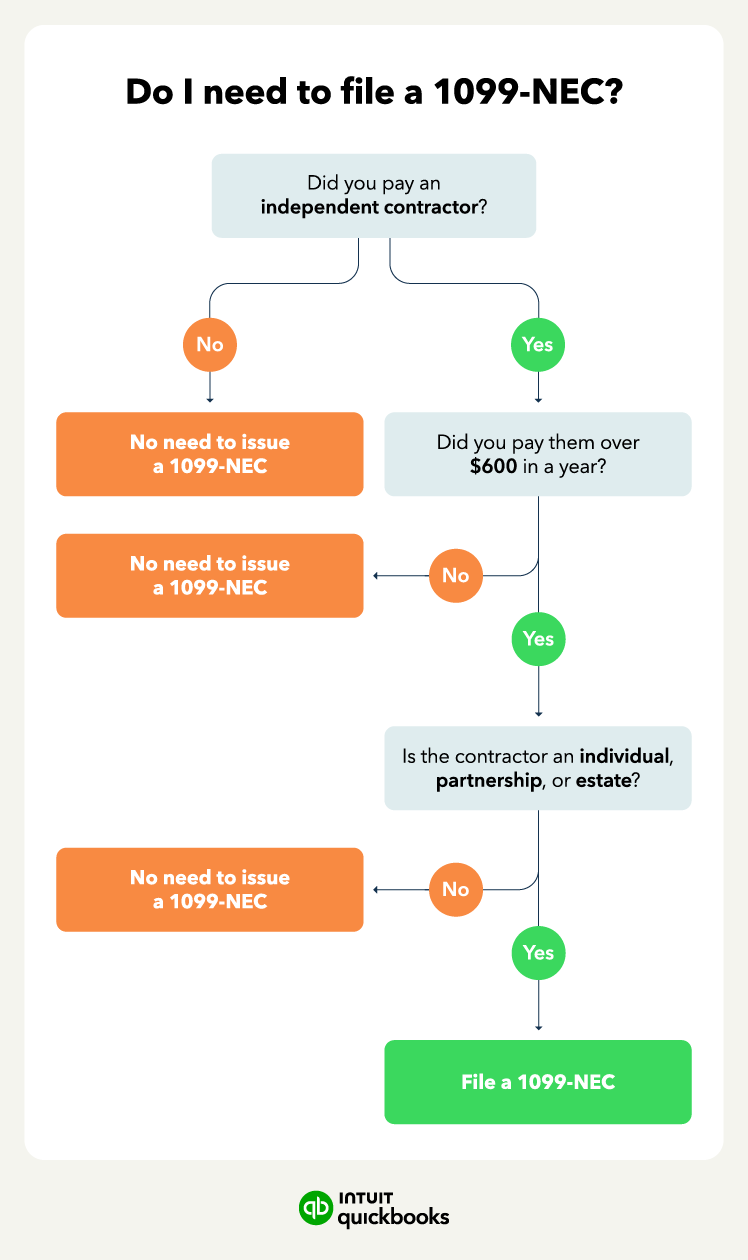

If you're a small business owner who works with freelancers, you may need to file Form 1099-NEC. Introduced in 2020, this form reports income paid to independent contractors, helping the IRS track their earnings and ensure the correct amount of taxes is collected.

In this article, we'll explore the details of Form 1099-NEC, including how it works, how to fill it out, and key differences from other 1099 forms. By understanding Form 1099-NEC, you can ensure compliance with tax regulations and maintain a smooth business operation.

Jump to:

- How does Form 1099-NEC work?

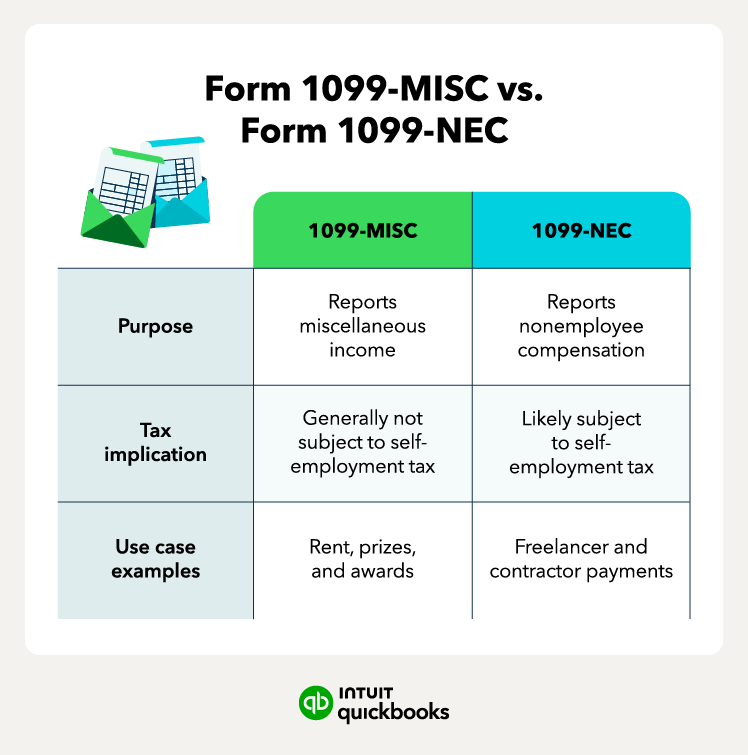

- What’s the difference between 1099-MISC and 1099-NEC?

- What are the filing requirements and deadlines for filing Form 1099-NEC?

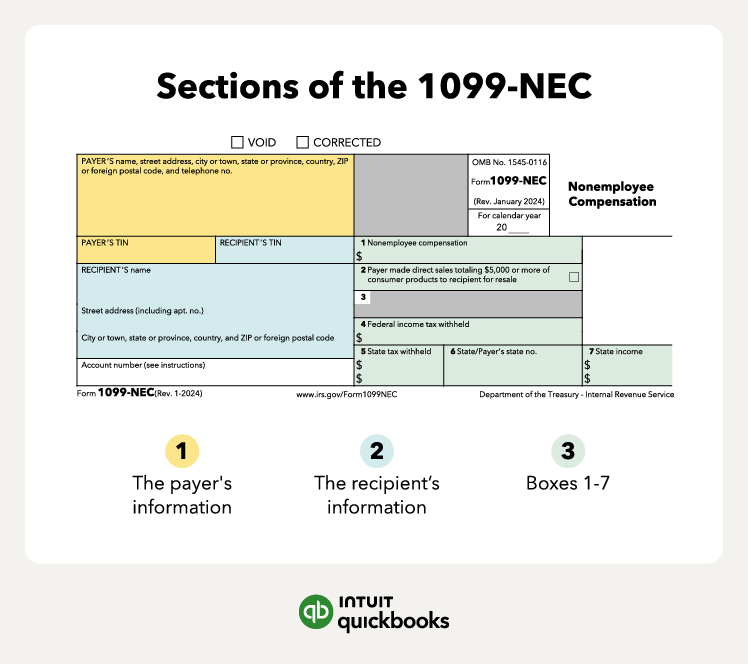

- How to fill out a 1099-NEC form

- What are the penalties for not filing a 1099-NEC form?

- Common challenges with filing 1099-NEC forms

- Find peace of mind come tax time