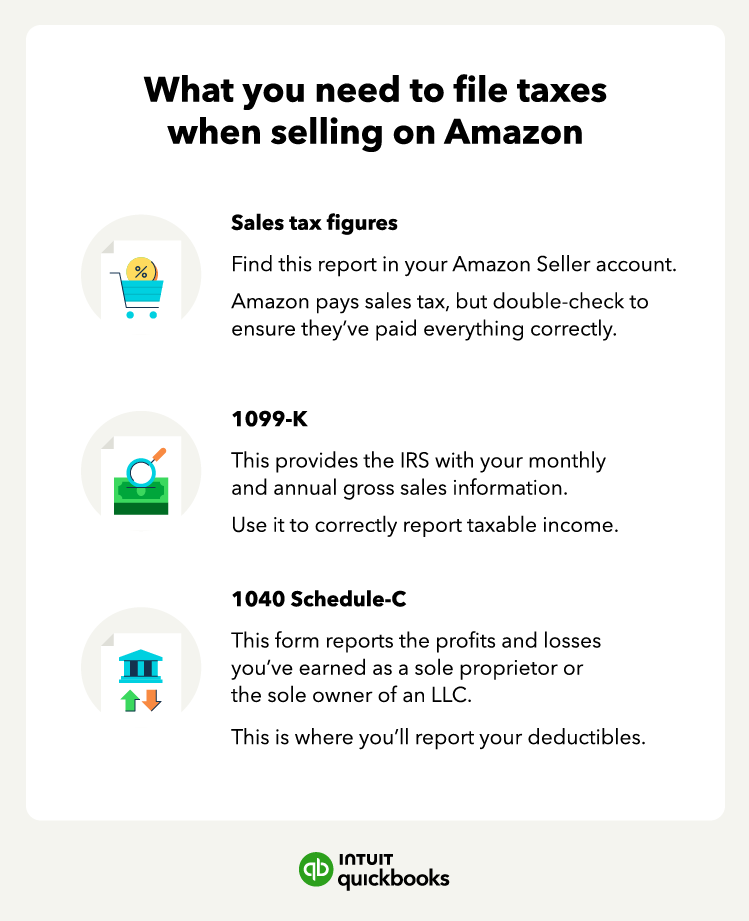

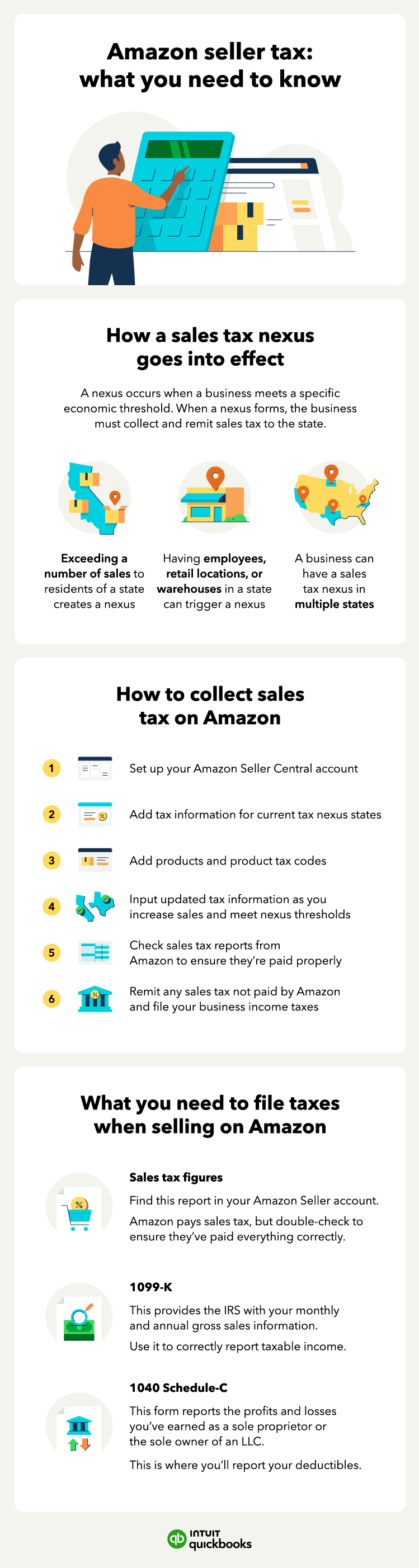

Just because Amazon handles sales tax on your behalf doesn’t mean they take care of any income tax your business owes. You’ll need to access to several small business tax forms, including your sales tax figures, your 1099-K tax form, and a 1040 Schedule-C when you file your income taxes.

Sales tax

If you sell items at a retail establishment or through your own website, you’ll need to collect and remit sales tax on those items. Most point-of-sale systems will have these tax amounts built in, but you can also use a sales tax calculator to ensure you’re charging the right amount.

Even though Amazon takes care of paying sales tax on your behalf, you’ll still need to report it on your income tax return. You can find Amazon seller tax forms in your Seller Central account.

- Navigate to the “Reports” section and find the Tax Document Library

- Look for the “Sales Tax Reports” section and click the button that says “Generate Tax Report”

- You can choose from 1 of 3 reports: the Sales Tax Calculation Report is for the sales tax that you are responsible for paying, the Marketplace Tax Collection Report covers all of the taxes that Amazon has collected and remitted for you, and the Combined Sales Tax Report covers both.

With that information, you can file and pay taxes according to the proper schedule.

1099-K tax forms

The 1099-K is a sales reporting form that gives the IRS your monthly and annual gross sales information. This includes things like sales tax and shipping fees. Individual online sellers don’t have to fill out a 1099-K; the form will be filled out by Amazon. Amazon will provide the 1099-K to both the IRS and sellers if they meet certain criteria.

According to Amazon, all sellers who meet both of the following conditions will get their Amazon seller 1099-K form in the mail (or by email, depending on your preferences) by Jan 31:

- More than $20,000 in unadjusted gross sales, and

- More than 200 transactions.

Professional and individual sellers with more than 50 yearly transactions must also provide their tax information, even if they don't meet the above criteria. Otherwise they may risk losing seller status. Though this isn’t a requirement from the IRS, Amazon does this to ensure they have everyone’s tax information to comply with all IRS regulations.

The number of sellers who receive a 1099-K from Amazon will increase significantly at the end of 2023, when a new tax law will require online marketplaces to send a 1099-K to anyone who sells more than $600 in a year. It will also eliminate the quantity of transactions requirement. You can provide this information in your Seller Account under “Tax Information.”

1040 Schedule-C

If you’re operating as a sole proprietorship or the sole owner of an LLC in your state, and you have a business license, you’ll need to file Schedule C or Form 1040. Generally speaking, you don’t need a business license to become a seller on Amazon. However, some states will require you to get one. The criteria for getting a business license differ by state, but if you have employees, inventories, and offices in multiple states, you’ll probably need one.

If you’re just running a one-person operation out of your home, you likely won’t need one. It’s crucial to check your state’s requirements to avoid any mistakes. Remember that you’ll need to report income to the IRS whether you have a business license or not.

Deductions for Amazon sellers

Amazon sellers can claim deductibles on things like home office expenses and education costs. Make sure to keep all receipts that can be related to your online activities. Here are some important deductions that may come in handy for sellers:

- Amount you paid for goods sold, including the wholesale price or the cost of manufacturing

- Shipping costs, including supplies and fees

- Home office expenses, including computers, office furniture, office supplies

- Amazon Seller fees

- Mileage

- Donations

- Subscriptions

- Education related to e-commerce and online business

- Accounting, tax, POS, and inventory software

- Advertising, including digital ads, business cards, print materials

- Salary and benefit costs

- Consultant fees, including attorneys, accountants, copywriters, and web designers

It’s always a good idea to take advantage of tax breaks for small businesses so you can keep your company growing.

Run your business with confidence

As complex as managing Amazon internet taxes sounds, there’s business and accounting software to help you do the necessary work of tracking everything from your deductibles to your Amazon seller tax information. Learning to file small business taxes is easier when you have a system consolidating all the data you need.