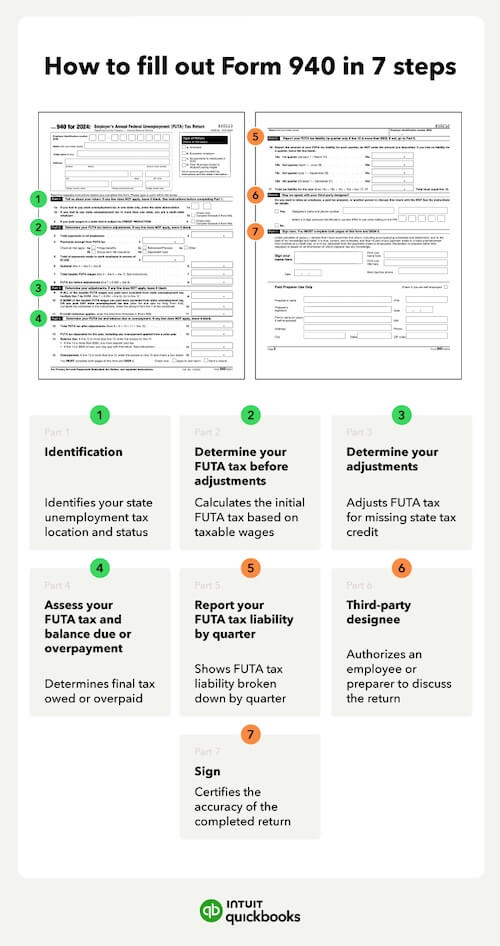

Section 1: Business information

Like many other tax forms, in the first section you’ll need to fill out your basic business information, such as address and EIN, and select the type of return (if applicable). You’ll also need to specify whether or not you are a multi-state business. It’s important to note that this is determined by where your employees live, not where your business locations are.

For instance, let’s say you operate a small marketing firm in Idaho. If all of your employees work in Idaho, you're a single-state employer. Now, let’s say you hire a graphic designer who works remotely from Colorado. This now means you have to pay UI in more than one state, making you a multi-state employer.

If you need to pay UI in more than one state, or your state is subject to a credit reduction, you’ll also need to complete Schedule A for Form 940.

Section 2: FUTA tax calculation

The second section of the Employer’s Annual Federal Unemployment Tax Return contains the base calculations for FUTA tax liability.

To begin, you’ll need to record all payments made to employees, including wages, tips, commissions, fringe benefits, etc. Then you’ll specify how much of this pay is not subject to FUTA tax.

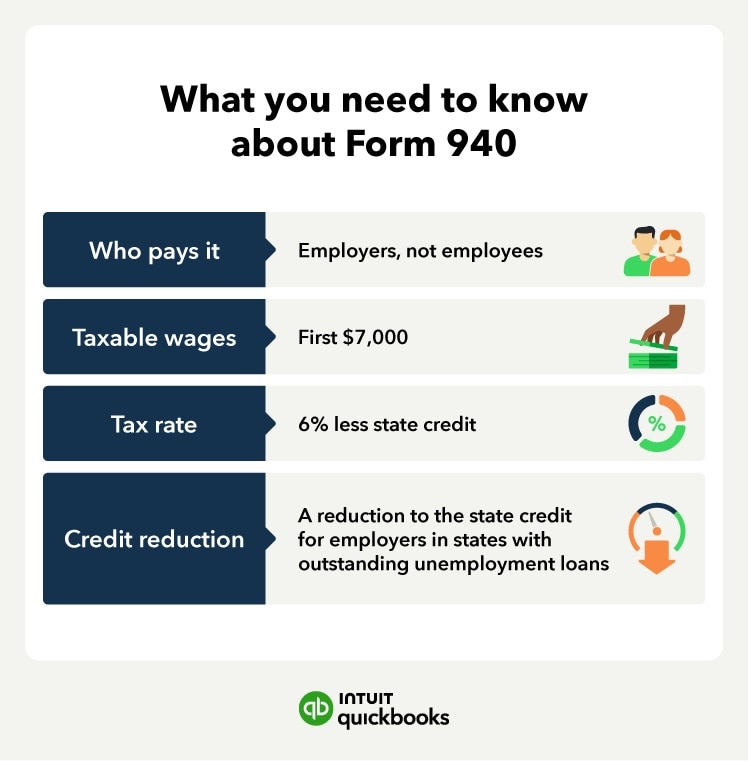

Remember, only the first $7,000 of pay is taxable, and certain pre-tax payments, such as retirement account contributions and dependent care, are exempt from FUTA tax.

You can then subtract the nontaxable total from your full payments to get your taxable amount. The final step is to multiply this number by 0.006.

Let’s take a look at an example scenario. Business A has paid employees $126,000 during the calendar year. Of that, $16,000 was for retirement contributions, and $78,500 was for payments exceeding the first $7,000. This leaves you with $31,500 in FUTA taxable wages. Multiplying this by 0.6% yields a liability of $189.

If you’ve just purchased a business or had one transferred to you, you’ll still need to file a 940 if the previous owner had paid employees. However, you will not be liable for FUTA tax unless you have paid any employee wages.

If you’ve just purchased a business or had one transferred to you, you’ll still need to file a 940 if the previous owner had paid employees. However, you will not be liable for FUTA tax unless you have paid any employee wages.