While small business owners are busy running the business and managing cash flow, it’s important to carve out a little time to ensure you keep as much money as possible in your pocket.

There are many tax breaks for small businesses—and you probably want to know all of them to help reduce your tax liability and keep more money in your small business.

We’ve pared down 25 of the highest impact and most generous tax deductions and write-offs available to small businesses in 2025, examples of each, and how much you can deduct.

Jump to:

- Startup costs

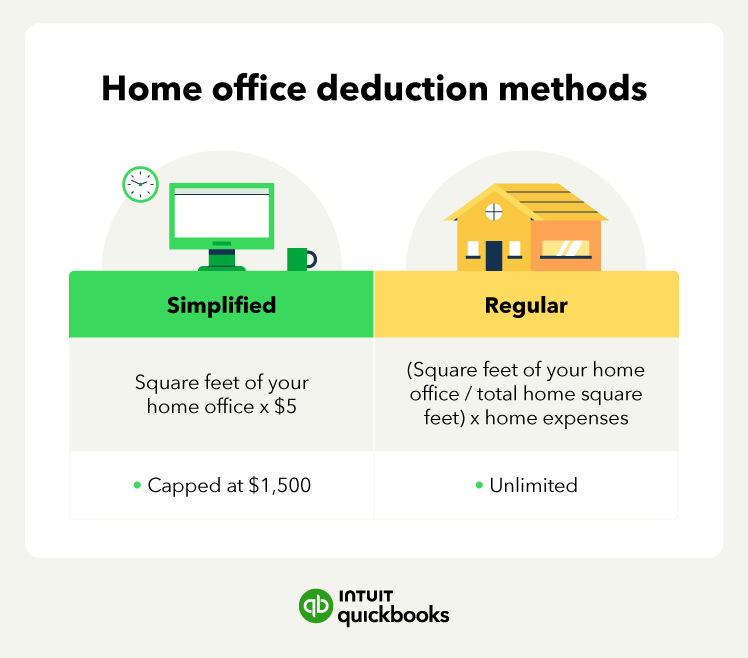

- Home office

- Retirement plan contributions

- Depreciation

- Section 179

- Health insurance

- Meals

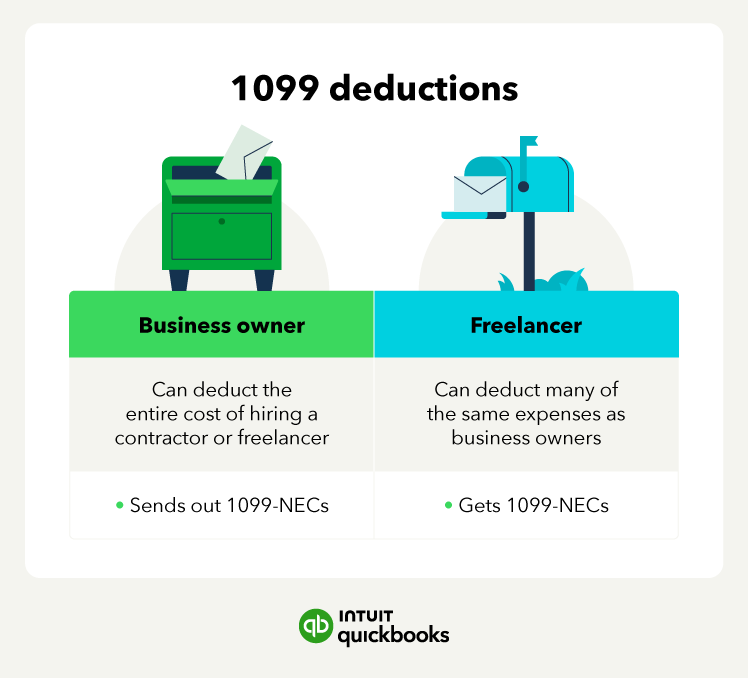

- 1099 deductions

- Travel

- Gifts

- Bad debt

- Education

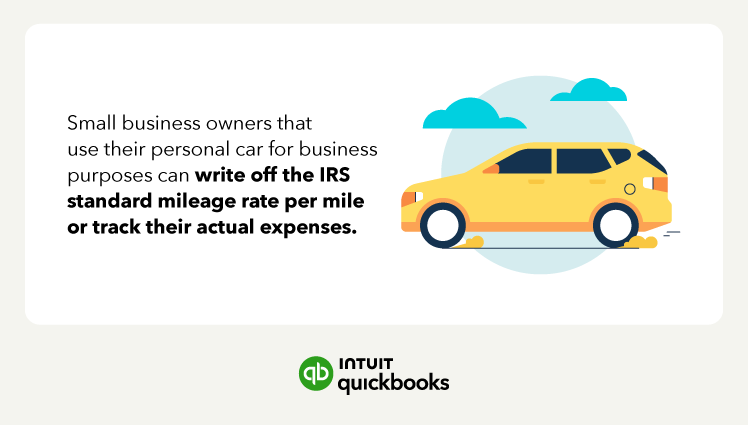

- Auto expenses

- Taxes

- Child care

- Charitable contributions

- Marketing and advertising

- Rent

- Utilities

- Subscriptions

- Interest

- Salaries and wages

- Legal and professional fees

- Internet and phone

- Insurance