Book value example

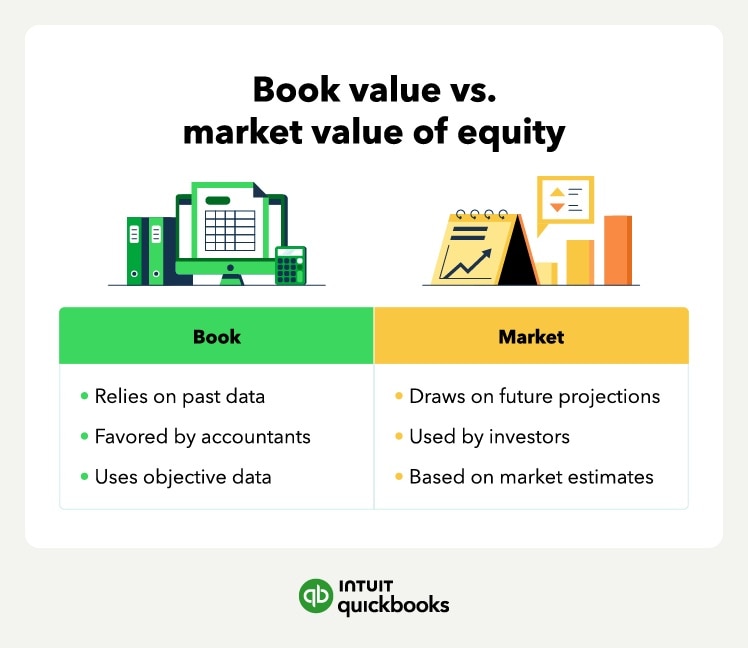

Equity's book value comes from a firm's financial statements and balance sheets. It’s the most common type of equity in accounting. Accountants use book value to derive worth from measurable assets and liabilities. For this reason, some analysts consider it more objective. However, book value relies only on past data, not future projections.

For an example of book value, consider a restaurant. Its assets, including money, inventory, equipment, prepaid expenses, and intangible assets equal one million dollars. Its liabilities include lines of credit, debt, deferred revenue, leases, and other commitments worth 800 thousand dollars. In this case, the formula is:

- $1,00,000-$800,000= a book value of $200,000

Market value example

Equity's market value reflects the amount investors will pay for shares. Accountants consider it less objective because circumstances can affect the result, making it higher or lower than the book value. However, since market value weighs financial forecasting and market estimates, it's useful to investors planning ahead.

For a publicly traded company, market value is easy to calculate. Assume an investment firm sold its latest share for $5,000. Additionally, suppose this company has 1,000 outstanding shares. In this case, you calculate the market value as:

- $5,000 X 1,000 = a market value of $5,000,000

If a company is private, you may not have the data for this equity equation. For the best results, hire an investment banker or accounting firm to analyze a company's past transactions, cash flow, and competitors' market value. Different experts may not come to the same conclusion, so don’t be afraid to get a second opinion.

How to leverage your equity: 3 best practices

Many investors focus on buying equity from a healthy company. While establishing yourself as a shareholder is important, the best investors know how to use their stock. By taking advantage of the tools given to shareholders, you can increase the return on your investment.

Assess your company’s financial health

Shareholders gain access to a company’s balance sheet and financial records. Even if you trust the firm’s leadership, never assume your investment will take care of itself. By keeping your finger on the pulse of a business’s cash flow, you can prepare for market spikes and drops. For the best results, follow these steps:

- Obtain updated financial information whenever you can.

- Share your investment’s market data with an investment banker or market analyst. Ask them about the performance of your investment and how upcoming changes may affect it.

- If your investment shares face a critical drop in value, consider selling them.

- If you want to hold on to your investment, present any issues you notice at the next shareholder meeting.

- Work with company leadership and vote on actions that improve your investment’s performance.

Make wise voting decisions

Shareholders get to vote in corporate elections and set a business’s goals, with the value of their vote proportional to their number of shares. Wise investors use their voting power at both special elections and annual meetings. As a shareholder, vote on all issues that affect the health of the company and your investment:

- Corporate actions

- Business policy

- Board of directors members

- Emergency issues

Remember to research the issues your company faces before casting a ballot. No two businesses share the same structure, so tailor your approach to the firm. To make the process easier, shareholders don't need to attend in-person elections. Instead, you can send a proxy to vote for you at meetings.

Reinvest your dividends

Many investors choose to live off of their stock earnings. Even though you should enjoy the benefits of your equity shares, reinvesting your dividends pays off the most over time. For the best results, you can:

- Reinvest in the same company: Reinvesting in a business you already own shares in is fast and easy. On top of that, you avoid commission fees and have access to fractional shares. For the best results, sign up for a dividend reinvestment plan (DRIP) to buy more shares every pay period.

- Reinvest your money in a new company: Buying shares in different companies creates a more diverse portfolio. Diverse investments can withstand more market destabilization over time. For suggestions and viable equity examples, consult a broker or financial manager.

Accurate reporting = accurate decision-making

Shareholder equity offers a reliable income stream and plenty of investment opportunities. However, anyone looking to leverage their equity needs accurate reporting on their shares’ value and other stock opportunities. That way, you can measure profitability for long-term growth and a higher ROI.

For an in-depth assessment of your equity's financial health, try QuickBooks business reporting features today.