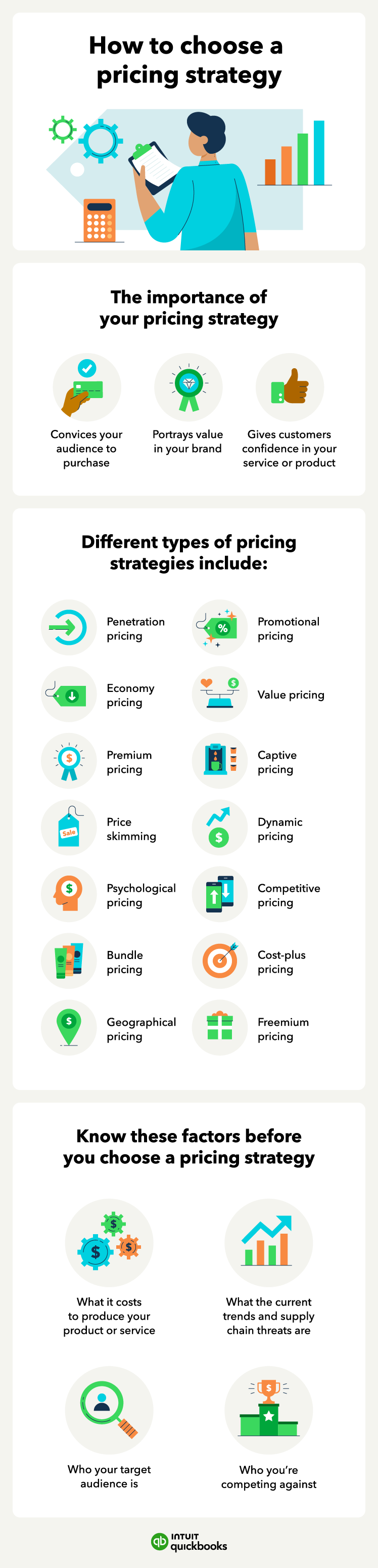

You know that setting prices for your small business is critical to your financial success. Determining a pricing strategy is the way to attract customers and meet profit goals.

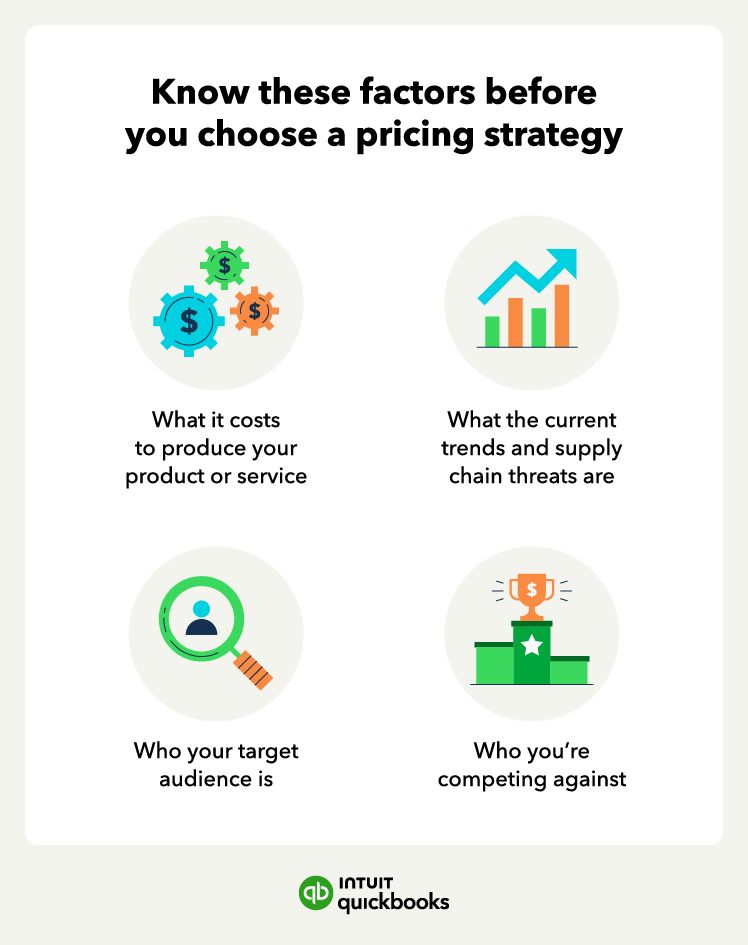

With the holidays ahead and economic conditions shifting throughout 2025, it's a good time for small business owners to revisit both short- and long-term pricing strategies. Tariffs have significantly impacted two-thirds (68%) of small businesses this year, with product-based businesses (71%) feeling the pain more acutely than service businesses (57%), the 2025 Holiday Shopping Report from Intuit QuickBooks found.

In response, some small businesses have been passing the higher costs on to customers by raising prices (32%), while a nearly equal number (30%) have been absorbing the increased expenses themselves, the survey found. As it is, a whopping 93% say their 2025 holiday sales are vital to their success this year.

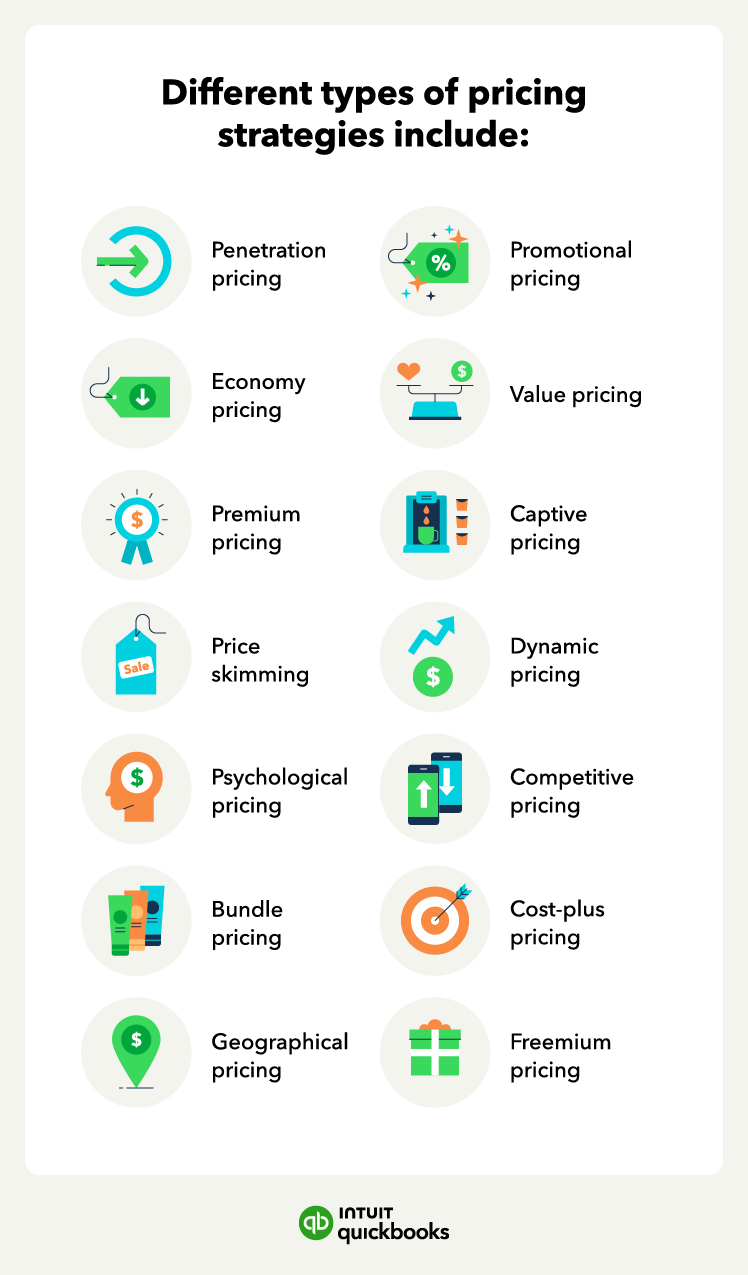

Whether you’re starting a new business or you’ve run your small business for years, the current economic climate and emerging pricing trends warrant a re-evaluation of your pricing strategy. Explore common pricing strategies that can help you ensure profitability, then learn how to choose the best ones for your business.