As a small business owner, you've got plenty on your plate. From navigating ongoing economic uncertainty to keeping up with changing tax laws, finding the time to manage your books is challenging.

According to QuickBooks’ entrepreneurship report, 34% of business owners have made errors when filing business taxes—either overpaying or underpaying what they owed. Proper preparation can help you avoid these costly mistakes when tax season arrives.

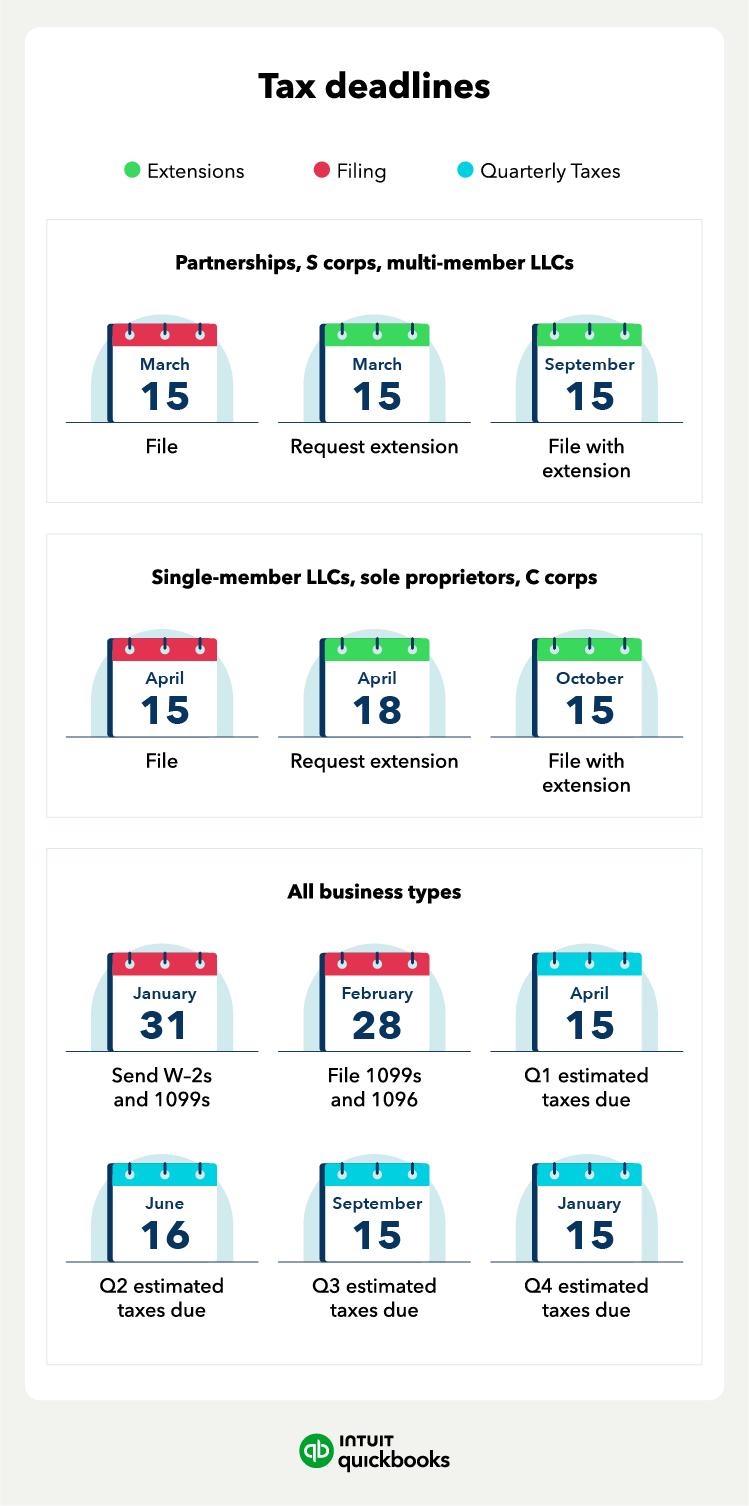

This small business tax preparation checklist for 2026 covers eight essential steps to simplify your tax prep and filing. There’s also a downloadable checklist with key tasks, required forms, and documentation you'll need.