Scroll through these basic accounting terms and definitions to learn more about accounting for small businesses.

Accrual basis accounting

Accrual basis accounting, aka accrual accounting, is when you record all revenue and expense-related items as the transaction first occurs rather than after payment is received.

For example, if a customer buys $5,000 worth of product on credit, you’d record $5,000 in revenue immediately rather than waiting to receive payment.

Accruals

Accruals are revenues and expenses recognized by a business before being recorded in its accounts.

For example, if a company has done business with a customer but has not yet received payment, the company would mark down the expected revenue as an accrual.

Accounting period

An accounting period is the length of time in which accounting functions are recorded and analyzed. Depending on the business, an accounting period can last weeks, quarters, or a calendar or fiscal year.

For example, if a business decided to compile its accounting data by quarter or every three months starting at the beginning of the year, its first accounting period would be January through March.

Accounts payable

Accounts payable, aka payables, is an account in the general ledger used to track money a company owes to creditors.

For example, if a company owes $4,000 on its company credit card, $4,000 would be recorded in the accounts payable account.

Accounts receivable

Opposite of accounts payable, accounts receivable is an account in the general ledger used to track money owed to a business by its customers or other debtors.

For example, if a customer has purchased $2,000 of products on credit, $2,000 would be recorded in the accounts receivable account.

Assets

Assets are any tangible or intangible item with monetary value that a business owns or controls. Cash, patents, investments, and stocks are all examples of business assets. Accountants record assets on the left side of the balance sheet.

Burn rate

Burn rate is the pace at which your company spends money. In other words, the burn rate is the amount of money your business needs to cover all expenses and commitments in a time period.

To calculate the burn rate, you’ll select a period and then subtract your on-hand cash at the end of the period from your on-hand cash at the beginning. Then, you’ll take that number and divide it by the number of months in that period. Once you’ve done that, you’ll know your company’s burn rate for that set period.

For example, if you begin a three-month period with $90,000 and end it with $30,000, your burn rate is $20,000 a month (($90,000 - $30,000) ÷ 3 = $20,000)

Capital

Capital is cash or other liquid assets a business can use to spend or make money.

In accounting, businesses split up capital into specific categories. For example, money received from investors in exchange for stock is categorized and recorded as equity capital.

Cash basis accounting

Cash basis accounting is a form of accounting in which businesses record transactions at the time money changes hands.

For example, if customers purchase a product or service on credit, the transaction wouldn’t be recorded until they make their payment.

Cash flow

Cash flow is how money moves in and out of a business. Businesses record their cash flow in the cash flow statement.

For example, if your business has more money going out than it does coming in, it has negative cash flow. On the other hand, if your business has more money coming in than it does going out, it has positive cash flow.

Chart of accounts

The chart of accounts is a comprehensive list of all the accounts in a business’s general ledger.

A chart of accounts includes assets, liabilities, equity, revenue, expenses, and cost of goods sold. The chart of accounts will also include subaccounts. For example, subaccounts of assets may include cash and accounts receivables.

Closing the books

Closing the books is a phrase representing an accountant’s finalization of relevant accounting records during an accounting period.

For example, if an accountant finalizes and approves all accounting records for the period, the books are technically “closed.” From there, other accounting documents, such as the balance sheet and income statement, can be completed using the finalized records.

Cost of goods sold

Cost of goods sold (COGS) is the total direct costs it takes to produce the goods a business sells.

For example, accountants calculate COGS within an accounting period using the formula: (Starting inventory + purchases) - ending inventory = COGS.

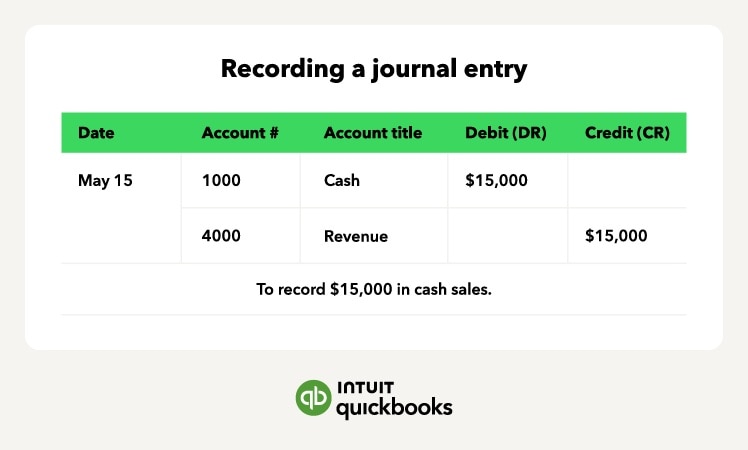

Credits

Credits are accounting entries that increase a liability, revenue, or equity account and decrease the balance of an asset, loss, or expense account. These entries are recorded on the right side of the account and reflect outgoing money.

For example, if your business purchases $1,200 of office supplies on credit, it would be recorded as a credit in the accounts payable account.

Debits

Conversely, debits are accounting entries that increase an asset or expense account and decrease a liability or equity account. These entries are recorded on the left side of the account and reflect incoming money.

For example, if your company receives $2,000 in cash, it would be recorded as a debit in the cash account.

Depreciation

Depreciation is an accounting method used to determine the cost of a physical asset over time. Whenever a fixed asset decreases in value, businesses record it as depreciation.

For example, if a moving company purchases a moving truck for $60,000 and uses it for five years before selling it for $40,000, it has depreciated $4,000 a year according to the straight-line method (($60,000 - $40,000) ÷ 5).

Double-entry accounting

Double-entry accounting is a fundamental accounting concept stating that every transaction has an equal and opposite effect in at least two different accounts.

For example, if a business purchases $4,000 of office supplies on credit, it'll record a debit of $4,000 to the asset account and a credit of $4,000 to accounts payable. That way, both the increase in assets and liabilities are accounted for.

Equity

Equity refers to the difference between liabilities and assets on the balance sheet.

For example, if a company has $250,000 in total assets and $100,000 in total liabilities, it has $150,000 in equity.

Expenses

Simply put, expenses are the cost of doing business. This includes money spent and costs incurred while trying to generate revenue.

For example, business expenses include rent, equipment, and payroll.

Fiscal year

A fiscal year is a 12-month period businesses use for budgeting and financial reporting. While it may start on Jan. 1 and end on Dec. 31, it doesn’t have to.

For example, a fiscal year can be from Oct. 1 to Sept. 30.

Gross income

Gross income, aka gross profit, is the total value of products and services a business sells before accounting for COGS. If the gross income turns out to be a negative number, the business has instead faced a gross loss.

Inventory

Inventory refers to assets that a business plans to sell. This includes items ready for sale, those in production, and the materials needed to make them.

For example, a furniture business’s inventory may include lumbar, drawer handles, and dressers.

Journal entries

A journal entry records a business transaction in a business’s accounting books. A proper journal entry includes the date of the transaction, the amount to be debited and credited, a short description of the transaction, a reference number, and the general ledger accounts affected.

Liabilities

Liabilities refer to money a business owes. For example, liabilities may include payroll, taxes, credit card balances, bank loans, and accounts payable. Accountants record liabilities on the right side of the balance sheet.

Liquidity

Liquidity is a term that refers to how easily a business can sell an asset for cash. If a business can easily turn an asset into cash, then it is a liquid asset.

Accounts receivable and securities are both examples of liquid assets.

Net profit

Net profit, aka net income, refers to the money a business makes after factoring in taxes and COGS from the total value of products or services sold during a period.

If the total cost of taxes and goods sold is more than the value of products and services sold, it is known as a net loss.

On credit

On credit, or "on account," is a term used to describe goods or services sold to customers without receiving payment upfront.

For example, a business may sell its products to customers in exchange for future payments or a series of payments. This is also known as customer credit.

Overhead

Overhead is a term that describes any expenses required to continue business operations that don’t directly affect a company's products or services.

Examples of overhead include insurance, administrative costs, and utilities.

Payroll

Payroll, aka payroll accounting, is the process of tracking and recording money paid to employees. Payroll accounting also includes tracking money withheld from each paycheck, including taxes or any benefits the employee receives.

Present value

Present value is a concept that factors future revenues, expenses, and debts for inflation to provide an accurate value of future funds with present-day dollars.

Purchases

Purchases are the exchange of money for inventory or goods during an accounting period.

Receipt

A receipt is an official record that a transaction took place.

Retained earnings

Retained earnings, aka earnings surplus, are the profits left over after a business has paid off all costs in an accounting period. If a business has positive retained earnings, then the business’s equity will increase.

Return on investment

Return on investment (ROI) is the percentage of profit or loss produced by an investment.

For example, if someone invests $1,000 in company stock and later sells the stock for $1,500, the ROI is 50%.

Revenue

Revenue is the income a business generates by selling goods and services.

For example, a clothing store would record the money made from selling clothes as revenue.

Trial balance

A trial balance is a bookkeeping report that compiles the closing balances of each account in the general ledger. Creating a trial balance is crucial in closing the books at the end of an accounting period.