Common payroll tax mistakes in Arizona (and how to avoid them)

Navigating Arizona’s complex payroll tax landscape can be challenging. Here are the most frequent errors employers make—and how to stay compliant.

Misclassifying employees vs. independent contractors

One of the most frequent and costly errors is incorrectly classifying workers as independent contractors when, by law, they should be considered employees. The IRS and the Arizona Department of Economic Security (DES) have specific criteria to determine worker status. Misclassification can lead to unpaid employment taxes (Social Security, Medicare, FUTA, SUI), back wages, interest, and significant penalties.

Thoroughly review the IRS and DES guidelines for distinguishing between employees and independent contractors. When in doubt, err on the side of caution or consult with a legal or tax professional who specializes in employment law.

Incorrectly calculating taxes or withholding amounts

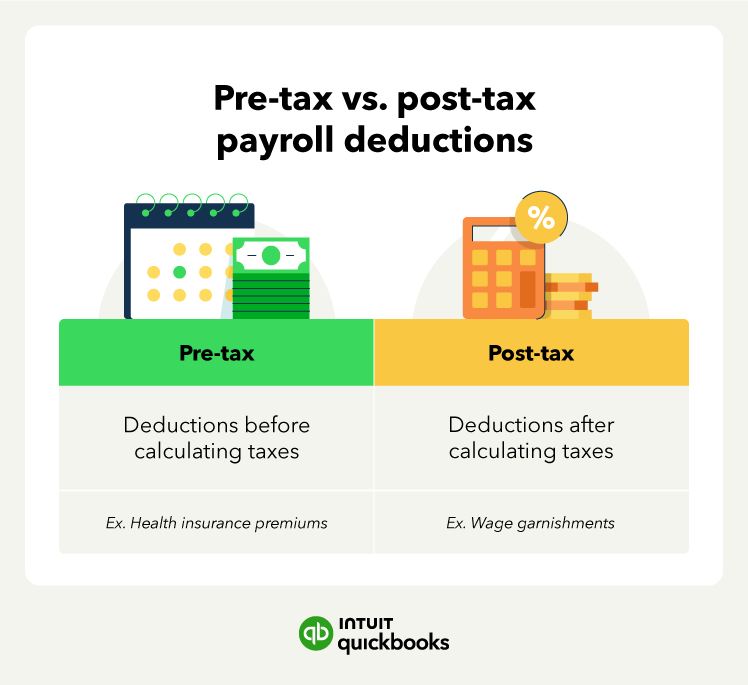

Payroll tax calculations involve applying the correct rates to the appropriate wage bases, accounting for employee withholding allowances (Federal W-4, Arizona A-4), and understanding taxable vs. non-taxable wages. Using outdated tax tables, misinterpreting withholding forms, or simply making arithmetic errors can lead to under- or over-withholding, resulting in penalties for the employer and headaches for employees at tax time.

Always use the most current tax tables and wage bases provided by the IRS, Arizona Department of Revenue (ADOR), and DES. Double-check all calculations, especially when setting up new employees or processing changes. Utilize payroll software that automates these calculations and updates tax rates regularly.

Missing tax deadlines and deposit schedules

Federal and state payroll taxes have strict filing and deposit deadlines (e.g., quarterly for Arizona Form A1-QRT and UC-018). Failing to remit payments or file returns on time can trigger significant penalties and interest from both the IRS and Arizona agencies. The deposit frequency for federal taxes (monthly or semi-weekly) also depends on your total tax liability, and missing these specific deposit dates can lead to penalties.

Create a robust calendar system that highlights all federal and Arizona payroll tax deadlines. Set up automated reminders. If possible, opt for electronic filing and payment methods through AZTaxes.gov and the DES Unemployment Tax and Wage System, as these often have later deadlines and provide immediate confirmation.

Poor recordkeeping

Maintaining accurate, organized, and complete payroll records is crucial for compliance and for surviving potential audits. This includes employee personal information, W-4s, Arizona A-4s, wage records, hours worked, tax deposits, and payroll reports. Inadequate records can make it difficult to prove compliance and respond to inquiries from tax authorities.

Keep detailed records for at least four years, as required by both federal and Arizona law. Store records securely, whether digitally or physically. Implement a systematic approach to record-keeping, ensuring all relevant documents are easily accessible.

Failure to stay updated on tax law changes

Tax laws, rates, and regulations at both the federal and state levels are subject to change annually or even more frequently. Failing to keep abreast of these updates can lead to non-compliance, incorrect calculations, and missed opportunities for credits or exemptions.

Regularly review official publications from the IRS, Arizona Department of Revenue, and Arizona Department of Economic Security. Subscribe to their newsletters or alerts. Attend webinars or consult with professionals who specialize in payroll tax compliance.

Tip: QuickBooks Payroll can help you avoid these common mistakes by automating calculations, tracking deadlines, and keeping accurate records.