What is an ACH Payment?

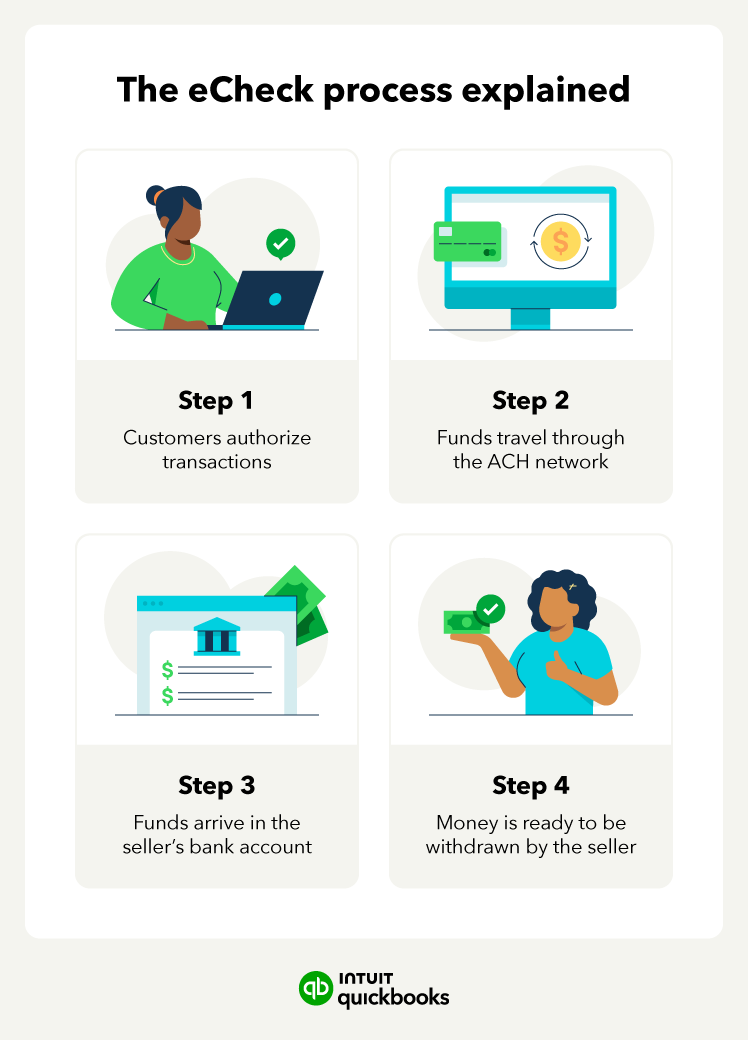

An ACH Payment is a broad term for any electronic transaction processed through the Automated Clearing House network, which is a US-based electronic fund transfer system. In simple terms, this system is a centralized method that banks use to transfer money without relying on paper checks or card networks.

For your small business, understanding this means realizing that when you accept an eCheck, you're using a highly regulated and reliable system for funds transfer.

What is an eCheck used for?

eChecks are incredibly versatile, but they really shine when it comes to guaranteeing a predictable income stream. They're commonly utilized for online purchases, bill payments, and setting up recurring payments, as they are reliable and convenient.

Example: If you run a gym, you can use eChecks to set up automatic, monthly membership fee deductions directly from your customers' checking accounts, reducing late payments and saving you time on collections.

Are eChecks safe?

eCheck payments are a safe alternative to paper checks, which can be vulnerable to fraud. eChecks reduce the risk by using data encryption and eliminating the need to handle sensitive bank information physically.

Example: When a customer pays an invoice for your consulting services using an eCheck via a secure online form, their bank details are encrypted. This is much safer for you than accepting a paper check with their routing and account numbers sitting in your office for anyone to see.

How fast can an eCheck be processed?

It's important to know that eChecks cannot be processed on weekends. The transaction must be processed through the ACH network during regular business hours (typically 3-6 days), so a payment can take a few days to clear.

Example: If a customer pays you for catering services on a Friday, the funds won't start moving until Monday and won't be fully available until later that week. You need to account for this in your cash flow projections and payment terms.

Why do eChecks decline?

An eCheck can be declined for various reasons, such as insufficient funds or incorrect account information. Once the recipient's bank has processed a payment, it generally cannot be canceled.

Example: If a new client for your landscaping service provides incorrect bank details, their eCheck will be declined. You’ll then have to follow up and obtain the correct information, as the initial transaction isn’t easy to reverse or correct once submitted.

Who can use eChecks?

Most people with a bank account can use eChecks. However, it's always a good idea to check with your bank or payment processor for any specific requirements or restrictions before initiating a transaction. By accepting eChecks, you expand the pool of customers who can pay you easily and conveniently.

Example: Offering eChecks as an option alongside credit cards and digital wallets ensures that customers who prefer or only use direct bank debits—like many corporate clients—can still pay you without friction.