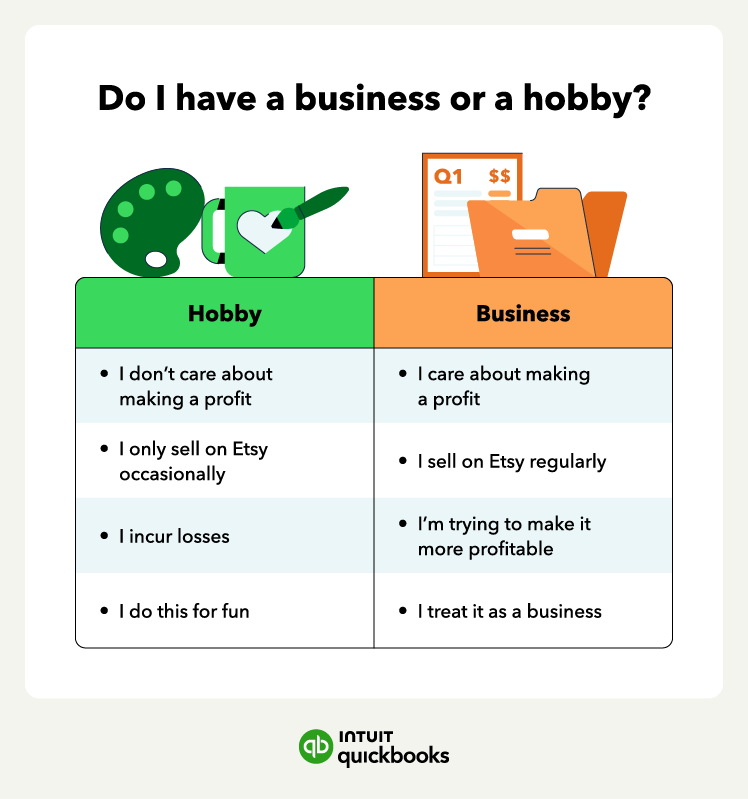

You may consider your Etsy shop a hobby if:

- Making a profit is not your main motivation to sell on Etsy.

- You only sell items on Etsy occasionally and don’t try to sell consistently.

- You incur losses from Etsy sales and don’t make an effort to try to become profitable.

- Your primary purpose is personal pleasure or recreation rather than making a profit.

If your Etsy shop is considered a hobby, you shouldn’t need to pay self-employment taxes. Nevertheless, you need to report it as part of income, generally under the “Other Income” line of your tax return, and can’t deduct hobby expenses that exceed your hobby income.

Now, you may consider your Etsy shop a business if:

- Making a profit is your main motivation on Etsy.

- You maintain regular activities and make efforts to improve and expand.

- You try to change your business practices to make it more profitable.

- You maintain detailed records of income and expenses, have a separate business bank account, and treat your Etsy shop as a business.

If the IRS considers your Etsy shop a business, it will count as self-employed activity unless you already have a different business structure. This means you’ll need an Employer Identification Number (EIN) or use your Social Security Number (SSN) if you’re a sole proprietor.

2. Organize and complete necessary tax forms

If you determine your Etsy shop is a business for tax purposes, you have to organize and complete the necessary tax forms. The forms you may need to complete and submit include:

- Schedule C or Schedule C-EZ: This form reports your income and expenses to the IRS and is part of your individual tax return (Form 1040). In the Schedule C form, you’ll need to provide information about your sales, expenses, and net profit or loss.

- 1099-K: This form reports the total payments you earned from Etsy sales during the tax year. For 2023 sales, Etsy will provide a 1099-K form if you earn $20,000 or more in gross sales during a calendar year.

- Schedule SE: This form reports the self-employment taxes, which cover the Social Security and Medicare tax. You’ll file this form if you made at least $400 in self-employed income during the tax year.

Fill out each form and ensure the information is correct, including your tax identification number, income, and expenses.

3. File your quarterly estimated taxes

Unlike W-2 employees, sole proprietors’ businesses pay estimated taxes each quarter. If you believe you owe more than $1,000 in taxes in a year, you’ll have to pay taxes quarterly.

To calculate how much you have to pay each quarter, you can base it on the previous year’s taxes if your income is consistent throughout the year or use form 1040-ES to calculate your estimated quarterly taxes.

You must submit your quarterly taxes to the IRS by these deadlines: