Global trade has been booming. The United Nations Conference on Trade and Development (UNCTAD) reported that it grew by about $300 billion in just the first half of 2025. With so much buying and selling across borders, the paperwork that keeps those deals moving is more important than ever. One of those documents is the proforma invoice.

If you run a business, you’ve probably dealt with plenty of invoices, but proforma invoices are a little different. Keep reading, and we’ll explain what a proforma invoice is, how it’s different from other invoices, when to use it, and how to create one.

Jump to:

- Defining proforma invoice

- The purpose of a proforma invoice

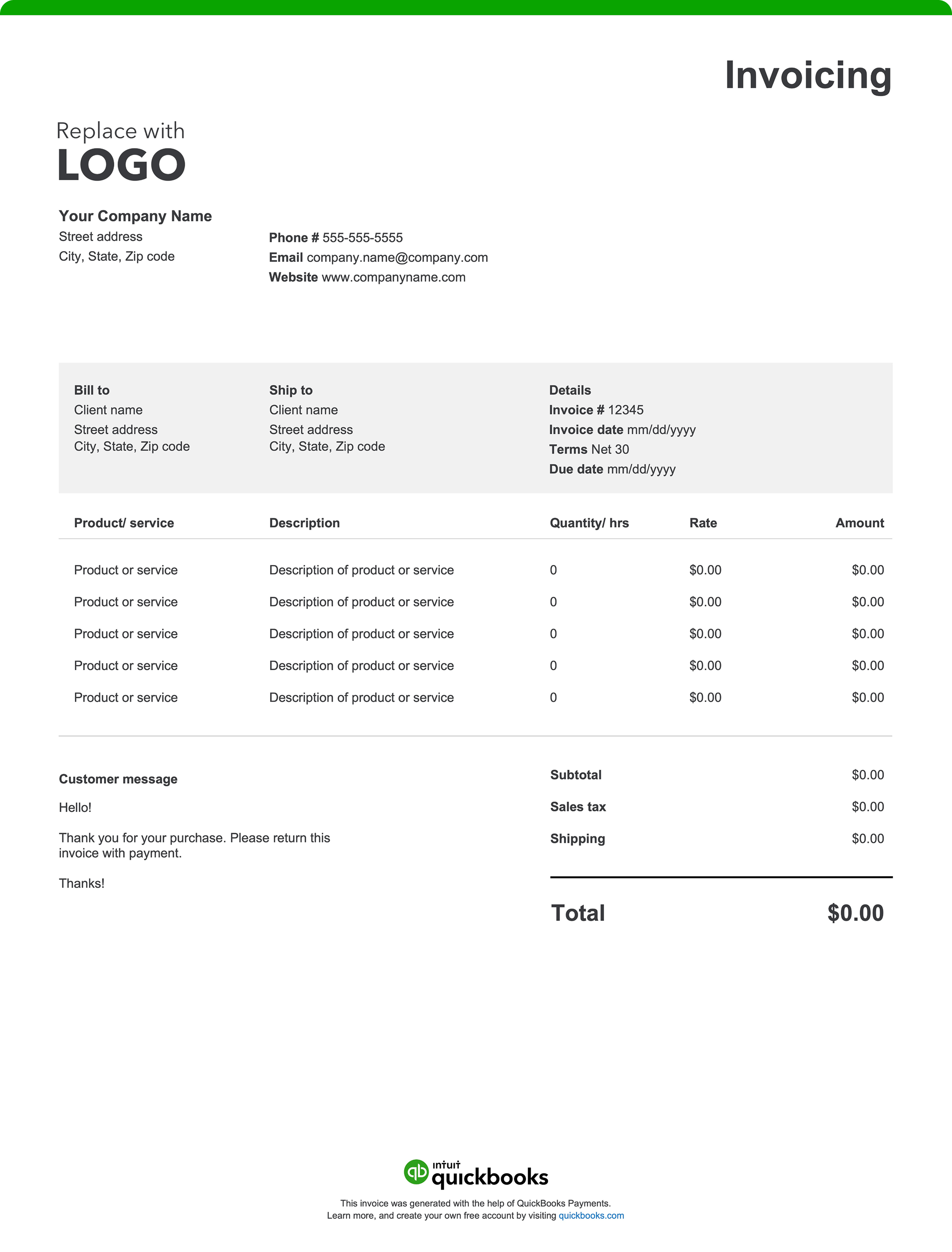

- What a proforma invoice should look like

- Invoice vs. a proforma invoice

- Commercial invoice vs. proforma invoice

- Common examples for When a Business Should Use a Proforma Invoice

- How to create a proforma invoice

- Proforma invoice examples

- How to pay a proforma invoice

- How to send a proforma invoice

- Is a proforma invoice legally binding?

- Final thoughts on proforma invoices