Whether it's your car's headlights turning on when it gets dark or your phone connecting to your Wi-Fi router when you get home, we all love when things happen automatically.

Now what if you could experience this same feeling within your accounting processes?

With automated accounting, you can.

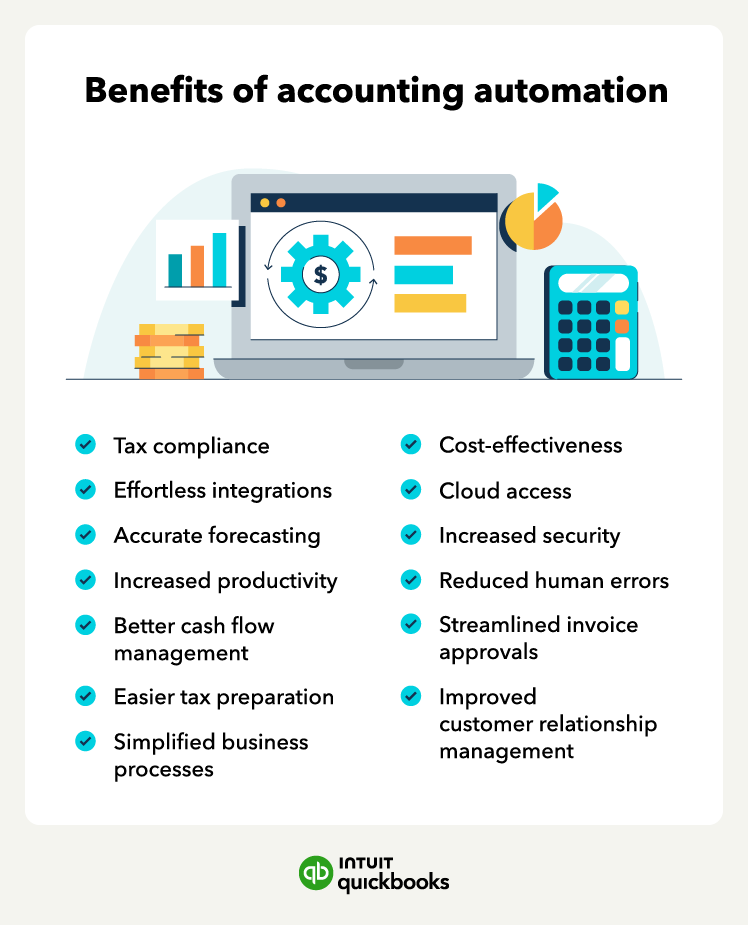

By automating your accounting processes, you can reap a wide variety of accounting automation benefits, including:

- Tax compliance

- Simplified business processes

- Cost-effectiveness

- Accurate forecasting

- Increased productivity

- Improved customer relationship management

- Increased security

- Streamlined invoice approvals

- Better cash flow management

- Easier tax preparation

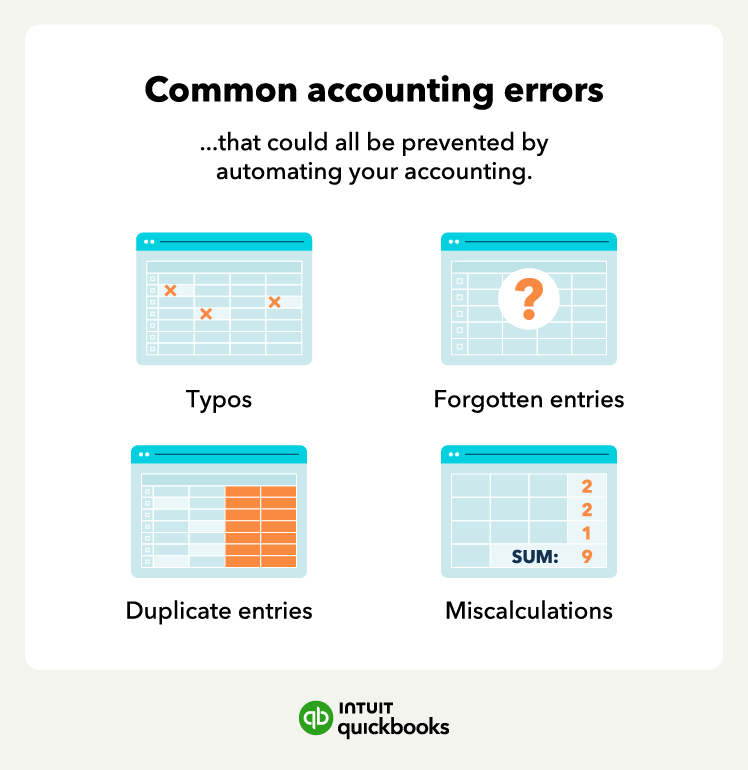

- Reduced human errors

- Effortless integrations

- Cloud access

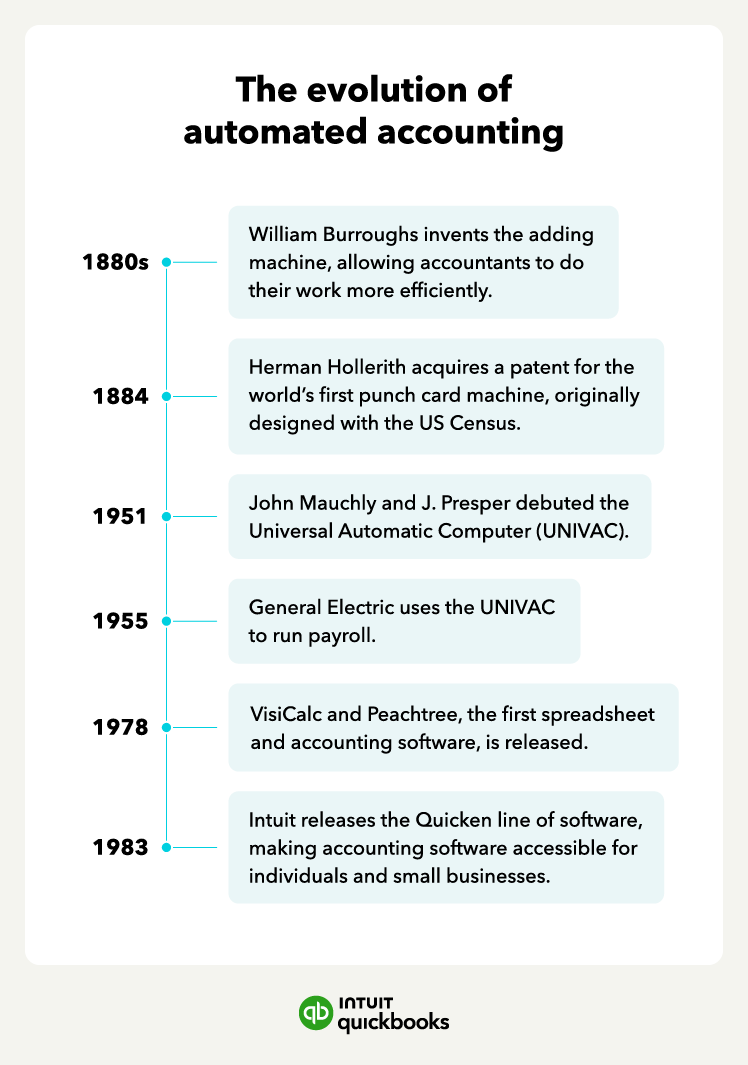

After all, accounting processes have become increasingly automated, dating back to the 1880s. To help you understand exactly how accounting automation can help your small business, let’s walk through each of the 13 benefits.