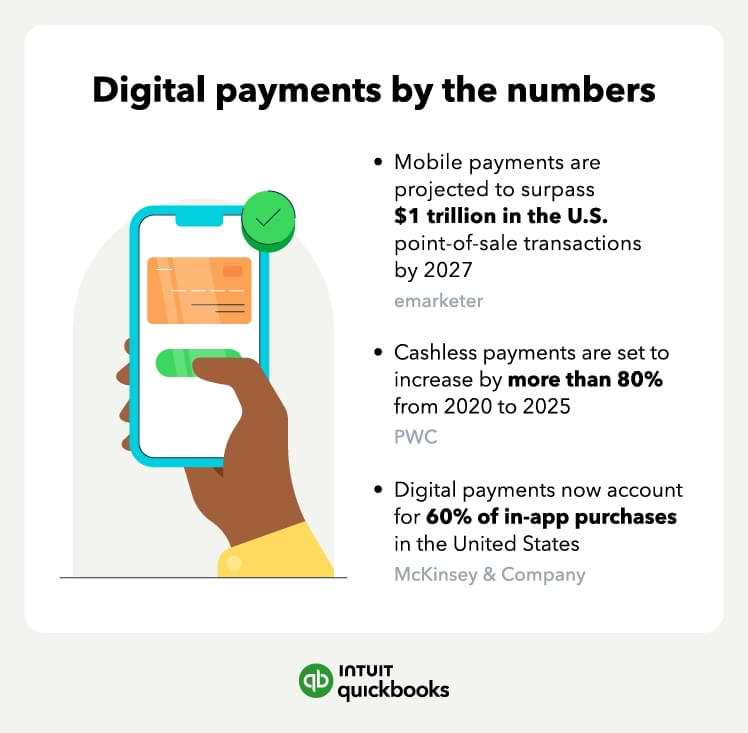

Preparing your small business to accept digital payments, or electronic payments, is more important than ever. They're becoming one of the most common payment methods and have the potential to make your business more efficient and accessible to customers.

In fact, 86% of businesses used faster or instant digital payment methods in 2023, signaling how essential digital payments have become for operational efficiency and customer satisfaction.

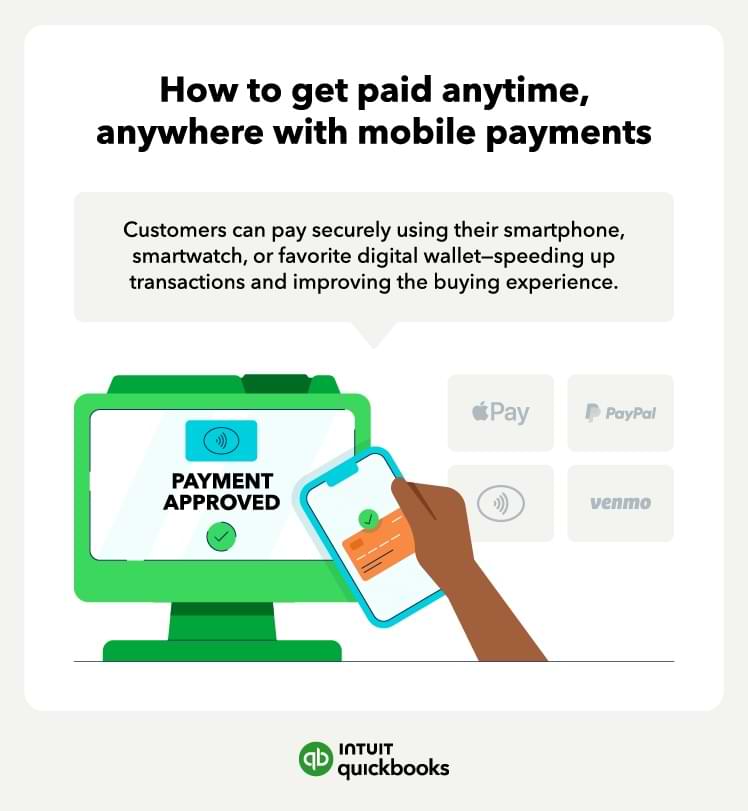

These include all noncash and noncheck methods, while mobile payments are made using mobile devices. Read our small business guide below to learn how digital payments work, the different types available, their benefits and challenges, and how to keep transactions secure:

Benefits of accepting digital payments

Challenges of accepting digital payments

The QuickBooks GoPayment point of sale app and

The QuickBooks GoPayment point of sale app and

Approximately

Approximately