How to record payroll

Your first payday is an exciting event. Follow the basic steps to set up and run your first payroll.

1. Set up payroll-related accounts. These are explained in detail below. Essentially, payroll-related accounts include a mixture of expenses and liabilities.

- Employee compensation (expense)

- Employer taxes and insurance (expense)

- Benefits (expense)

- Payroll taxes payable (liability)

- Employee deferrals payable (liability)

2. Obtain necessary paperwork from new employees and add their names to your accounting records. The necessary paperwork includes three main forms:

- Form W-4, federal withholding form

- Form I-9, Employment Eligibility Verification form

- State withholding form, if applicable

3. Calculate taxes and other deductions based on compensation. Taxes and other deductions are based on the forms your employees fill out. The forms will tell you how much of an employee’s wages you should deduct each pay period. Calculations will also depend on your state and sometimes your city or county. Familiarize yourself with any local tax laws that could require additional payroll deductions.

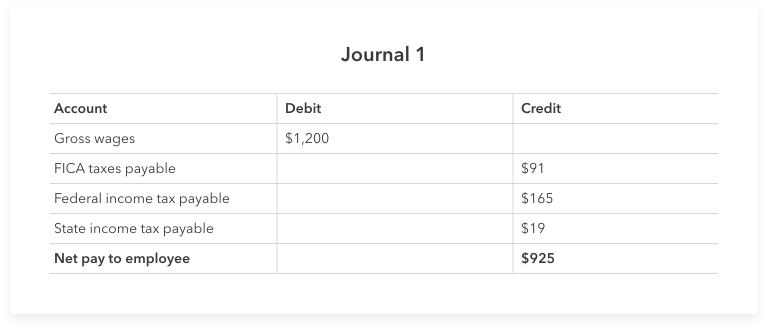

4. Record payroll checks. This goes back to the Journal 1 example. In that journal entry, you’re recording all of the deductions you have to take, as a business owner, from the employee’s check. For transparency and visibility, employees can find these deductions on their pay stubs.

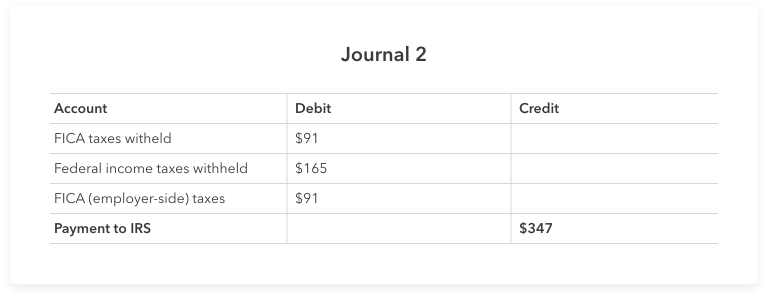

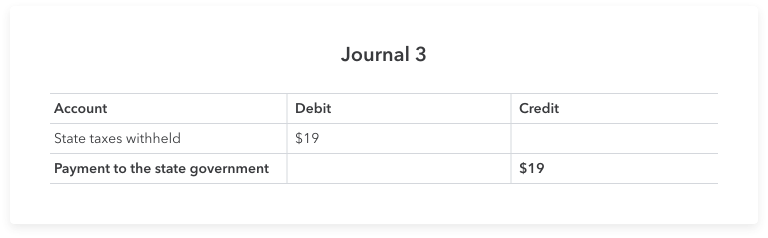

5. Record tax payments. This goes back to journals 2 and 3 where you’re recording all taxes you’ve paid. These include taxes the employee is paying via their withholdings each pay period, as well as taxes the business owes. For example, employees don’t pay unemployment taxes. Those are among their employer’s responsibilities. But a record of tax payments will show unemployment taxes listed alongside any taxes the employee paid.