Get everything you need to streamline payday, track time, manage HR, and offer team benefits with the #1 payroll provider.¹

Have QuickBooks Desktop? Explore your options.

Explore the features

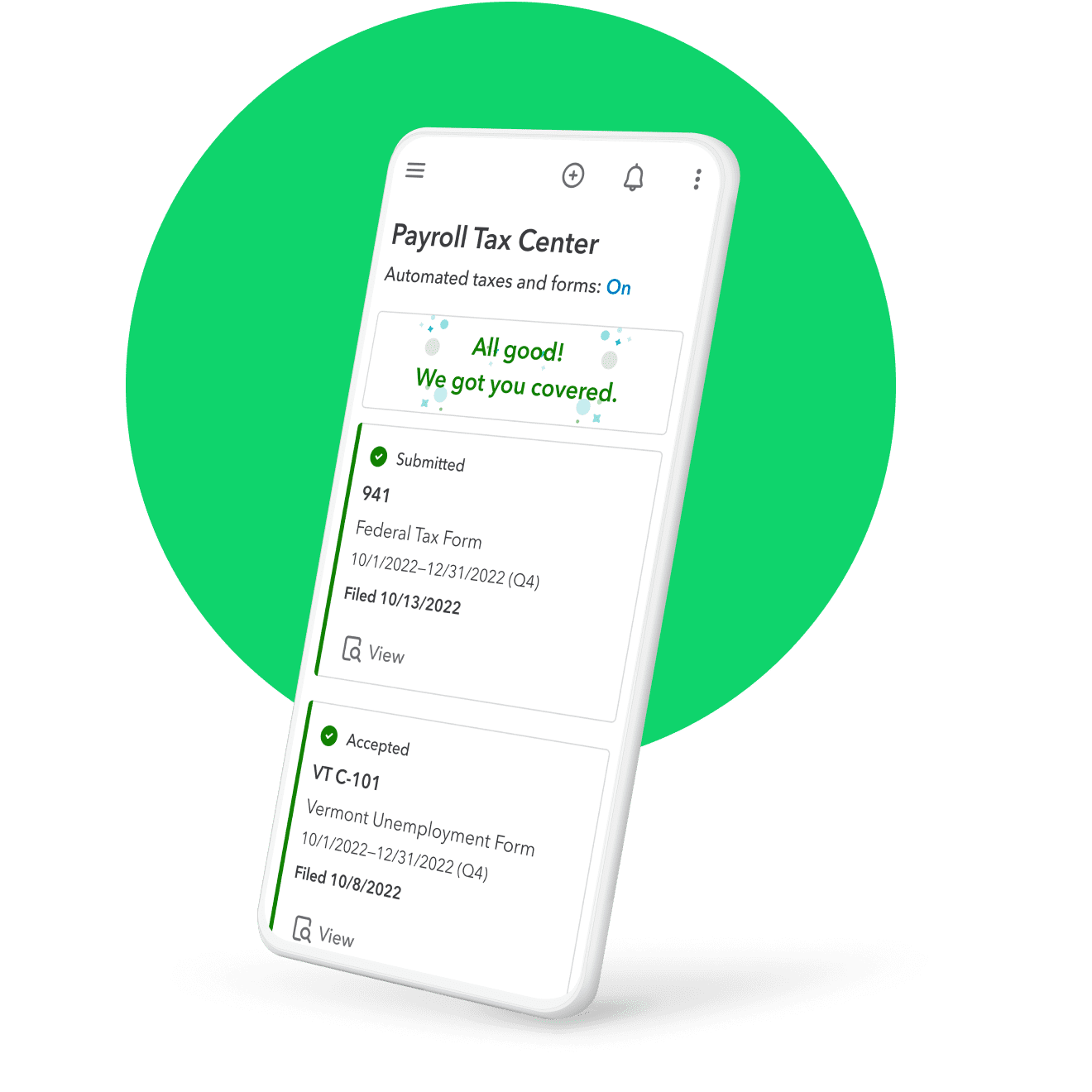

Stay covered at tax time

With tax penalty protection, we'll pay up to $25,000 if you receive a penalty for any reason.**

Pay your team fast

Hold onto cash longer and pay your team on your schedule with same-day direct deposit.**

Taxes done for you

We’ll calculate, file, and pay your payroll taxes, with an accuracy guarantee.**

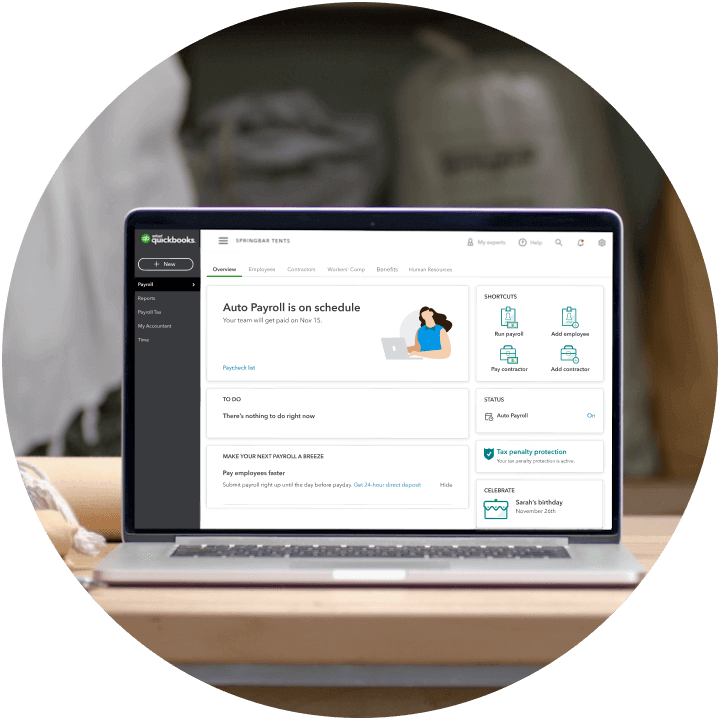

Automatic payroll

Reduce manual entries and free up your time when you set payroll to run on its own.**

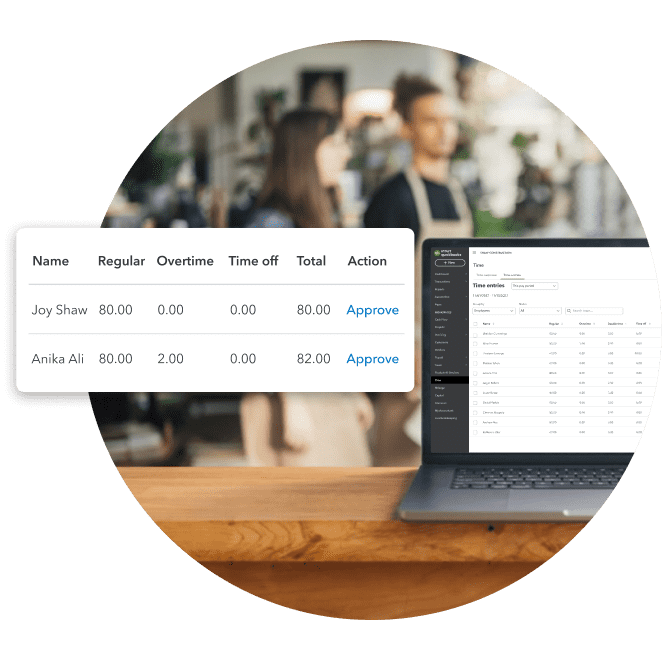

Manage time tracking

Improve accuracy, approve timesheets, and save over 2 hours every time you run payroll.2

Seamless integration

Payroll, time tracking, and accounting data connect, so you can save nearly 4 hours a week.3

Offer team benefits

Attract skilled applicants, retain your best employees, and help them grow with you.

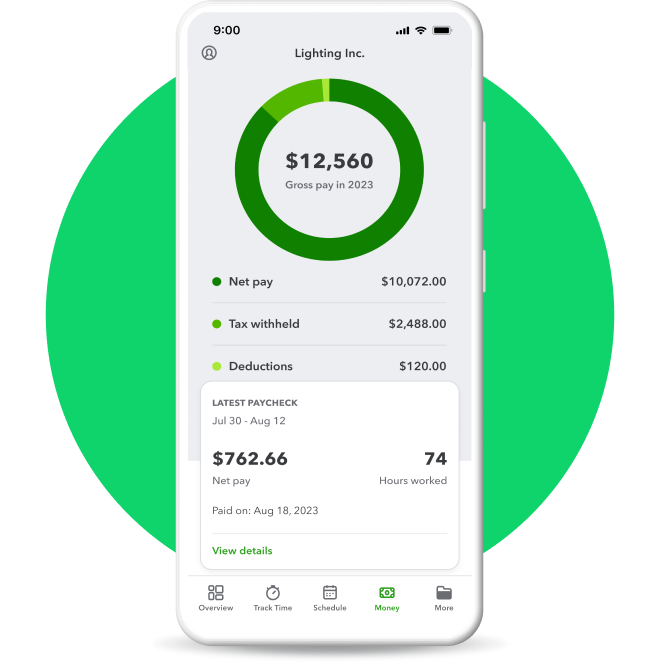

Workforce app

Your team can view pay info and W-2s, plus track hours with the QuickBooks Workforce app.**

Manage and pay your team with confidence

Automate tedious tasks and get back to business. Set payroll to a schedule, so your team gets paid on time, every time.

Reduce manual entry, increase accuracy, and manage timesheets with QuickBooks Time.** Payroll and time tracking data seamlessly connect, cutting payroll costs by over 4%.5

Your team can access their pay stubs, W-2s, and other important pay details online or in the app.** Plus, if you manage time tracking, they can clock in and out with a tap.

We’ll calculate, file, and pay your federal and state payroll taxes for you—100% accurate tax calculations guaranteed.**

Benefits for every budget

Find everything you need from employee benefits to hiring and management tools.

Healthcare packages

Prioritize your team’s well-being with affordable packages that include medical, dental, and vision insurance by Allstate.**

401(k) plans

Retain top talent with an affordable plan by Guideline, match contributions, and help employees save for their future.**

Workers’ comp

Stay compliant by connecting a policy by Next.** Pay as you go, simplify annual audits, and get automatic calculations.**

HR advisor

Talk to a certified HR advisor by Mineral to stay compliant, hire and onboard your team quickly, and scale with confidence.**

How QuickBooks Payroll works

Learn how to get set up, pay your team, find HR support and benefits, and sync with accounting so you can manage everything in one place.