When you think of cash management, your first thought may be to increase collections from accounts receivable. Accounts payable, however, is another major factor in cash management. Below we’ll define accounts payable and how to set up an effective process for accounts payable management.

Accounts payable definition, examples, and how it works

What is accounts payable?

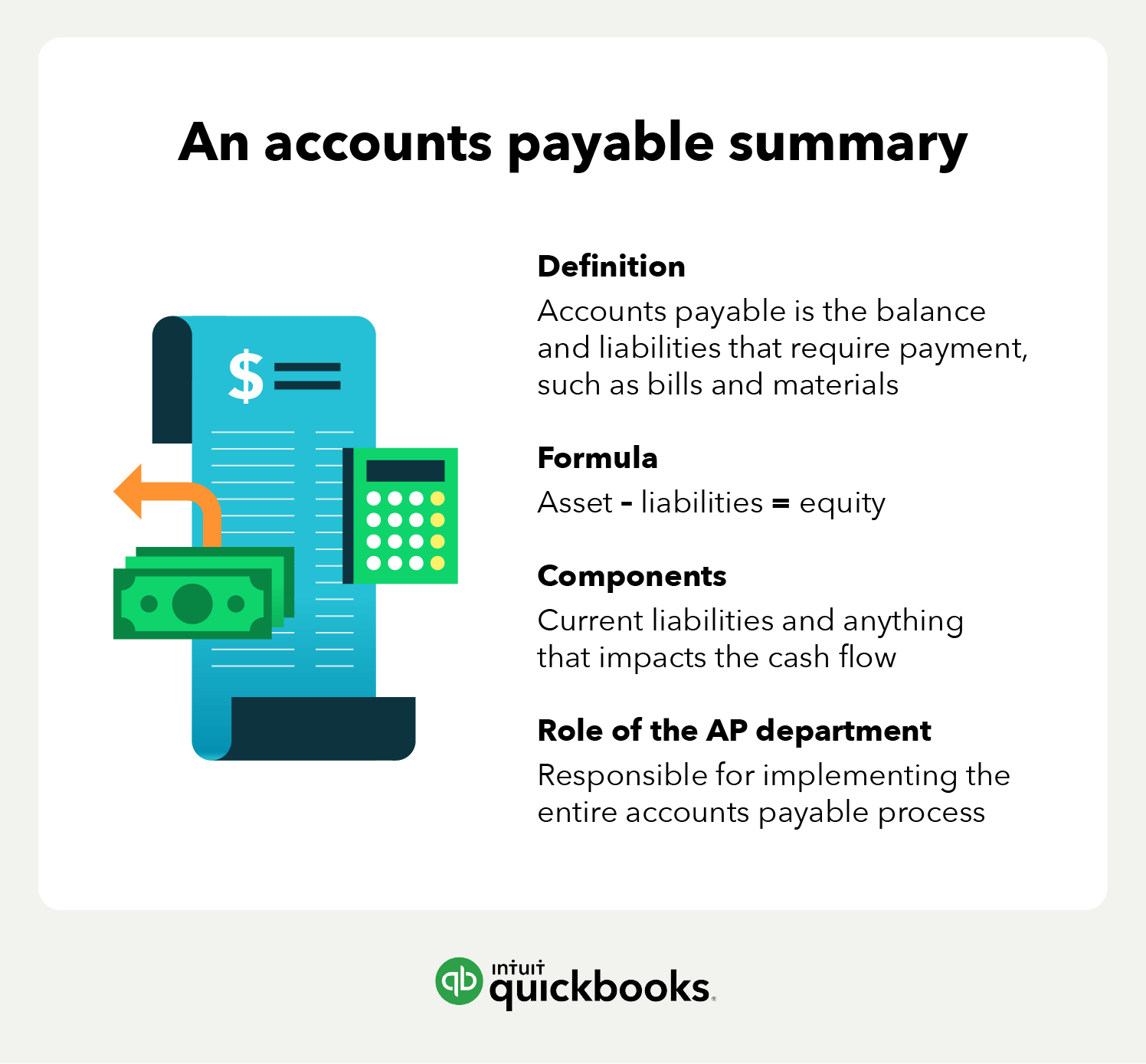

Accounts payable is the funds due to subcontractors or vendors for goods and/or services. The accounts payable balance includes bills and other liabilities that must be paid over the next few months. Accounts payable is a component of the liabilities balance in the balance sheet equation:

Assets - liabilities = equity

Balance sheet accounts are separated into current and noncurrent accounts.

The accounts payable components

The accounts payable components include trades payable, debt, and credit card balances. Let’s talk about these factors and how they affect your accounts payable system as a whole.

Current liabilities

Accounts payable is a component of current liabilities, which are obligations that must be paid within the next 12 months. Current liabilities also include:

- Trades payable: Some firms use trades payable to record bills received from suppliers. Other companies post the supplier invoices to accounts payable and don’t use the trades payable account.

- Short-term debt: The principal and interest due on a loan are posted to current liabilities. If a firm owes $4,500 in principal and interest over the next 12 months, for example, the balance is a current liability.

- Credit card balances: Amounts due on credit cards are posted to current liabilities.

Noncurrent liabilities

Noncurrent liabilities are debts that are due in a year or longer. Most of the balance on a five-year loan, for example, is categorized as a long-term (noncurrent) liability.

Current assets

Financial statements also include current assets, which include cash and balances that will be paid within 12 months. Accounts receivable and inventory are current assets. A fixed asset, such as machinery, is a noncurrent asset account.

The accounts payable balance impacts your business’s cash flow.

Impact of cash flow

Business owners must monitor the accounts payable balance and use a cash forecast to plan the payments. A company’s cash position is important because every firm needs a minimum cash balance to operate. Owners must consider the timing of cash inflows from accounts receivable and the cash outflows required for accounts payable.

To manage cash flow, create a monthly cash flow roll forward using these line items:

- Beginning cash balance

- Cash inflows from accounts receivable and other sources

- Cash outflows for accounts payable, inventory purchases, and payroll

- Ending cash balance

The ending cash balance in March is the beginning cash balance in April. Review your company’s balance sheet and analyze each asset and liability account to determine the impact on cash flow.

To work productively, you need to design an efficient system to manage the payment process.

What is the role of the accounts payable department?

The accounts payable (AP) department is responsible for implementing the entire accounts payable process. The department is also a key driver in supporting the organization as a whole when it comes to vendor payments, approvals, and reconciliations.

Some examples of this include:

- Subcontractors

- Equipment

- Utilities

- Licensing

Skills needed in the accounts payable role

Just like there are multiple components to the accounts payable process, there are also many skills required to accomplish this process. For example:

- General accounting rules: You’ll need to know how debits and credits affect the balance sheet they sit on.

- Organization: Keeping invoices organized and readily available simplifies the AP department and payment process.

- Personability: Those who work in the AP department spend a good amount of time dealing directly with vendors. Having positive vendor interactions can mean the difference between good and bad vendor relationships.

While all of these skills are needed and highly valued in the AP department, many companies choose to automate using tools like QuickBooks Online ,where they can digitize, organize, and streamline their AP process.

Accounts payable process steps

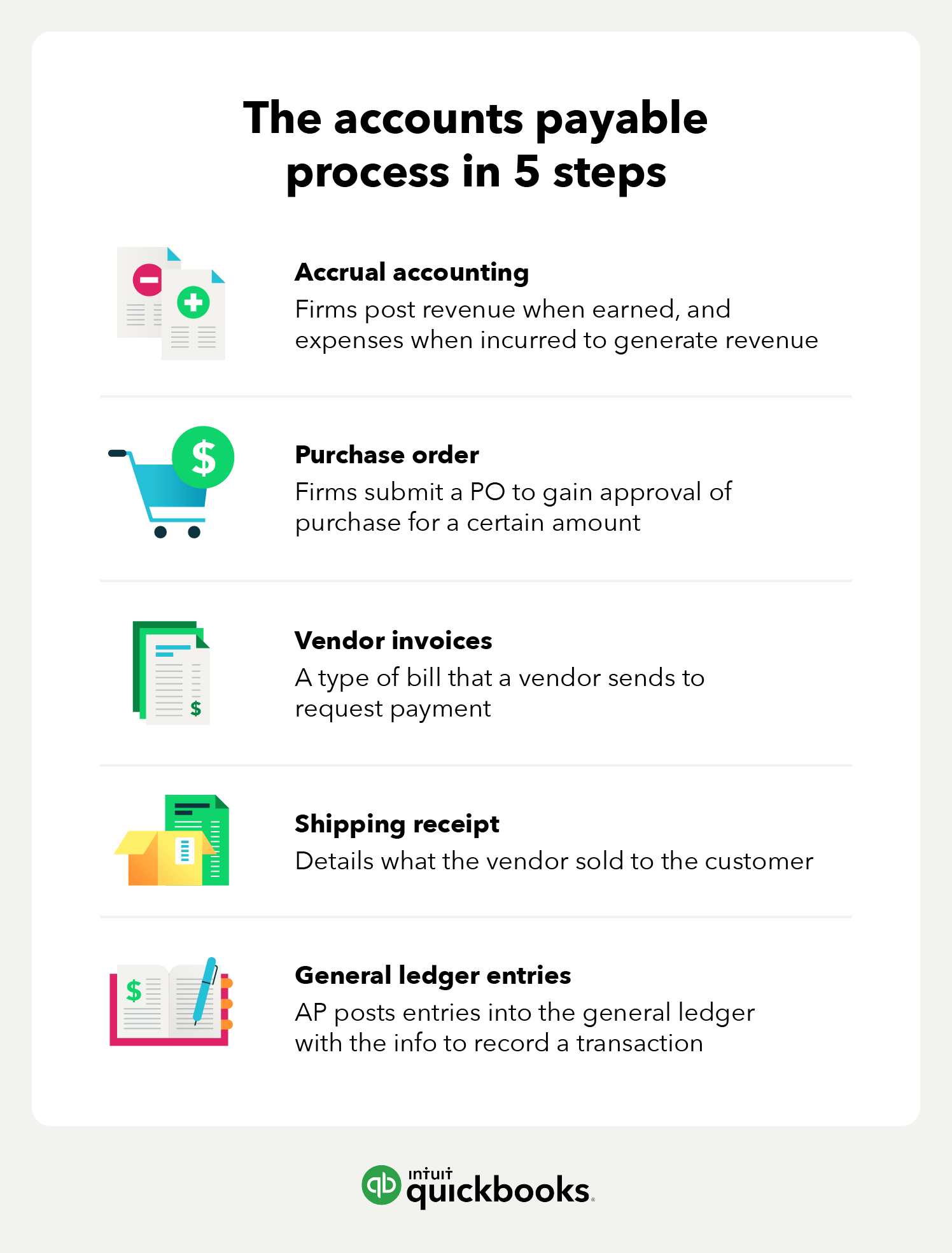

To effectively manage accounts payable, you must post transactions using the accrual basis of accounting. The process can be seen here:

- Accrual accounting

- Purchase order

- Vendor invoices

- Shipping receipts

- General ledger entries

1. Use accrual accounting

Accrual accounting requires firms to post revenue when earned and expenses when incurred to generate revenue. All businesses should use accrual accounting so that revenue can be matched with expenses, regardless of the timing of cash flows.

The accounts payable department should use accrual accounting to post transactions and for financial reporting. To set up a clearly defined process, meet with your AP department. If your business is smaller, a bookkeeping employee may handle accounts payable.

2. Issue the purchase order

Most spending decisions require a purchase order (PO). Assume, for example, that Acme Manufacturing needs to order a $10,000 piece of machinery. Before the order is placed, the plant manager must complete a PO, which lists the machinery’s price and other details.

The owner or someone else with financial responsibility, like the CFO), approves the PO. At this point, the order can be placed. Small purchases, such as $40 in office supplies, don’t need a PO. Generally, POs are used only for larger purchases over $1,000. Purchase orders help a business control spending and keep management in the loop of outgoing cash.

3. Receive the vendor invoices

When the order is placed, the vendor will send an invoice. The person responsible for accounts payable tasks should record the following information in the accounting system:

- Due date: The date when the invoice should be paid

- Payment terms: Some vendors offer a discount if the invoice is paid within 5-10 days. If a discount is offered, you may decide to pay the invoice in a shorter period of time.

- Contract information: Includes the vendor’s name, address, email, and the client’s invoice number. If the vendor takes electronic payments, include that information with the invoicing data.

- Purpose: If you need to plan the payment for larger purchases, include a description of the purchase.

When the item is received, the vendor should include a shipping receipt.

4. Request a shipping receipt

The shipping receipt details what the vendor sold to the customer. The receipt includes a description and the number of items included in the shipment.

The data on the purchase order, invoice, and shipping receipt should be the same. Reviewing these documents ensures that the order was approved and that you received the items that were ordered.

If the data matches, the accounting department can generate a check. The owner should review all of the documents before signing the check and paying the invoice.

In addition to managing paperwork, the AP department needs to post accounting entries.

5. Post general ledger entries

The accounts payable department posts journal entries into the general ledger. A journal entry contains all of the information needed to record a transaction. There are two common journal entries for accounts payable: a purchase on credit and an invoice paid in cash.

Purchase on credit

When Acme Manufacturing places the order for the $10,000 piece of machinery on March 5, it posts this journal entry:

- Debit #3100 machinery (asset account): $10,000

- Credit #5000 accounts payable: $10,000

(To record the March 5 purchase of machinery on credit)

Acme posts a debit to increase the machinery asset account (#3100), and posts a credit to increase accounts payable (#5000).

The journal entry includes the date, accounts, dollar amounts, debit and credit entries, and a description of the transaction.

When the invoice is paid, the accounts payable balance is decreased.

Invoice paid in cash

Acme Manufacturing pays the invoice on April 6, and posts this journal entry:

- Debit #5000 accounts payable: $10,000

- Credit #1000 cash: $10,000

(To record the April 6th invoice payment)

Acme posts a debit to decrease accounts payable (#5000) and a credit to reduce cash (#1000).

Accounts payable example

Any good or service that is purchased by the company should be listed as accounts payable on the balance sheet. Some examples include:

- Leased vehicle

- Subcontractor

- Equipment purchased

- Materials used for production

AP management tips

You should monitor accounts payable and make changes to improve your business. Here are three valuable metrics for accounts payable management:

Increase accounts payable turnover

Purchases on credit increase the accounts payable balance. Accounts payable turnover is the total purchases on credit divided by the average accounts payable balance. The period measured is typically a month or year.

Let’s assume that a business buys a large dollar amount on credit in March, and pays the invoices right away. The March purchase balance is high, but the average accounts payable balance may only be a few days. If you increase the accounts payable turnover ratio, you’re paying for credit purchases faster.

To conserve cash, you may want to take more time before you pay invoices. If most of your invoices are due within 30 days, you can delay payment until you collect more money from customers.

The accounts payable aging schedule is another great tool to manage payables.

Decrease the accounts payable aging schedule

An aging schedule separates accounts payable balances, based on the number of days since the invoice was issued. Acme Manufacturing, for example, has $100,000 in payables from 0 to 30 days old, and $15,000 due in the 31-to-60-days-old category.

The aging schedule helps you decide when invoices must be paid. The vast amount of your payables should be in the 0-to-30-days-old category. Since most invoices are due within 30 days, you don’t want many outstanding invoices unpaid beyond 30 days.

If you wait too long to pay, you may damage your relationship with the vendor. Reliable vendors are important, and you need to pay them in a timely manner. Take action to manage accounts payable.

Streamline the AP workflow

Efficiency is a great way to streamline your accounts payable process. The best way to do this is through the utilization of key factors. These include:

- Use automation software such as QuickBooks to improve your workflow. (More on this below.)

- Improving your relationship with your suppliers. Suppliers that feel valued are much more likely to offer specials and discounts.

- Optimizing by using digital filing systems in lieu of paper. Having digital files eliminates the pain of having to manually sort through stacks of paper documents each time you need a file.

Accounts payable FAQ

Accounts payable may not be the most popular topic to ask questions on, but there are definitely questions floating around that need to be addressed. We’ve tracked down a few frequently asked ones and are ready to deliver the best answers below.

What’s the difference between accounts payable and accounts receivable?

The best way to break these two apart is to provide definitions and examples of both.

Accounts payable: Any good or service that was purchased by the company.

- Examples: Machinery, subcontractors, power/utilities

Accounts receivable: Any good or service that was purchased by customers that produced income owed to the company.

- Example: When a customer purchases a coffee at Starbucks, this purchase falls under accounts receivable

Is accounts payable a debit or credit?

Accounts payable most commonly operates as a credit balance because it is money owed to suppliers. However, it can also operate as a debit once the money is paid to the vendor.

Can you automate accounts payable?

You can and most certainly should automate accounts payable. Automation tools such as QuickBooks Online not only simplify your accounting processes but reduce the common errors that accompany nonautomated AP. Other benefits include:

- Simplification of filing systems

- Scalability of future growth

- Reducing reliance on employees

How to set up the proper AP system

Review your systems for managing accounts payable and use technology to automate the process. Use QuickBooks accounting software to scan invoices, post payables into your accounting system, and pay invoices electronically.

Use the tips discussed above to conserve cash and maintain good relationships with your vendors. Now is the time to take charge of the accounts payable process to improve your business results.