Best practices for handling W-9 forms

As a business owner, W-9s should be handled with care. From when to request W-9s to securely disposing of old W-9s, here are some tips for managing these sensitive forms.

Request early

As a business utilizing the services of a non-employee, the sooner you request a completed W-9, the better. To ensure that payments and taxes are recorded correctly, the W-9 request and completion should occur before the first payment is issued to your contractor.

Additionally, updated W-9s should be requested from all existing contractors your business uses at the start of every year.

With a hard due date of January 31st for sending out 1099-NECs, you don’t want to leave W-9 information collection till the last minute.

Securely store the forms

W-9s contain sensitive information. To protect a contractor’s TIN, address, and other info, completed forms should be stored securely.

If you are using paper (physical) forms, they should be stored in a secure location, preferably locked. When you are ready to dispose of the forms, use a cross-cut shredder to ensure the information remains protected.

For W-9s stored in digital format, there are some basic electronic storage security rules you can follow:

- Use an electronic signature platform when collecting contractor signatures

- Send W-9s via email using encryption

- Implement password protection and multi-factor authentication (MFA) on W-9 forms

- Limit access to completed W-9s

- Do not send or access W-9s using an unsecure internet connection

When you're ready to dispose of old W-9 forms, ensure they're destroyed completely. For digital copies, this means you need to permanently delete the files, not just send them to the recycle bin.

Verify the information

The most critical part of a W-9 is the TIN. This needs to be accurate to prevent tax filing issues. Luckily, the IRS offers a TIN matching service that can help you verify the information your contractor provided.

To get started, you’ll need to register for online e-services and apply to the TIN Matching Program. Once signed up, you’ll be able to match TINs on an individual or bulk basis.

Getting TINs matched before filing 1099s with the IRS is especially crucial for businesses that pay income that could be subject to backup withholding.

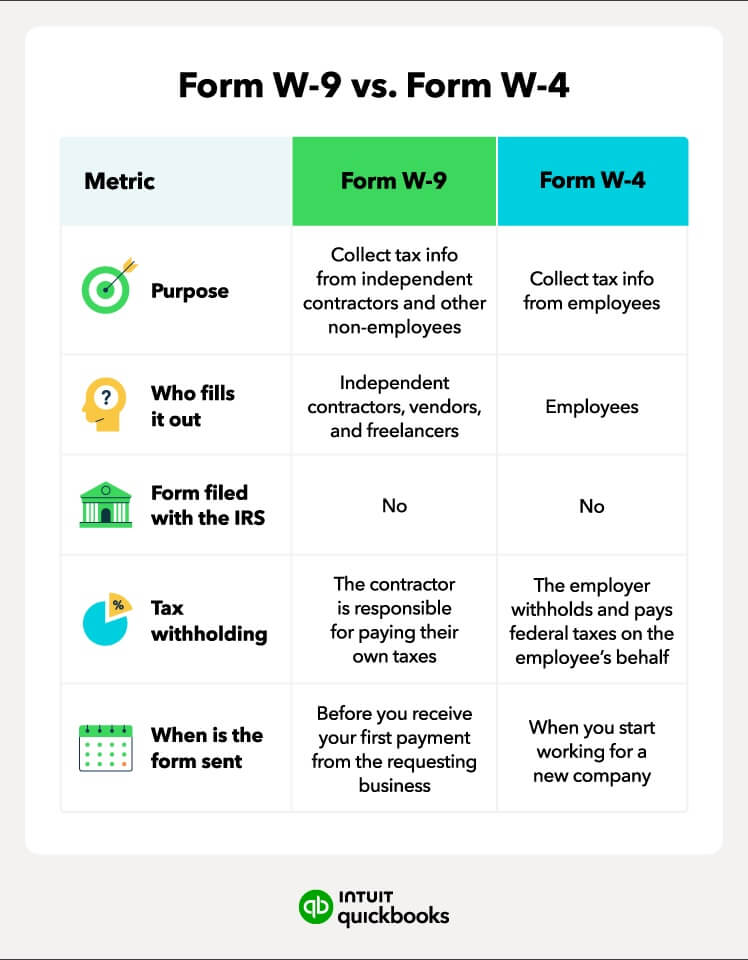

A similar-sounding form,

A similar-sounding form,