The importance of law firm accounting

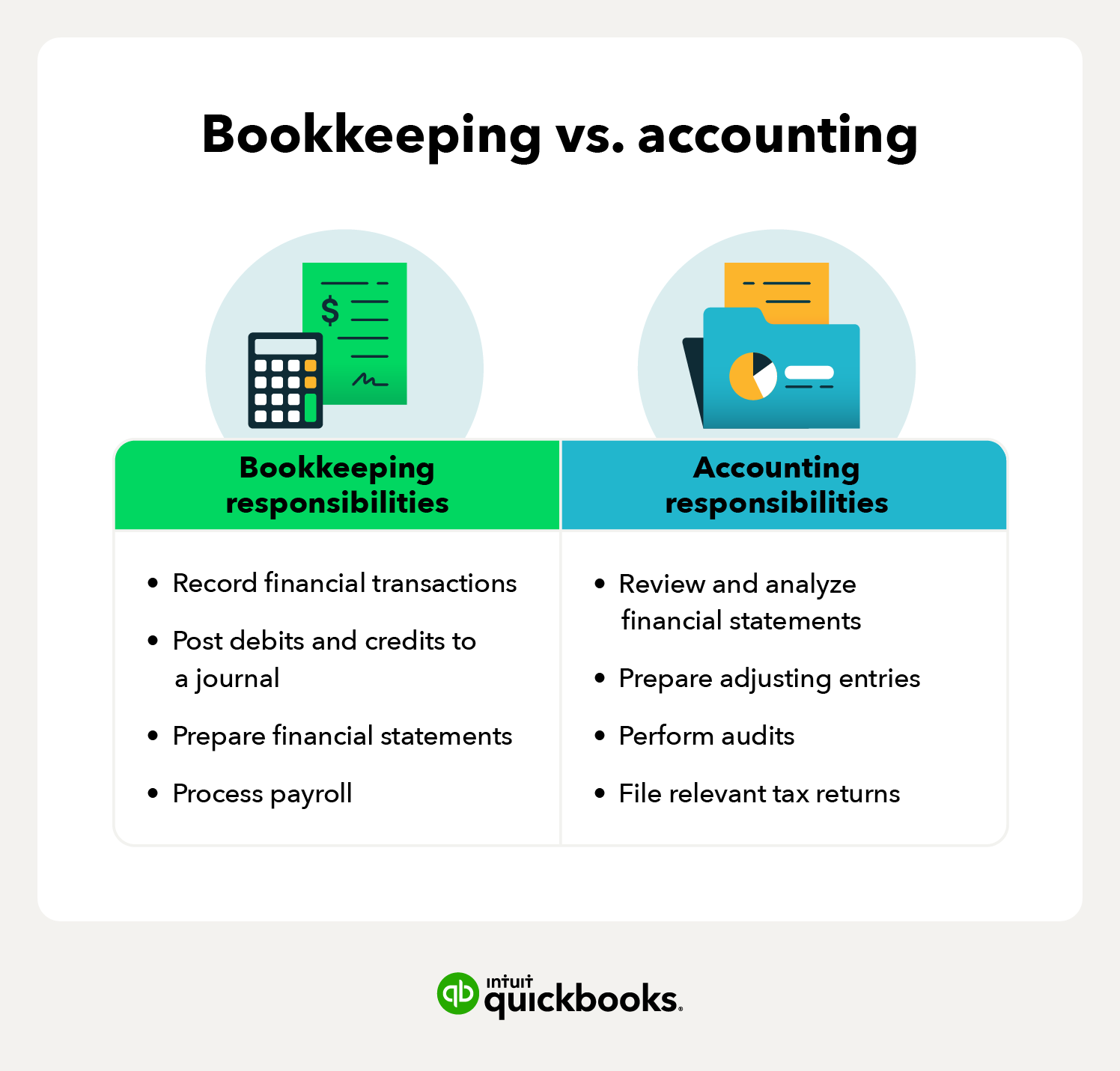

Law firm accounting and bookkeeping share similarities with other industries. However, they’re actually areas of specialization, requiring knowledge of complex legal accounting principles and regulations.

Ethical obligations

As a law practice, you have a fiduciary duty to your clients, as well as an ethical responsibility to properly handle the financial resources clients entrust to you. You must also maintain transparent records of their finances.

Regulatory compliance

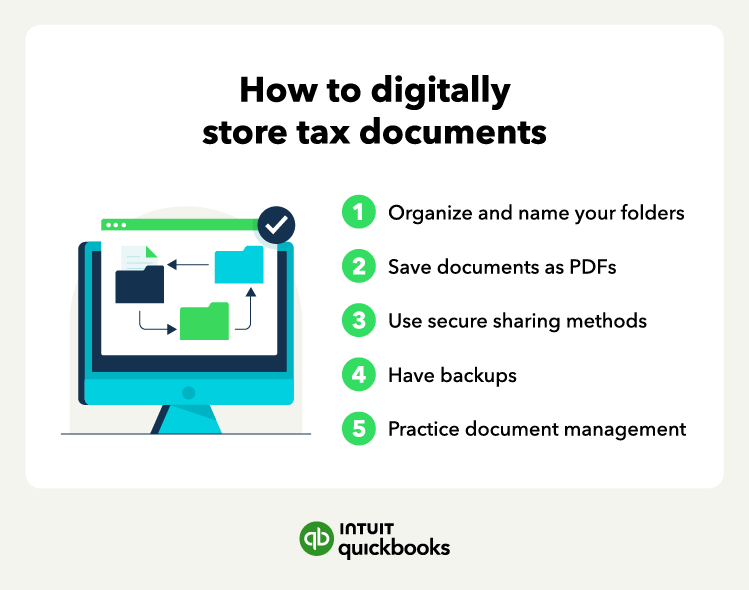

Each state bar has its own specific regulations, and you must be thoroughly familiar with and adhere to these rules. Your firm may be subject to random or scheduled audits to ensure compliance. Failure to comply with regulations, particularly those concerning trust accounting, financial reports, and recordkeeping, can lead to disciplinary action, including fines or disbarment.

Client trust

Proof of transparency surrounding financial records helps earn your client’s trust and confidence in your practice's ability.

Key financial statements

Your financial statements tell the story of your law firm’s financial health. The key financial statements include:

Income statement: Also known as a profit and loss (P&L) statement, an income statement shows your firm’s revenues, expenses, and net profit or loss over a specific period. If your firm struggles with profitability, your income statement can highlight areas where you might need to cut costs or adjust pricing.

Balance sheet: A balance sheet helps you assess financial stability and debt management by showing what your firm owns (e.g., cash, accounts receivable, office assets) and what your firm owes (e.g., loans, unpaid vendor invoices). For example, if your firm has a high amount of outstanding invoices (accounts receivable) but little cash on hand, you may need to improve your collections process to boost cash flow.

Cash flow statement: A cash flow statement tracks how money moves in and out of your firm over a specific period, helping you understand whether your business is generating enough cash to cover its expenses. For example, if your firm is technically profitable but struggles to pay bills on time, your cash flow statement might reveal that too much cash is tied up in unpaid invoices.

Budget and financial forecasting

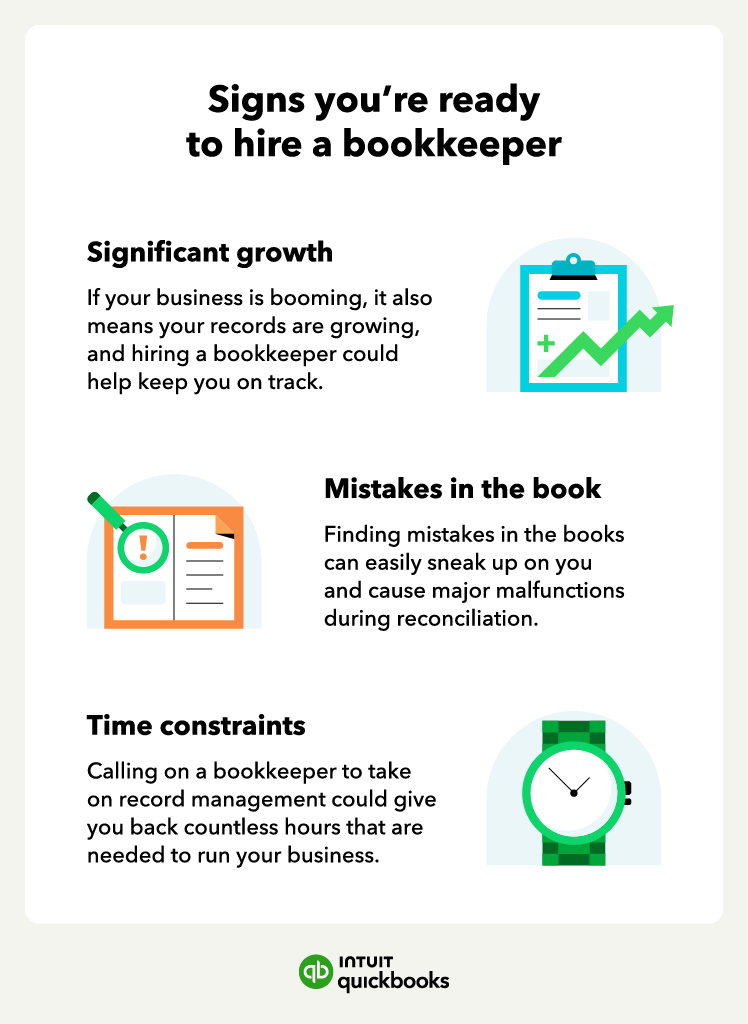

Budgeting and financial forecasting are another key part of law firm accounting. A well-planned budget outlines your expected income and expenses over a set period, helping you stay on track with spending, manage cash flow, and identify areas for cost-cutting or investment.

Financial forecasting uses historical data to predict future revenue, expenses, and cash flow. This helps you anticipate slow periods, plan for hiring, and make informed business decisions. For instance, if your projections show a dip in revenue next quarter, you can get ahead of the problem by focusing on bringing in more clients, adjusting spending, or setting aside extra cash now.