7. Audit-proof your taxes

Tax mistakes can lead to fines, penalties, or IRS audits. The IRS uses your taxpayer identification number and formulas to select individuals for audits, which means that everyone has a chance at an audit. However, you can lower your chances of an audit by:

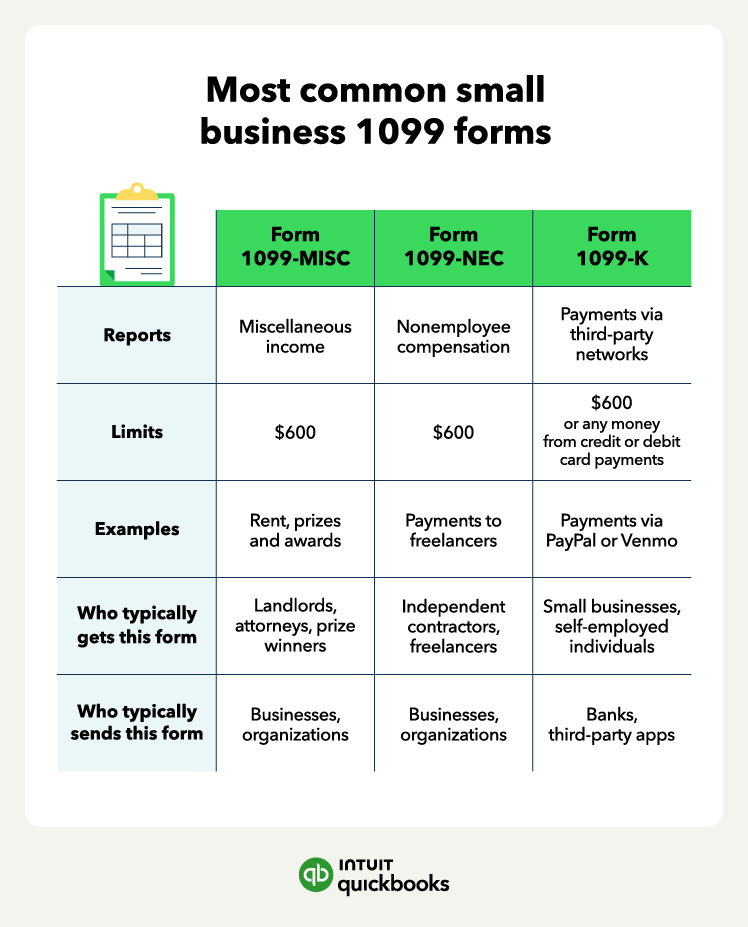

- Ensuring your reported income matches your tax documents: As an employee, you receive a Form W-2 at the end of the year, but as a contractor, you receive a 1099-NEC form. Match your internal records or accounting software with the forms you receive from your clients.

- Documenting commonly audited expenses: The IRS will audit some income and expenses more than others—people commonly abuse the system and make mistakes. For self-employed contractors, a few common areas that sound the alarm are auto and home office expenses,

- Not claiming a hobby as a business: If you sustain a loss for your business for many years in a row, the IRS may claim that you’re pursuing a hobby and not running a business. You’ll need to prove that you had the intent to make a profit and clarify the reasons you didn’t.

If the IRS decides your business is a hobby, they might disallow any business expenses you have previously written off, meaning you could be on the hook for back taxes and penalties.

Find peace of mind come tax time

Readying yourself for tax season can be a stressful process, but there are tax tips for 1099 employees that make it easier. To make sure you’re ready for tax time, keep your expenses and receipts organized so you can claim the maximum amount of deductions you’re eligible for as a self-employed worker.

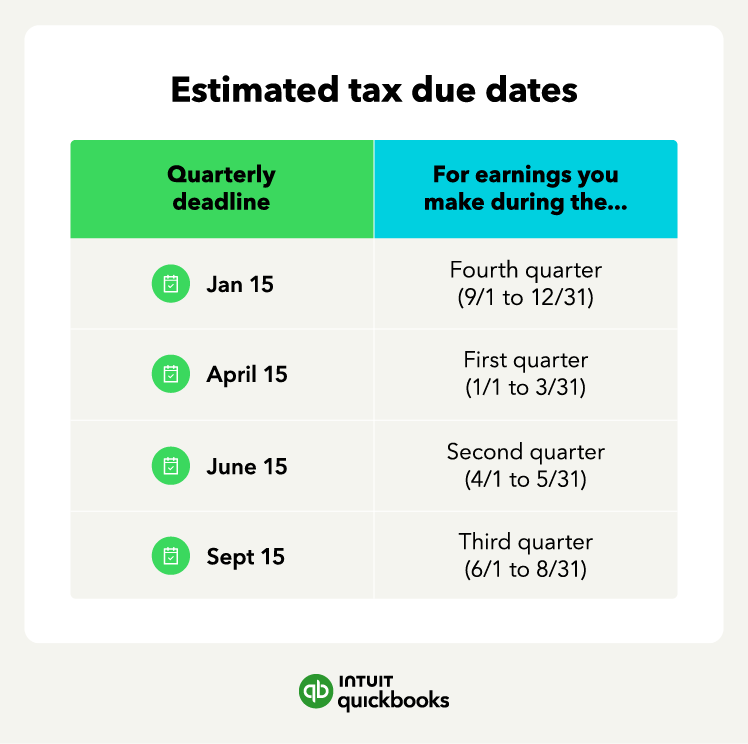

A dedicated accounting software for self-employed individuals and solopreneurs can help you stay on top of expense tracking. It can also help you estimate and pay your taxes on time.