How to set up Single Touch Payroll

by Intuit•4• Updated 10 months ago

Learn how to set up Single Touch Payroll (STP) in QuickBooks Online.

Step 1: Set up ATO Supplier Settings

First, you need to set up the ATO (Australian Taxation Office) settings in QuickBooks Online. To do so:

- From the left menu, select Payroll.

- Select the Payroll Settings tab.

- Under Business Settings, select ATO Settings.

From here the steps differ slightly if you are setting up as the employer, as a registered Tax/BAS Agent, or as an intermediary for multiple employing entities.

Step 2: Set up Electronic Lodgement and STP

Enabling electronic lodgement will allow you to lodge employee tax file declarations and STP lodgements online directly to the ATO. You must enable electronic lodgement before you can enable STP.

The following steps must be completed correctly otherwise your STP lodgement will fail. If you encounter an error, use the following guide to assist in troubleshooting.

.gif)

- From the left menu, select Payroll.

- Select the Payroll Settings tab.

- Select ATO Settings.

- Select the Electronic Lodgement & STP tab.

- Follow the on-screen instructions and verify your business info.

- Call the ATO on 1300 852 232 and provide them with your Software Provider and ID. Or update your details through the Access Manager.

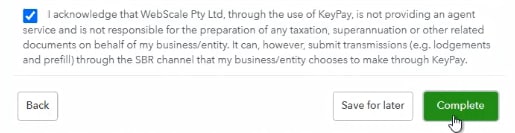

- Tick the acknowledgment message and select Complete.

How to set up STP as an employer - Video Guide

Prefer to watch a video? If you're setting up STP as the employer, here's a video guide on the above steps:

Standing Authority Declaration (Tax/BAS agent only)

This section only appears if the registered Tax/BAS Agent is set as the ATO lodgement type.

In this scenario, a declaration should be made by the employer or authorised employee at the time of providing the information to the Tax Agent and the wording of the declaration should be per the requirements set out within Section 6 of the Taxpayer Declaration Guide.

If this declaration has been completed, you can enter the details of this authority here. You are then able to use the Standing Authority when lodging pays events.

If the payroll information changes for a particular pay run, the Tax Agent must request client authority before lodging the pay event.

To add a Standing Authority, select Add Standing Authority.

- Enter the full name and email address of the person who has provided the standing authority.

- Enter the date the written authority was provided, then select Save.

Note: A registered agent doesn't need to have a Standing Authority with their client–it is not essential for STP reporting. All this means is that before you lodge a pay event, you will need to request client authority from within the system. The person(s) appointed to provide the authority will log into the applicable pay event and approve the event. Only after this time will the registered agent have the ability to successfully lodge the pay event.

Frequently asked questions

--------------------------------------------

Do you have a question about this topic? Post it on our Community.

Content sourced from Employment Hero

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Single Touch Payroll FAQsby QuickBooks•161•Updated September 18, 2023

- Single Touch Payroll (STP) guideby QuickBooks•19•Updated almost 2 years ago

- How to set up an employee in QuickBooks Payroll powered by Employment Heroby QuickBooks•63•Updated 1 year ago

- Single Touch Payroll - Troubleshooting errorsby QuickBooks•6•Updated September 19, 2023