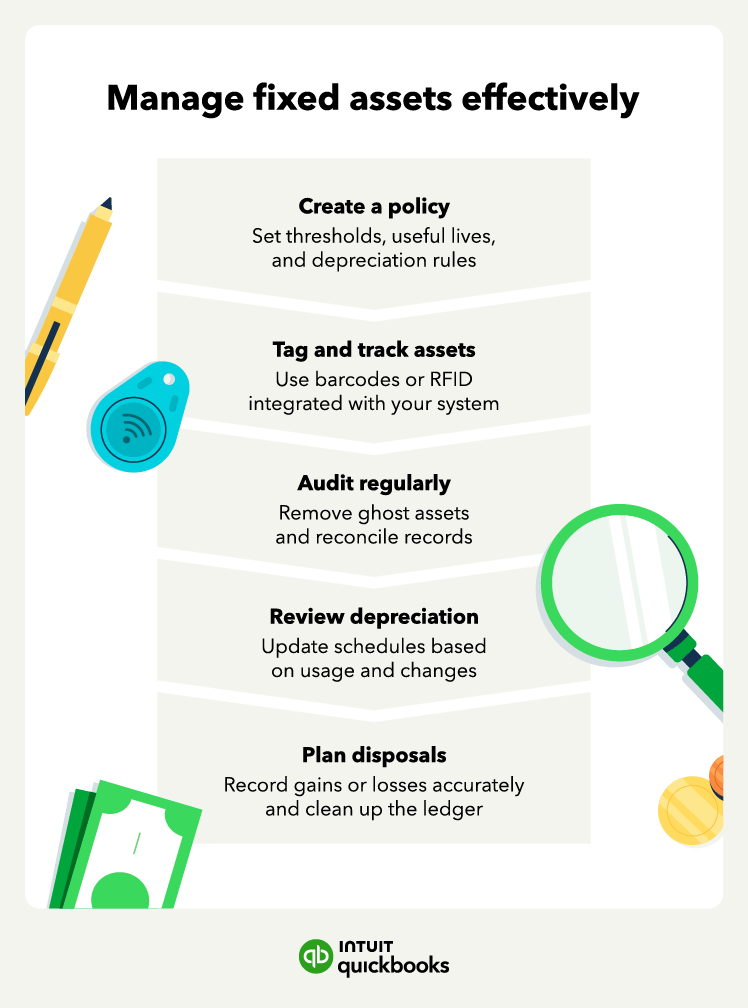

Limited visibility into your organization’s fixed assets can lead to inefficiencies and inaccurate financial reporting. Manual tracking processes aren’t enough—they can lead to legal risks, mistakes in valuing assets, and slower financial reporting. Poor asset management can also cause you to lose warranty savings and face high maintenance costs.

Implementing a robust fixed asset management solution, which helps track, monitor, and manage your business assets, can solve these problems. It can help streamline your financial operation with features like real-time asset tracking and automated depreciation calculations.

Learn more about fixed asset management and how it can help enhance your budgeting accuracy, unlock tax benefits, and do much more.

Jump to:

- Understanding fixed assets

- Characteristics of a fixed asset

- Fixed assets and your balance sheet

- Why fixed asset management matters for your business

- Common types of fixed assets by industry

- How to manage fixed assets effectively

- Common fixed asset mistakes (and how to avoid them)

- The role of fixed assets in strategic planning

- Questions every finance leader should ask about fixed assets

- Run your business with confidence