2. Home office

Amount: Depends on the method

Many freelancers work out of their homes in the early days, especially when their businesses are first getting off the ground. As a result, the IRS allows self-employed persons to deduct a portion of their mortgage or rent going to a home office.

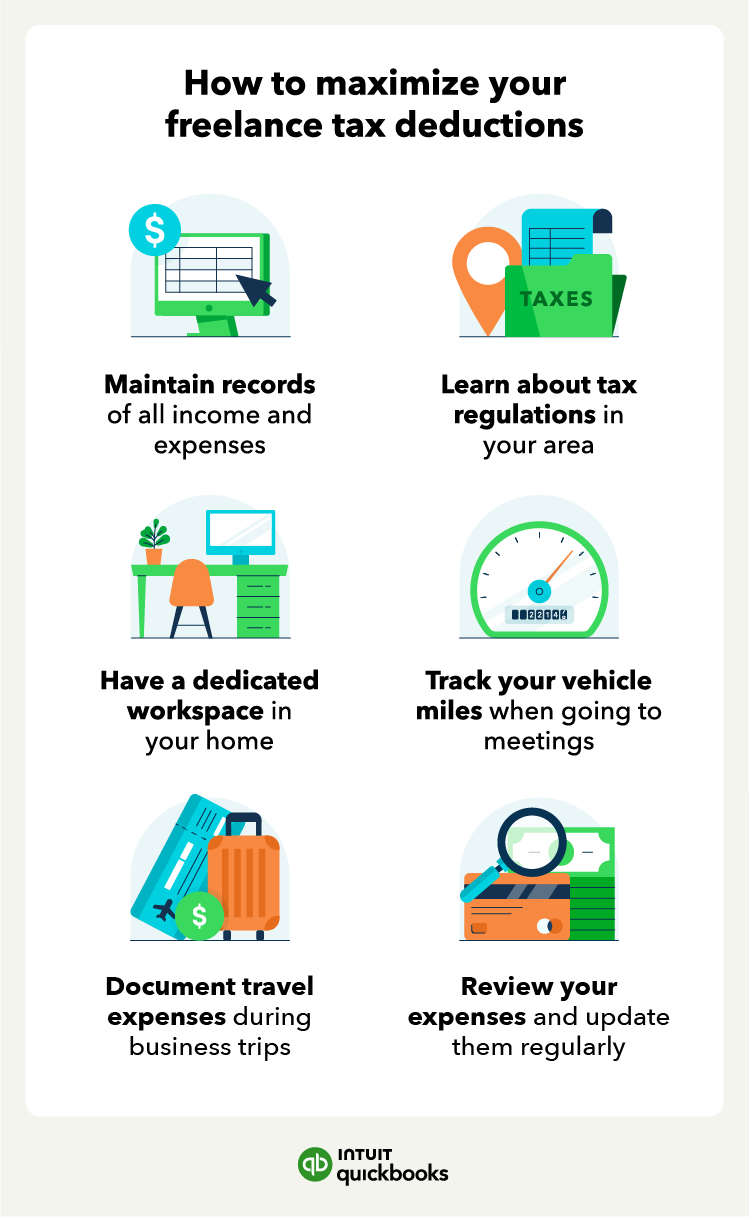

To qualify for the home office tax deduction, you must have a specific area in your home designated for working, and you must refrain from using it for other purposes.

When claiming this deduction, you can calculate the deduction’s value using the regular or simplified home office deduction option:

- Simplified method: Deduct $5 per square foot of your home office space for up to $1,500 deduction.

- Standard method: Calculate the square footage of your home office, divide by the square footage of your home, and multiply by all your home expenses.

The standard method is more complicated than the simplified method since you have to keep track of all your home expenses. However, you can deduct an unlimited amount using the standard method, while with the simplified method, you can only deduct up to $1,500.