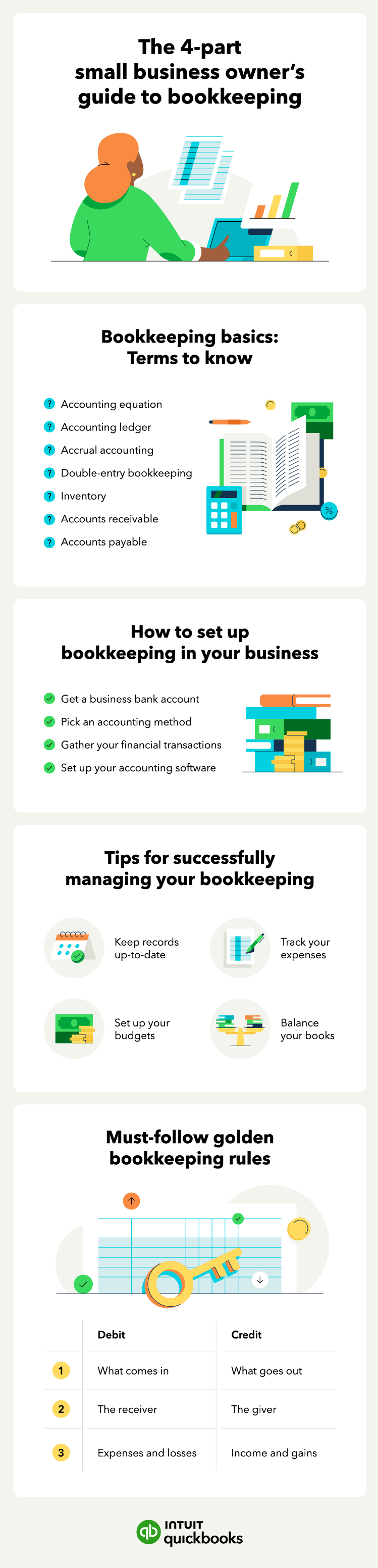

Bookkeeping is fundamental to running a small business. A lot goes into it—from managing payables and receivables to balancing books. But what might seem like an overwhelming task isn’t so bad when you break it down to the bookkeeping basics.

Must-know terms for bookkeeping

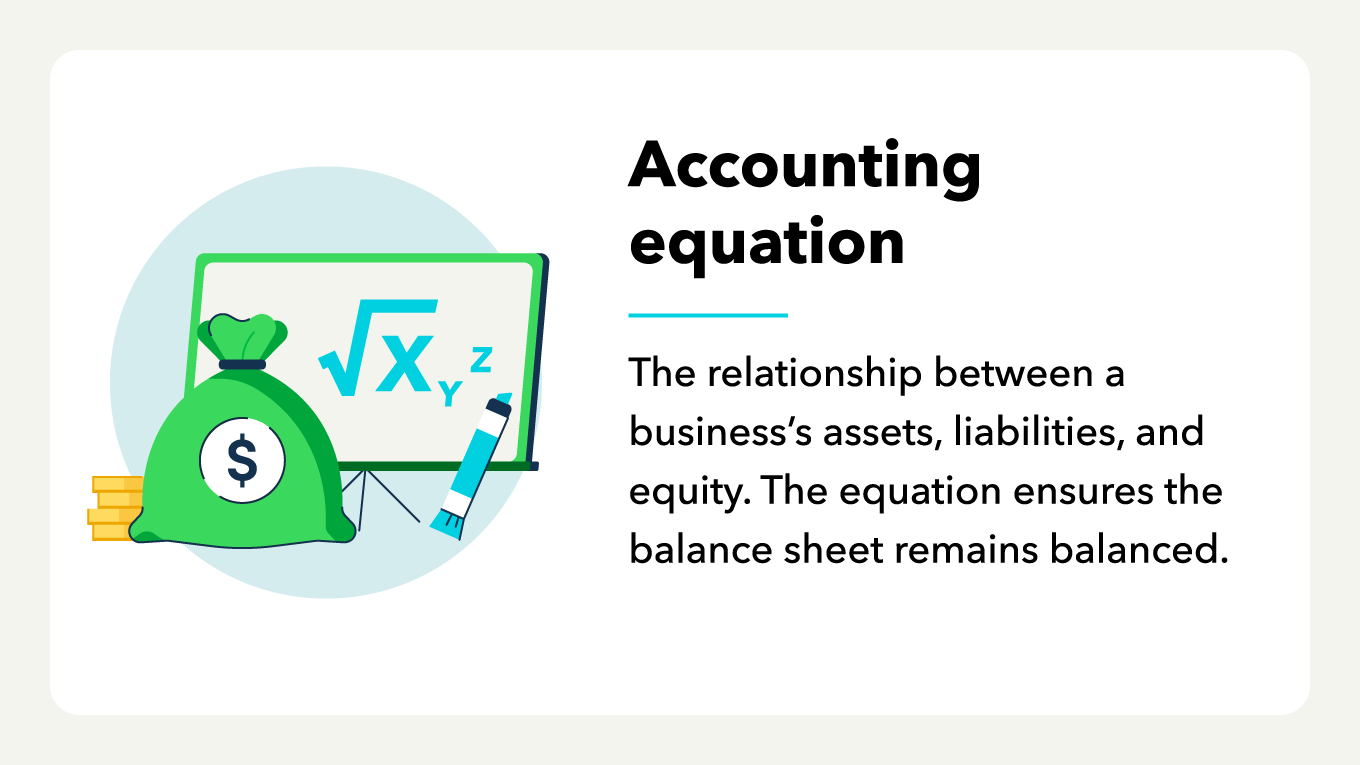

- Accounting equation

- Accounting ledger

- Accrual accounting

- Double-entry bookkeeping

- Inventory

- Accounts receivable

- Accounts payable

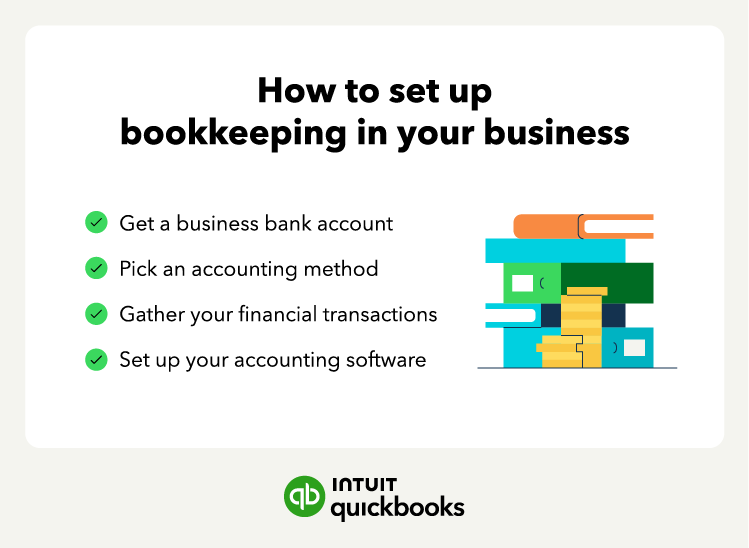

What you need to set up small business bookkeeping

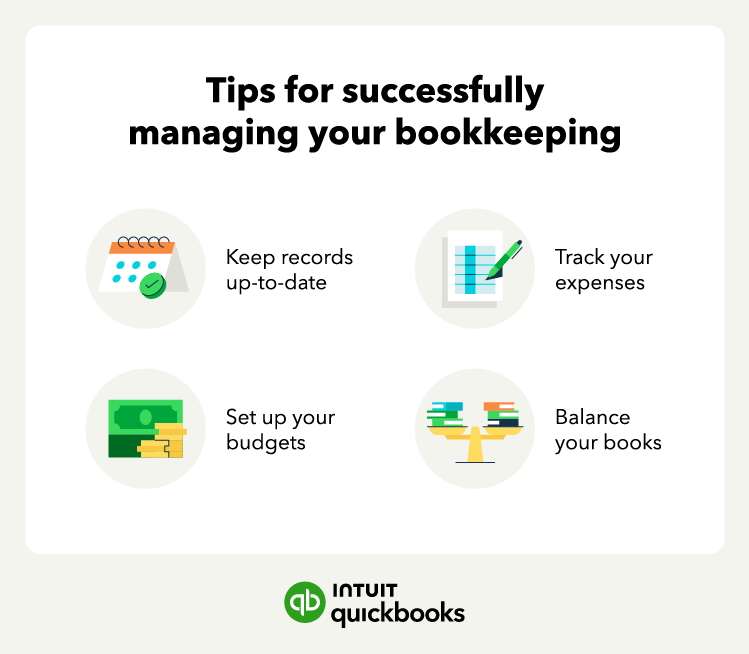

Bookkeeping best practices for success

.gif)