- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and Payroll

- :

- Adjust Payroll Liabilities

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Best answer May 07, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

I'm here to ensure you can make the necessary adjustment for Employment Allowance in QuickBooks, sld2012. This way, you'll be able to update the balance you owe to HMRC to £0.00.

I'd suggest turning off the Employment Allowance feature in the Payroll tab from Account and Settings. This way, it'll remove the allowance and zero out your balance. Here's how:

- Go to the Account and Settings menu.

- Select the Payroll tab.

- Click anywhere in the Employer NI relief section.

- Select the No, I don't qualify button in the Employment Allowance section.

- Click Save, then Done.

After that, you'll have to resubmit your EPS filing to the HMRC. Let me guide you how.

- Go to the Taxes menu.

- Select Payroll Tax.

- Choose the EPS and view the details.

- Click Submit.

Furthermore, you're unable to enter your payments you make to the HMRC with Standard Payroll. The P32 report just shows the liability/amount you need to pay. Just write a check for record-keeping and pay directly to the agency.

Moreover, you can effectively manage your payroll account and employees by referring to this article: QuickBooks Online Standard Payroll Hub. It contains topics about setting up and run payroll, manage employees, Real Time Information (RTI), Workplace Pensions, and reports.

Please let me know if you have other concerns. I'm just around to help.

0 Cheers

11 REPLIES 11

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

I'm here to ensure you can make the necessary adjustment for Employment Allowance in QuickBooks, sld2012. This way, you'll be able to update the balance you owe to HMRC to £0.00.

I'd suggest turning off the Employment Allowance feature in the Payroll tab from Account and Settings. This way, it'll remove the allowance and zero out your balance. Here's how:

- Go to the Account and Settings menu.

- Select the Payroll tab.

- Click anywhere in the Employer NI relief section.

- Select the No, I don't qualify button in the Employment Allowance section.

- Click Save, then Done.

After that, you'll have to resubmit your EPS filing to the HMRC. Let me guide you how.

- Go to the Taxes menu.

- Select Payroll Tax.

- Choose the EPS and view the details.

- Click Submit.

Furthermore, you're unable to enter your payments you make to the HMRC with Standard Payroll. The P32 report just shows the liability/amount you need to pay. Just write a check for record-keeping and pay directly to the agency.

Moreover, you can effectively manage your payroll account and employees by referring to this article: QuickBooks Online Standard Payroll Hub. It contains topics about setting up and run payroll, manage employees, Real Time Information (RTI), Workplace Pensions, and reports.

Please let me know if you have other concerns. I'm just around to help.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

@Rea_M wrote:I'm here to ensure you can make the necessary adjustment for Employment Allowance in QuickBooks, sld2012. This way, you'll be able to update the balance you owe to HMRC to £0.00.

You'll have to turn off the Employment Allowance feature in the Account and Settings menu's Payroll tab. This is to remove the allowance, make adjustments, and zero out your balance.

- Go to the Account and Settings menu.

- Select the Payroll tab.

- Click anywhere in the Employer NI relief section.

- Select the No, I don't qualify button in the Employment Allowance section.

- Click Save, then Done.

After that, you'll have to resubmit your EPS filing to the HMRC. Let me guide you how.

- Go to the Taxes menu.

- Select Payroll Tax.

- Choose the EPS and view the details.

- Click Submit.

Furthermore, you're unable to enter your payments you make to the HMRC with Standard Payroll. The P32 report just shows the liability/amount you need to pay. Just write a check for record-keeping and pay directly to the agency.

Moreover, you can effectively manage your payroll account and employees by referring to this article: QuickBooks Online Standard Payroll Hub. It contains topics about setting up and run payroll, manage employees, Real Time Information (RTI), Workplace Pensions, and reports.

Please let me know if you have other concerns. I'm just around to help.

Why do i need to turn off Employment Allowance when I want to avail it?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

Hiya Rea,

Why would i need to turn off Employment allowance when i would like to avail it?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

Hello again, @sld2012.

As mentioned by my colleague @Rea_M, turning off the Employment allowance is needed. This is for you to remove the allowance, make adjustments, and zero out your balance. To complete this task, you can follow the above steps.

Moreover, I don’t want to leave you empty-handed, you'll want to visit our Community Help Articles hub in case you need some related articles in managing your account.

Let me know if you have any additional questions by using the Reply option below. I'm here to ensure your continued success. Have a great day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

@MirriamM wrote:Hello again, @sld2012.

As mentioned by my colleague @Rea_M, turning off the Employment allowance is needed. This is for you to remove the allowance, make adjustments, and zero out your balance. To complete this task, you can follow the above steps.

Moreover, I don’t want to leave you empty-handed, you'll want to visit our Community Help Articles hub in case you need some related articles in managing your account.

Let me know if you have any additional questions by using the Reply option below. I'm here to ensure your continued success. Have a great day!

@MirriamMThank you for your reply. If i do the above steps how do i then claim and account for Employment Allowance?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

I appreciate your prompt response, sld2012.

To claim and account for Employment allowance, you can create a bank deposit and account it in any income account.

Here's how:

- Click the + New icon on the left menu.

- Pick the Bank Deposit.

- From the Account drop-down▼menu, choose an income account you want to deposit the money into.

- Hit Save and close.

Take a look at this article for more information: Record and make Bank Deposits in QuickBooks Online.

I'm here to help if you need anything else, just leave a comment below. Have a fantastic day!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

@MirriamM wrote:I appreciate your prompt response, sld2012.

To claim and account for Employment allowance, you can create a bank deposit and account it in any income account.

Here's how:

- Click the + New icon on the left menu.

- Pick the Bank Deposit.

- From the Account drop-down▼menu, choose an income account you want to deposit the money into.

- Hit Save and close.

Take a look at this article for more information: Record and make Bank Deposits in QuickBooks Online.

I'm here to help if you need anything else, just leave a comment below. Have a fantastic day!

@MirriamMAs my Initial post stated 'Adjust Payroll Liabilities' It is not a deposit that has been received from HMRC but an adjustment that is required.

E.g.

My payroll liabilities for a month is £1800 of which £600 relates to Employer's National Insurance Contribution. The Employment Allowance can be used to offset the £600, so basically we pay HMRC just £1200. There is no actual refund or deposit just an adjustment to the liabilities is required.

As my Payroll Liabilities account shows an outstanding of £1800, i need to make an adjustment so that the account shows £1200 instead.

When i used QBDT, this is how payroll liabilities adjustments were made:

Employees > Payroll Centre > Adjust Liabilities:

Category: Amount

NIC Employer -£600 (negative)

This would then reduce the total outstanding to HMRC from £1800 to £1200.

But as the PAYE in QBO has no sub accounts and taxes and NI are all added into one account, how do i make this adjustment.

Hope this simplifies my query.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

I appreciate you coming back with those details, sld2012.

It's my goal to ensure you get the best help needed.

Concerns with payroll adjustments requires assistance from our QuickBooks Care Support. They have the tools make necessary adjustments on your payroll.

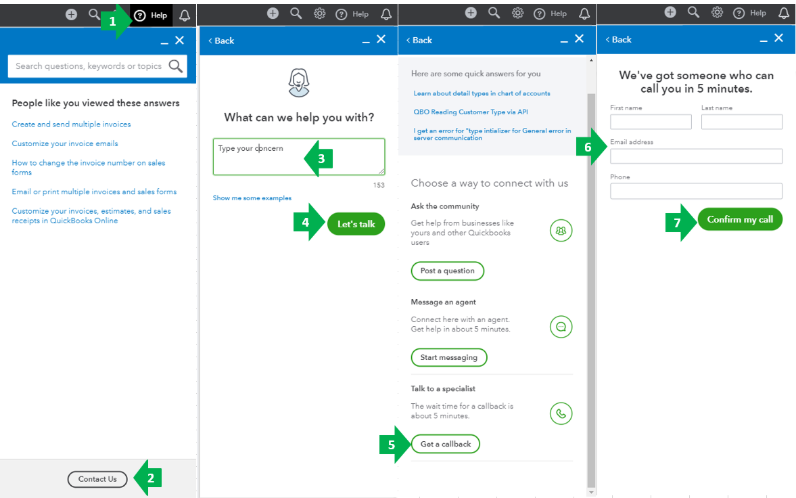

Here's how to contact us:

- Go to the Help menu at the upper right.

- Select Contact Us.

- Enter your concern (Payroll Adjustment).

- Click Let’s talk.

- Choose Get a callback.

- Type in your contact info.

- Select Confirm my call.

You are always welcome to visit us again if you need help with something else. Have a good one.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

Hi

Can someone help me please.

I need to adjust the amount of Employers Allowance allowed in this month's liabilities as I am in credit with HMRC from last year. So I need to increase the amount of deduction on the P32??

Urgent help needed please

Thanks

Lisa

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

Hi

Did you sort this after please as I have a similar problem which was easy to sort on QBDT but online is a nightmare to find these things??

Thanks

Lisa

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Adjust Payroll Liabilities

Hello Lisawills68,

Thanks for commenting on this thread.

In order to help you can you tell us the payroll you are using in your Quickbooks is it Advanced payroll or Standard payroll?

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...